What do Clearscore Credit Score Bands (out of 1000) Mean?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Understanding your Clearscore credit score bands, out of 1000, can seem tricky. Don’t worry; you’ve come to the right place. Every month, over 12,000 people visit our site to learn about topics just like this one.

In this article, we’ll explore:

- Any changes made to the Clearscore bands

- Whether or not you have to pay for the service

- The bands before they were changed

- How to lower your repayments

- What the new Clearscore rating bands are, and what they mean

Maybe you’re worried about not being able to pay a debt, or you’re concerned about what might happen if you can’t. We understand how you feel; some of us have been in the same situation.

So, let’s look at ways you might improve your credit score, and what a good Clearscore rating looks like.

Source: Debtcamel

What’s a Good Clearscore rating?

To achieve a ‘Good’ Clearscore rating, it’d have to be valued between 531 and 670. It’s worth getting this if you can because you’d get much better deals when applying for credit.

In short, a Good Clearscore rating means that lenders are more likely to offer you lower interest rates on loans, credit cards etc!

Does the newer Poor band negatively impact your score?

No. Just because you now fall into Clearscore’s ‘Poor’ band, it doesn’t negatively impact your credit rating.

For example, if your score stood at 420 before the change, it still stands at 420 after the changes were introduced!

The only thing that changed was the label of the rating band. Lenders only look at your score, not the band!

You may have gotten quite a shock when the changes were introduced which is perfectly normal. But rest assured just because the labels changed, your credit score did not!

What are the 5 factors that affect your credit score?

There are, in fact, four other factors that affect your credit score apart from payment history! This includes the amount of debt you have, the length of time you’ve been using credit, new and recent credit plus the sort of credit it is!

Will a soft check affect your credit score?

No. A soft check doesn’t affect your credit score. It’s an inquiry that potential lenders carry out on your credit report but other prospective lenders don’t get to see it.

A soft credit check only remains visible to you for 12 months and includes the following:

- Every time you check your own credit report through Clearscore

- When someone checks your report to prove your identity

- Some lenders do a soft check to see if you can afford a loan, but always check what they do first!

Does a hard check impact your credit score?

Yes. A hard check on your credit report will impact your credit rating because all potential lenders will see it!

Moreover, the majority of hard checks remain on your credit report for 12 months. However, a debt collection check stays on there for 2 years!

When you apply for too many loans or credit cards, each one appears on your credit report. Lenders see this as you being desperate to get a loan which is a definite no-go for them to get involved.

I’ve listed what would result in a hard check on your credit report here:

- Credit card, loan and mortgage applications

- Certain mobile phone, and broadband contracts involve hard checks being carried out

You should always check whether a provider will carry out a hard check before applying for anything. Especially if your credit history isn’t as good as it could be or you’ve got lots of debt!

How do you contact Clearscore?

I’ve listed ways to contact Clearscore if you need to talk to an adviser about anything in the table below:

| Address | Vox Studios, VG 203 1-45 Durham Street London, SE11 5JH, UK |

| [email protected] | |

| Telephone | 0207 582 8212 |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Did the Clearscore bands change?

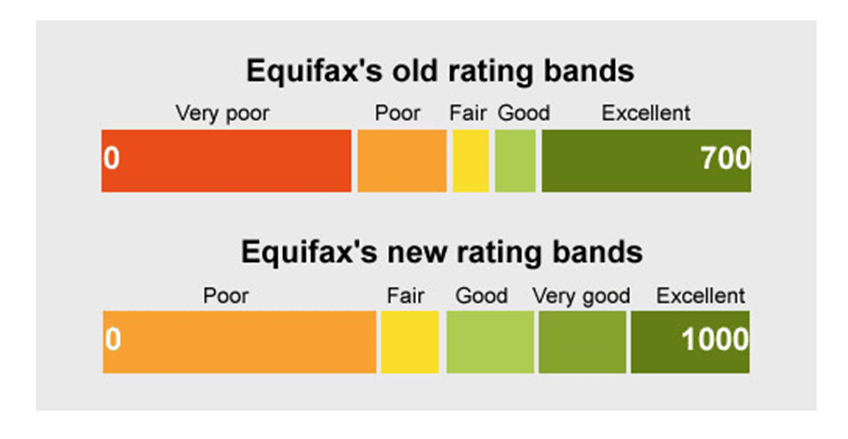

Yes. Back in 2021, Clearscore upped their rating bands from 700 max to 1000 max.

I’ve illustrated the change below which shows just how much of an impact it had in specific ranges:

What were the Clearscore bands before the change?

The clearscore five bands before the 2021 changes which I’ve listed below:

- Very Poor

- Poor

- Fair

- Good

- Excellent

The bands reflected whether your credit rating was ‘very poor’ right up to being ‘excellent’.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What are the newer Clearscore rating bands?

The newer Clearscore rating bands remain at five. However, there’s no longer a ‘Very Poor’ tag. Instead, there’s a ‘Very Good’ tag.

Therefore, the newer Clearscore rating bands are as follows:

- Poor

- Fair

- Good

- Very Good

- Excellent

As the diagram above illustrates, each band has its own value which is based on a 0-1000 value.

It’s supposed to make it a lot easier for you to understand your credit score which in turn should help you improve it when you can.

» TAKE ACTION NOW: Fill out the short debt form

What are the newer bands’ values on a scale from 0 to 1000?

As mentioned, each band has its own value attached to it which I’ve listed here:

- Poor – 0-438

- Fair – 439 – 530

- Good – 531 – 670

- Very Good – 671-810

- Excellent – 811-1000

Why did Clearscore up their rating bands to 1000?

Clearscore upped their rating bands to 1000 to get in line with the way Equifax calculates your credit rating.

The idea is to make it that much easier for you to see where you stand when it comes to your credit rating.

Moreover, having a higher scale provides you with a detailed picture of how things affect your rating.

At the same time, Clearscore reckons it gives the company a better insight into how to improve your score.

All in all, the result of the change is supposed to help you keep a good credit score so you have more chances of getting better credit ‘deals’!

What are the key changes to the band ratings?

The main changes to the Clearscore rating bands mean that if you were in the ‘ Poor’ band, chances are you could be in the ‘Fair Band’ since the change.

Also, the value of the ‘Good Band’ is higher than in the older bands which means that more people now find their credit rating appears to have improved.

The higher bands are split into two, namely ‘Very Good’ and ‘Excellent’. It means that a few people who used to be in the ‘Excellent Band’ found their score had dropped to the ‘Very Good Band’.

Does your credit score improve or get worse with the newer bands?

No. The newer Clearscore rating bands don’t necessarily mean a credit score got worse or that it improved.

For instance, if your score stood at 278 and was deemed Very Poor before the changes, it would still be 278 but placed in the newer ‘Poor’ Clearscore rating band.

Your credit rating didn’t change because it’s only the rating band label that actually changed when the newer system was introduced.

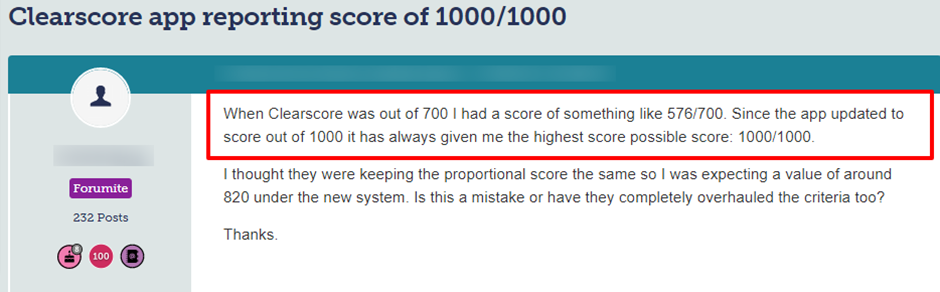

However, some people found their scores improved dramatically after the changes were introduced.

Check out what happened to one person when they checked their Clearscore after the changes took effect:

Source: Moneysavingexpert

How can you get a higher Clearscore band?

Your credit history is the most important thing to think about when it comes to your credit rating. In short, your score is based on your credit history and four other things.

So, if your credit history has always been good, your rating will reflect this. If your credit history is a little suspect, improving it takes time and patience!

However, there are things you can do to improve your credit rating which I’ve listed below:

- Make sure you make all your payment on time and try not to miss any. This means paying all bills on time, not just your credit cards, bank and other loans! For example, a late payment to your phone provider could harm your credit score and a missed payment would definitely impact it!

- If you’ve just split up from a partner, remove them from your credit history if you’re no longer financially tied to them

- Build up lender trust by always paying on time

- Use any credit you have responsibly

- Check your credit score regularly to make sure there are no mistakes recorded on it

- Avoid applying for lots of credit in a shorter period

- Make sure you’re on the electoral register

- Avoid high credit card balances by trying to keep them below the set limits

As mentioned, you have to work at improving your credit rating in real time. That said, these days it can be hard to keep on top of bills and debts!

If you’re struggling to pay bills, credit cards, or unsecured and secured loans, you should seek advice from a debt expert. Preferably before things get too bad!