Cheapest Car Insurance Brokers for High-Risk Drivers?

Finding affordable car insurance after a driving conviction can be a real worry. You’re not alone. Every month, over 1,000 people visit our site for advice on car insurance after a conviction.

In this article, we’ll help you to:

- Understand what it means to be a high-risk driver.

- Find out who are the cheapest car insurance brokers for highrisk drivers.

- Learn how your car might make you a high-risk driver.

- Explore how to lower your high-risk car insurance premiums.

- Discover affordable options for convicted drivers.

We know that being seen as a high-risk driver can make things tough, especially when it comes to finding cheap car insurance.

We’re here to show you that it’s not impossible to find affordable coverage, even with a conviction or points on your licence.

Are Brokers Good for Insurance?

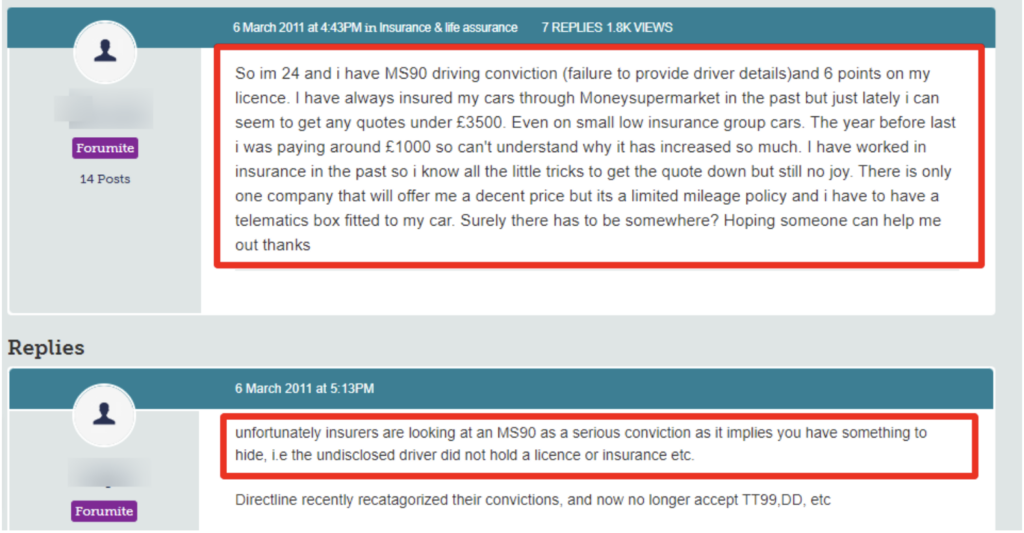

A broker can help you by doing much of the legwork when trying to find high-risk car insurance. The broker will have access to a range of firms that fill the role of a standard insurance provider, and also specialist insurance firms that provide vehicle cover to higher-risk drivers.

Is It Best To Use a Broker for Car Insurance?

This is a good question, and I am kind of on the fence over the answer. Let me give you a pros and cons style answer, below.

- Pros of using a broker – if you are in the high-risk category, and want to find cheaper insurance for convicted drivers, a broker will know which insurance company is likely to be the cheapest. Furthermore, the broker understands how insurance premiums work, and may be able to negotiate better terms, such as a no-claims bonus at sign-up.

- Cons of using a broker – a broker will only interact with a fairly small number of traditional insurers and specialist insurance brokers. Therefore, there may be other insurers that the broker doesn’t deal with that can provide cheap high-risk car insurance.

You have nothing to lose by approaching a broker though and asking them for help. As they do not charge you for this service. Instead, they are given a commission by any insurance firm that you decide to purchase car cover from.

What Is High Risk in Insurance?

A high-risk vehicle insurance policy is one that takes into consideration the considerable risk factor that the driver presents as a client. The insurance policy wording won’t be any different, but the cost will. The more motoring convictions you have, as well as factors such as the car you drive being high performance, the more the chance you are considered high risk, and the more expensive your vehicle cover will be.

Who Is High-Risk Car Insurance For?

Don’t be tempted to think that high-risk car insurance is only for people who have driving convictions. There are a number of things that can make you seem a high risk to insurance firms. I have listed some of these, below.

- You drive a high-performance car.

- You have one or more unspent driving convictions.

- You have been disqualified from driving. A drunk driving ban for example.

- New drivers who have only had a full licence for a short time are seen as high risk.

- A young driver is seen as a higher-risk driver.

And of course, these factors can combine to make you seem even more of a high risk for insurance purposes. For example, you drive a high-performance car and have a driving conviction. Or you are a young driver who drives a high-performance car, for example.

Who Do Car Insurance Companies See As the Highest Risk?

Without a doubt, insurance companies see people that have had serious driving convictions, such as a band C speeding ticket and subsequent criminal prosecution, as being amongst the highest risk. As well as people who have been given a driving ban due to their driving style (dangerous driving for example) or for drunk driving.

How Do I Know if My Policy Is Considered High Risk?

When you were looking for cheap car insurance, you will have likely been quoted far more than you expected for your insurance premium if you are seen as a high risk. And in some cases, such as people who drive high-performance cars, you would know already that you are in the high-risk category for insurance purposes.

Alternatively, if you had to go to a specialist insurance firm to get car insurance for convicted drivers, you would know that you are buying high-risk insurance.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

How Can My Car Put Me in the High-Risk Car Insurance Category?

Although it is naturally hard to find a cheap insurance premium for disqualified drivers, the car you drive can also put you into a higher risk category. For example, if you drive an expensive luxury car or a high-performance car, you would be seen as a higher risk.

Or you might be a young driver who is insuring a hot hatch, for example. Although the performance of this car is not outstanding, combined with your age, you would be seen as a higher risk by insurers.

Additionally, where you live can have an impact that can make you seem a high risk. If you own an expensive car in an area that has more than the average number of car thefts, the insurer would likely place you in a high-risk category.

Similarly, if you leave your car parked on a public road at night, insurance companies would see this as being a higher risk when selling you a car insurance policy.

Do I Need a Specialist Policy if I’m a High-Risk Driver?

If you are considered high risk by an insurer, due to a drunk driving ban for example, you don’t need any special policy. The policy wording will be no different to that which a responsible driver who has done an advanced driving course will be given. However, the cost of your insurance will be much more than a responsible driver with exactly the same insurance policy. Even if you have some no-claims bonus.

What Can I Do To Lower My High-Risk Car-Insurance Premiums?

There are a few things that you can do that could make your vehicle insurance a little cheaper if you are considered high-risk. I have listed some of these below.

- Switch to a car in a lower insurance band.

- For new drivers who recently passed their test, getting insured as a named driver on the policy of a family member can help.

- Stop using your car for work.

- Stop parking your car on a public road at night.

- Volunteer to have a vehicle tracker fitted to your car.

- Voluntary limit the number of miles you will drive for the year.

- Voluntarily offer to pay more excess.

None of these steps will be miraculous, and make your car insurance much cheaper if you are considered high risk. But combined, they might make your car insurance affordable.

Are There Any Quick Ways To Lower My High-Risk Car Insurance Premiums?

The most effective thing you can do to bring down the cost of your car insurance policy is to ask insurers to quote you for third-party-only insurance. The most expensive type of coverage insurers offer is fully comprehensive. This covers any damage to your car, even if you caused it.

Third-party-only insurance does exactly what the name suggests. It only covers you for damage that you do to another person’s vehicle or property. This is why it is the cheapest type of cover by far.

Find better convicted driver insurance deals

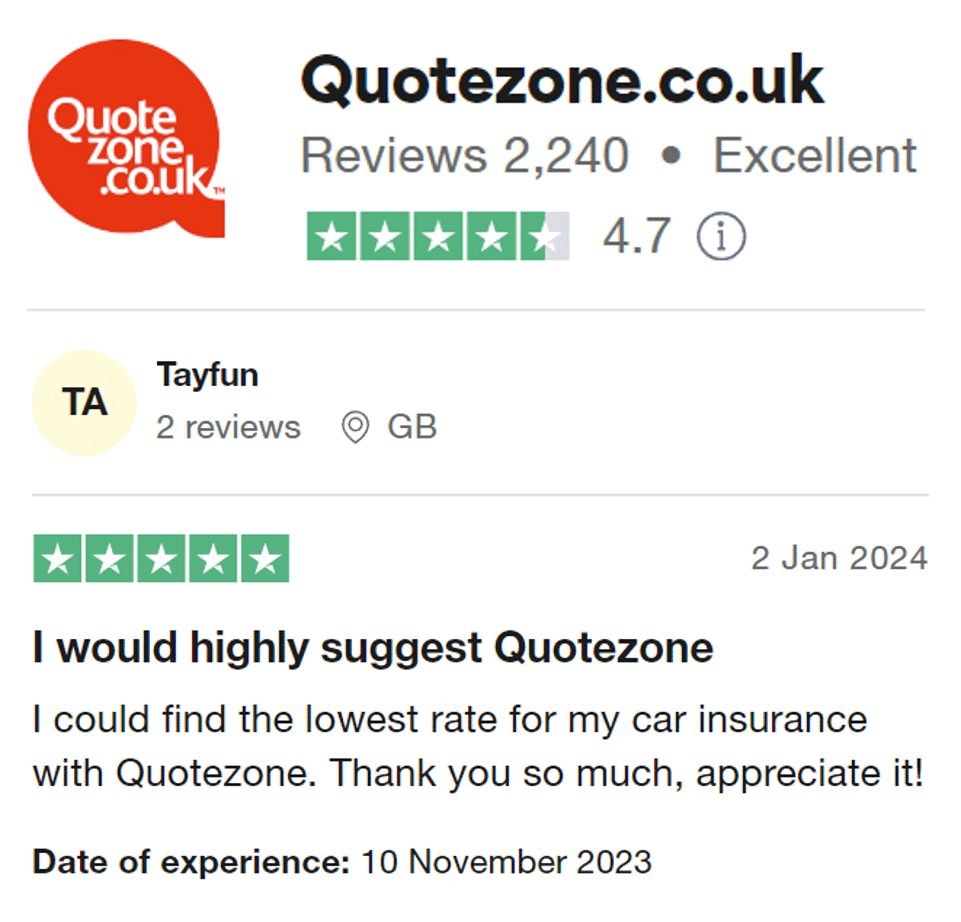

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Am I Classed As High Risk?

Are you trying to find the cheapest high risk car insurance, but are not sure if you are actually classed as a high risk driver? Below, I have listed many factors that might make you seem to be a higher risk to insurance firms.

- You are classed as a non-standard driver.

- You have a history of claims against your vehicle insurance. Even if this history of claims was driven by the actions of a third party.

- You have points on your licence, you will be seen as high risk until the points on your licence are spent.

- You have unspent motoring convictions.

- You drive a car or motorcycle that is classified as high-performance.

- You drive a car or motorcycle that is expensive.

- You are a young driver.

- You have only had your full driving licence for a short time.

- You were recently disqualified from driving and only got your driving licence back a short time ago.

And of course, these factors can combine to make the risk you present to insurance firms even higher. For example, you could new a new driver, that has unspent convictions for motoring offences, and who drives a car that is classed as being high-performance. In this case, the cost of your vehicle cover would likely be astronomical!

Who Is a Non-Standard Driver?

The term non-standard driver covers quite a broad spectrum of circumstances. Being a non-standard driver means that insurance firms are likely to view you as a higher risk than other drivers. I will list the kinds of things that can make you appear as a non-standard driver, below.

- Being involved in a recent motoring accident.

- Making any recent claims against your vehicle insurance.

- Sustaining any recent losses related to your vehicle.

- Having your vehicle stolen within the last three years.

- Suffering from a known medical condition that the Driver and Vehicle Licensing Authority (DVLA) needs to know about.

Please note, that some of these situations are not under your control. If your car was stolen, it likely wasn’t your fault. But it will make insurance firms look at you a little unfavourably for a few years, and could potentially put the cost of your premium up.