Cheapest Car Insurance for Disqualified Drivers?

When you get your licence back after a ban, it can be hard to find cheap car insurance. Don’t worry, we’re here to help. Every month, over 1,000 people visit this blog looking for guidance after a driving ban.

In this guide, we’ll share:

- How to find cheap insurance after a driving conviction.

- What being a ‘Disqualified Driver’ means.

- How long you need to tell your insurance about a ban.

- What happens if you don’t tell your insurance company about your conviction.

- The effects of a driving ban on your insurance costs.

We know it can be tough to find affordable car insurance after a driving ban. But we’re here to help you understand it’s not impossible.

Let’s dive in!

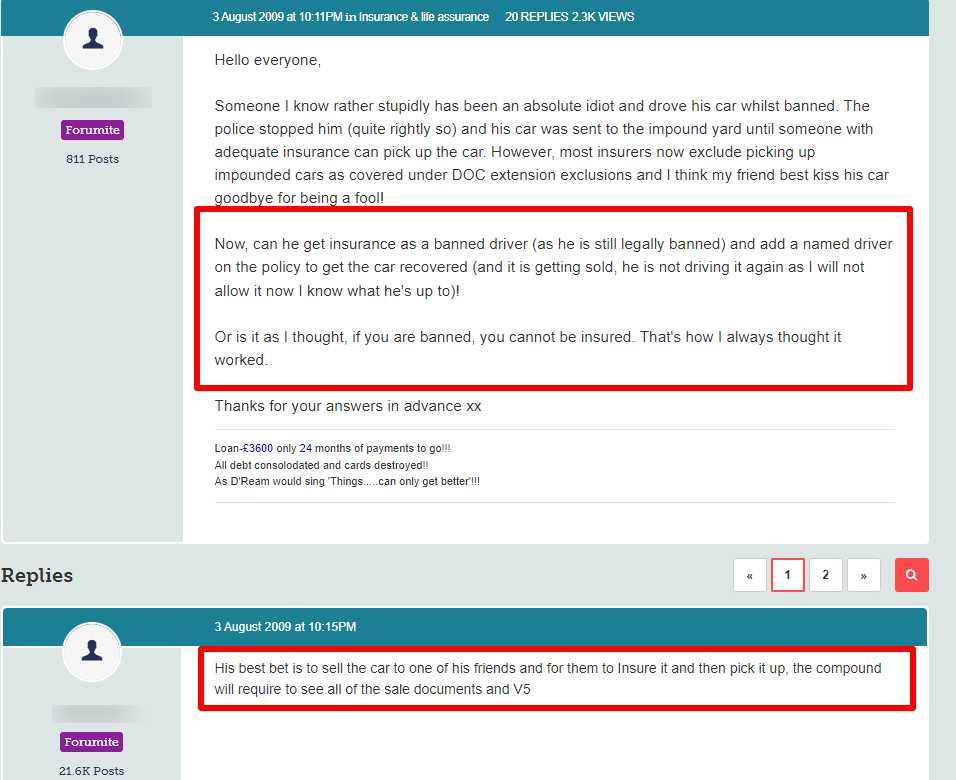

Can a Disqualified Driver Hold Car Insurance?

No, as a disqualified driver you cannot get car insurance at all, as no insurance providers will even give you a quote. Convicted driver’s car insurance is available though. Note, that if you are banned for a drunk driving conviction for example, you won’t even be able to pick up your car if it was impounded by the police, as driving without insurance could lead to further motoring convictions.

How Long After a Driving Ban Do You Have To Declare Insurance?

This depends on the insurance company. But you should, in general, tell your insurance provider as soon as you have been banned, as it is likely that your car insurance is already invalid due to your motoring offences that lead to the ban.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

How Much Does Insurance Go Up After a Ban?

If you have just come off of a driving ban, you can expect the cost of your car insurance premiums to go up by at least 100%. This is because you are seen as a high risk driver by insurers.

Can You Get Car Insurance After Disqualification?

Once your disqualification period is over and you have your licence back, you will be able to get insurance. However, you might be forced to go to a specialist car insurance firm, if traditional insurers won’t touch you. In this case, insurance for convicted drivers is always going to be more expensive. There is no such animal as cheap convicted driver insurance.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Is My Insurance Void if I’m Banned?

As there is no such thing as banned driver insurance, your current insurance policy would indeed be deemed void. It is an offence to drive a vehicle without insurance, so you can’t just go on driving.

How Long Does a Driving Ban Affect Your Insurance?

Once your ban is over, you can expect it to have an impact on your ability to get affordable car insurance for up to 5 years.

What if I Don’t Disclose My Conviction to a Car Insurance Provider?

If you do not tell the insurance company about your driving ban, you are going to be driving without valid motor insurance. Doing this can lead to further driving convictions and even criminal convictions in some cases.

Do Car Insurance Companies Check Driving Licences?

No, your insurance firm will not check your driving convictions and whether you have been disqualified from driving. It is up to you to be truthful about this. If you lie and are found to have obtained insurance fraudulently, this could lead to a criminal conviction.

Can a Banned Driver Still Insure a Car?

As a convicted driver who is currently under a driving ban, no insurance company is going to provide you with car insurance quotes, let alone actual cover. As I said previously, you can get cover if you are a convicted driver once the ban is up.

What Happens if My Conviction Is Spent?

Once your ban is over and your convictions are all spent, you should be able to get cheap insurance from traditional insurers once again, without having to deal with specialist insurance brokers, etc.

What Are My Options if I’m Refused Car Insurance Because of a Conviction?

If you have a driving conviction that resulted in a ban, and it remains unspent even though you have your licence back, you might be seen as too high risk to insure at all. In this case, all you can do if you can’t get convicted driver insurance is to wait until one or more convictions are spent.

What Happens After You Have Been Disqualified From Driving?

If you have been disqualified from driving, it means you can no longer drive any vehicle until you get your licence back. Furthermore, the unspent conviction that the ban relates to will stay on your driving record until it is spent. Until such time, it will be very hard to find affordable cover. However, spent convictions shouldn’t have an impact on your being able to get cheaper insurance.

What Classes Me as a High-Risk Driver?

There are many reasons why you might be seen as a high-risk driver by vehicle insurance firms. I have listed some of them below.

- You are a convicted driver due to a speeding ticket or other motoring offence.

- You are a young driver.

- You drive a high-performance or expensive car.

- You have had a previous driving ban.

- You have many penalty points on your licence.

How To Get Cheap Car Insurance After a Ban?

Finding cheap convicted car insurance after you have been disqualified from driving, is not going to be simple. The best thing you can do is shop around for the best deals on convicted driver car insurance. You can use a comparison website or the services of a broker to help with this.

What Is the Cheapest Car To Insure After a Ban?

One of the ways to reduce your insurance costs is to switch to a car in a much cheaper insurance band. Below, I have listed some of the cheapest cars to insure in the UK.

- Renault Clio

- Fiat 500

- Volkswagen Up

- Skoda Fabia

- Fiat Panda

- Volkswagen Polo

- MG3

- Hyundai i10

- Nissan Micra

- Toyota Aygo X

- Dacia Sandero

- Kia Picanto

- Ford Fiesta

- Kia Rio