Cheapest Temporary Insurance for Convicted Drivers with Points?

Driving with points on your licence can make car insurance a big worry. This is why we are here to help. Every month, over 1,000 people visit this site for advice on insurance for drivers with convictions.

In this article, we’ll help you:

- Find the cheapest insurance when you have a conviction.

- Understand if you can get temporary car insurance as a convicted driver.

- Learn about the cost of temporary car insurance.

- Know which driving convictions affect your insurance.

- Figure out how long convictions last until they are spent.

We understand the stress of finding affordable insurance with points on your licence. Many people worry that they won’t be able to afford it.

We want to reassure you that it is possible, and we’re here to guide you through it.

Can I get temporary car insurance as a convicted driver?

You could apply for temporary cover provided you haven’t received 6 penalty points in the last 24 months. Plus you mustn’t have been disqualified from driving in the last 5 years.

That said, insurers will look at other risk factors before they offer you temporary cover with points on your licence.

In short, as a convicted driver with points, the amount you pay for car insurance will be quite high. More so as it’s short term car insurance which always means insurance premiums are high!

Can you get temporary car insurance after a ban?

You could get temporary cover after a driving ban, but only if you’ve not been disqualified from driving in the last 5 years.

Moreover, the amount you pay will be higher than you might have hoped, which is the consequence of being at the wheel of a car during a driving ban.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Can I get car insurance with a criminal conviction?

You may be offered insurance if you’ve got a criminal conviction. But finding a better deal could prove challenging. Plus, it might not be as cheap as you hoped it would be!

That said, it depends on the conviction and the number of points you got. Plus, an insurer would want to know about unspent convictions you got in the last 5 years as to whether they’d insure you or not!

Which convictions can I get temporary car insurance with?

Driving convictions and penalty points will affect the amount you pay for temporary cover. That said, the fewer the points the less it should affect your premium.

However, the opposite is true if you receive 11 points and a disqualification! Motor insurance providers view you as a high-risk driver when you’ve got penalty points and a conviction!

As mentioned, you could apply for temporary cover provided you haven’t received 6 penalty points in the last 24 months. Plus you mustn’t have been disqualified from driving in the last 5 years.

Your best option could be to contact a broker or a specialist insurance company. They may offer you a non-standard insurance policy.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Temporary car insurance for convicted drivers

Short-term vehicle insurance could get you out of a fix if you need to be on the road. However, it’s a good option if you’ve got less than a year for a conviction to be ‘spent’.

The downside to this type of deal is that it’s going to cost you a lot more to insure a vehicle in the long run.

Temporary car insurance for dangerous driving conviction

Insurance companies may offer you short term cover but they will charge high premiums thanks to you being an extremely high-risk driver.

» TAKE ACTION NOW: Find the best insurance for drivers with points

Which convictions affect my insurance?

I’ve listed some of the driving convictions that will earn you penalty points and affect your insurance in the table below:

| Type of offence | Severity | Penalty Points | Time the points stay on your licence |

| Drink-driving | Risk disqualification | 3 – 11 points | 4 – 11 years |

| Drug-driving | Risk disqualification | 3 – 11 points | 11 years |

| Careless driving | Risk disqualification | 3 – 11 points | 4 – 11 years |

| Failing to stop | 5 – 10 points | 4 years | |

| Driving while banned | Risk disqualification for second time | 6 points | 4 years |

| Causing death while banned | Risk disqualification for second time | 3 – 11 points | 4 years |

| Construction & Use offences | 3 – 6 points | 4 years | |

| Reckless/dangerous driving | 3 – 11 points | 4 years | |

| Insurance offences | 6 – 8 points | 4 years | |

| Licence offences | 3 – 6 points | 4 years | |

| Speeding | Risk disqualification | 3 – 6 points | 4 years |

Do I need to declare criminal convictions when applying for temporary car insurance?

You must declare driving convictions and penalty points to car insurance companies when you renew a policy or apply for new insurance. Even when you apply for temporary motor insurance for a limited period.

The Road Traffic Act 1998 states that you must declare penalty points and convictions to insurers when you apply for motor insurance. That said, if you are currently insured when the points are recorded, you only have to declare when you renew your policy.

Plus, you don’t have to declare spent penalty points to an insurance company that are 5 years old. In short, motor insurance providers cannot legally increase the amount you pay once penalty points are spent!

Do insurance companies check driving convictions?

Yes. You should tell your insurer about any penalty points you get because insurers will check whether you’ve got any convictions.

They use the information to work out how much to charge you. If you don’t tell them, it could impact your insurance cover. In short, your policy could be void.

What happens if you don’t declare driving convictions?

When you don’t declare unspent penalty points to an insurer, your policy will be void. In short, you may not be covered if you’re involved in a road traffic accident.

Moreover, an insurer could deem you committed fraud and you risk being arrested by the police!

How Long Do Convictions Last Until They Are Spent?

You would get penalty points for a minor or more serious driving offence. The more serious the offence, the more penalty points get added to your licence.

Maybe you were caught speeding on a smart motorway, or maybe you were caught on camera running a red light.

Whatever the reason, you may avoid prosecution for a minor offence and get a few penalty points, and a fine to boot.

For example, you may not have to attend court but settle for a Fixed Penalty Notice (FPN) instead. However, even if you accept an FPN, you could still face prosecution!

However, if the offence is serious, you may face prosecution and conviction! Plus the number of penalty points you receive goes up too.

A serious driving conviction earns you 11 penalty points. Moreover, if you get 12+ points on your driving record, you’ll get a driving ban that lasts a minimum of 6 months!

In short, a conviction could stay on your driving record for 4 to 11 years before they are spent!

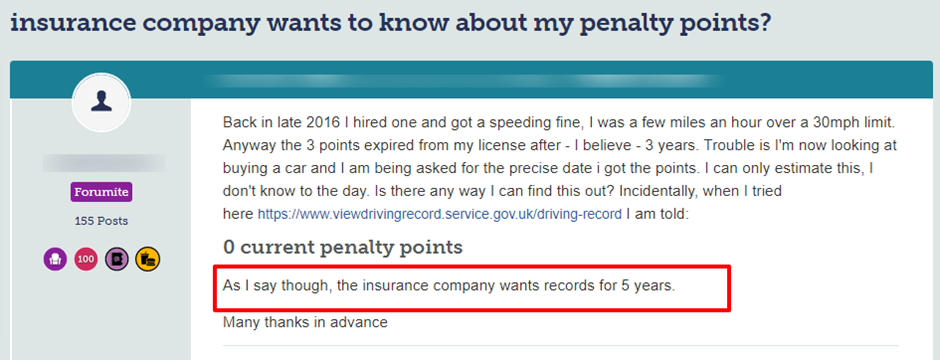

Check out the dilemma one motorist had to face when an insurer asked about penalty points:

Source: Moneysavingexpert

How To Get the Cheapest Temporary Insurance

You could do the following to reduce the amount you pay for temporary cover if you’ve got penalty points:

- Think about parking your vehicle off-road in a secure garage

- Consider increasing the excess you pay

- Opt for a policy with a black box (telematics)

- Choose the right insurance cover. For example, third-party cover would be less expensive than a comprehensive policy

- Opt to drive a vehicle in the low insurance group

- Contact several insurance providers to see which offers the better deal

You can try any of the above to reduce the amount you pay for temporary cover when you have penalty points.

You should definitely shop around when you’re searching for a better deal on temporary cover..

Is it worth using an insurance broker if you’re a convicted driver?

You could use a broker to find the best deal for you. They have the experience and the contacts within the insurance sector which could prove useful, saving you both time and effort.

That said, you may not get the cheapest quote on temporary cover whether you go through a broker or not. But it could mean more affordable car insurance than you’d get elsewhere.

In short, depending on the seriousness of a conviction and the number of penalty points you have, the amount you pay could still be very high. Plus, temporary cover is going to be a lot more expensive than an annual policy would be anyway!

Lastly, cheapest temporary insurance for convicted drivers, is it possible?

Temporary car insurance is more expensive than opting for an annual policy. So, if you’re a convicted driver with points on your licence, you should not expect to get a great deal!

That said, temporary cover could get you out of a ‘fix’, more especially as it provides cover for however long you need. But an insurer will need to know about your conviction and when you got the points.

For example, if you got the penalty points in the last 24 months and you were banned from driving in the last 5 years, temporary insurance won’t be an option!

Thanks for taking the time to read this post. I hope the information helps you find the right temporary car insurance to meet your needs and that it does not break the bank!