Cheap Car Insurance with Banned Drivers TT99 Conviction

Having a TT99 conviction can be tough, especially when hunting for an affordable car insurance. But don’t worry; we’re here to help. Over 1,000 people each month visit this site looking for guidance on insurance matters related to driving convictions.

In this article, you’ll learn:

- What a TT99 driving conviction is and why you might get one.

- How to find the cheapest insurance even with a TT99 conviction.

- If you can continue to drive with a TT99.

- The length of a TT99 ban and its impacts on your licence.

- How a TT99 conviction might affect your insurance.

We understand the pain of having a TT99 conviction and the worry it brings. Finding affordable insurance seems hard, but we’re here to assure you it isn’t impossible.

Let’s get started!

Can you still drive with a TT99?

When you receive 12 penalty points within a three-year period, you are banned from driving and cannot drive during the driving disqualification period.

Once your driving disqualification period has ended, you are allowed to drive again, but you might need to reapply for your driving licence.

It’s likely that your driving ban will have ended, but the TT99 still shows on your driving record as this remains on the record for four years.

How long is a TT99 ban?

The length of time you’re banned for a “totting up” offence is at the discretion of the court. However, most TT99 driving bans last for six months.

If you have been disqualified previously in the last three years, I have some bad news for you. Your driving ban is more likely to be for one year.

But I repeat, this will all be at the discretion of a judge.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Is TT99 a criminal conviction?

A TT99 endorsement isn’t a criminal conviction.

But it’s still a serious matter that will have an immediate effect on your ability to drive, and it can have long-term financial consequences, which we will discuss shortly.

What is the penalty for a TT99 conviction?

The penalty for a TT99 conviction is outlined in the following table:

| Conviction code | Nature of offence | Penalty points | Lifespan of the conviction | Fine amount |

| TT99 | Receiving 12 penalty points on your driving licence within any three-year period | NA | Four years from the date of conviction | NA |

And as mentioned earlier, you’ll be banned from driving for at least six months and possibly for a year or longer, as decided by a court.

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

How to find the cheapest insurance with a TT99 conviction

If you’ve got a conviction or points, getting insurance through a standard provider could be more expensive.

You might find cheaper deals through specialist insurers.

I’ve partnered with Quotezone who can help you find the best insurance specifically for convicted drivers with points.

Fill out the simple form below to find great quotes for convicted drivers today.

Does a TT99 affect your insurance?

Yes, having a previous driving disqualification – including a totting-up ban – can affect your vehicle insurance options and the cost of insurance premiums.

You will only need to disclose your TT99 endorsement and any endorsements that led to the TT99 conviction until they’re considered “spent”, which is usually five years. Once they are spent you don’t need to disclose this information to the insurance company, even if you’re asked. Insurance companies aren’t allowed to increase insurance premiums for spent driving convictions.

When you’ve been banned from driving, you’re considered a more risky driver. As a result, insurance companies won’t offer you the same cheap deals as they may offer someone with a squeaky-clean driving record. They want you to pay more to be insured as they expect you’re more likely to make a claim.

Car insurance for TT99 conviction

The good news is there are still insurance providers willing to offer insurance policies for previously disqualified drivers.

These policies might be marketed in different ways, such as:

- Disqualified driver insurance

- Banned driver insurance

- High-risk driver insurance

- Or even, TT99 driver insurance

What is the cheapest car insurance with a TT99 conviction?

The cheapest car insurance for someone with a TT99 conviction off the back of a driving ban can differ between individuals, and vehicles and is subject to change.

The best way to find suitable and more affordable high-risk car insurance is to search specifically for these types of policy names, rather than searching the standard car insurance market.

Additionally, it might be worth engaging the services of a vehicle insurance broker, preferably one that specialises in helping motorists who have previously been banned to get insured.

This was the strategy of the success story I have republished below…

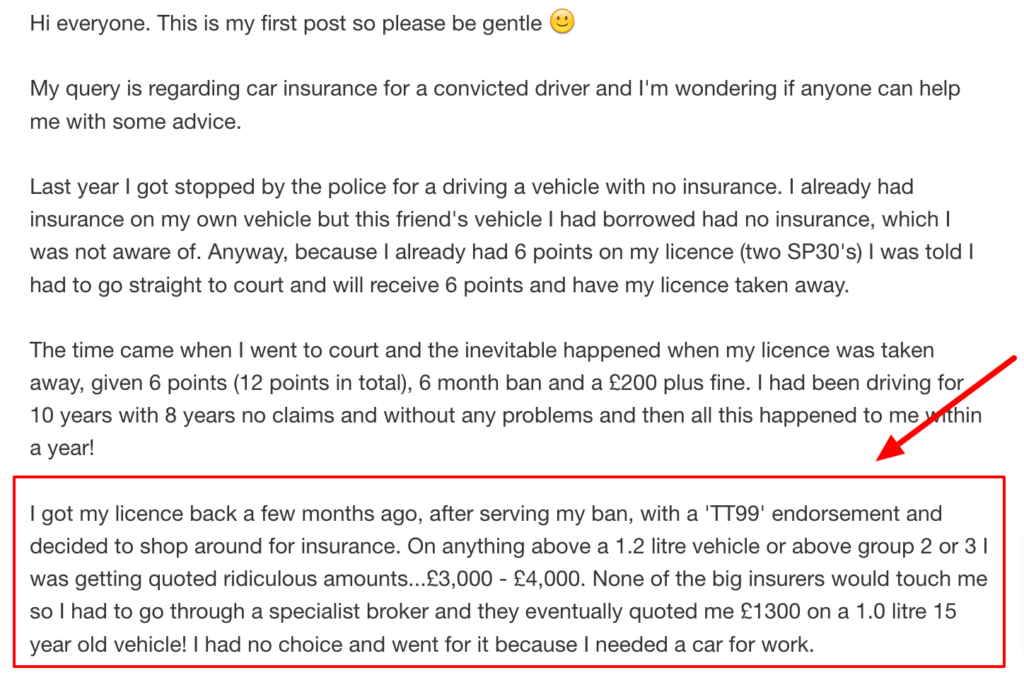

Cheap car insurance for banned drivers TT99 – a success story!

I found this familiar story posted on a reputable online forum. The forum poster tells us how high he was getting quoted due to his previous (TT99) driving ban. The quotes were just too unaffordable with some as high as £4,000 per year.

He then used a specialist insurance broker who managed to find him a lesser-known insurance company willing to insure him for a fraction of the previous quotes. Have a read for yourself here:

How long does a TT99 conviction stay on your driving licence?

A TT99 remains on your driving record for four years from the date of conviction – not the date of the offence.

You can view your driving record online by visiting the UK Government’s website. Or you can call the DVLA for information on your record.

You will need to verify your identity by passing security using each of these methods. You’ll ideally need your current driving licence to hand and your National Insurance number.