Do I have to pay CCS Collect Debt (CCSCollect)?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

When you get a letter from CCS Collect, you might feel worried. You might ask, “Do I have to pay CCS Collect Debt?” Don’t worry, you are not alone. Each month, over 12,000 people visit this site for guidance on debt issues.

In this article, we’ll talk about:

- Who CCS Collect is.

- How to deal with them.

- If you can pay less money to them.

- What happens if you don’t pay CCS Collect.

- How to stop them from talking to you.

We understand that dealing with debt collectors can be hard. It can affect your everyday life. We know this because some of our team have been in your place and have had to deal with owing money. Let’s get started and learn more about dealing with CCS Collect.

Is CCS Collect a legitimate business?

Yes. CCS Collect is a legitimate business that’s regulated by the Financial Conduct Authority (FCA). They’re founding members of the Credit Services Association (CSA) and therefore must follow the law when they contact you.

Why did I get a letter from CCS?

Chances are CCS is contacting you over an unpaid debt owed to another business/creditor. The debt collector is acting on behalf of the client to recover the money you allegedly owe.

In short, CCS doesn’t ‘buy’ debts for discounted amounts. The debt collector is instructed by the client to chase debtors for payment.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should I pay CCSCollect?

You may have to pay CCSCollect if the debt collector can prove you owe the money. However, CCS must provide you with authenticated proof.

Don’t just accept their word for it!

So, if the debt is yours, try to negotiate an affordable plan with CCS. Seek advice from one of the debt charities if you’re unsure or confused about anything.

Don’t agree, sign or pay CCS anything until you do.

Moreover, don’t let CCS pressure you into anything. It’s unlawful if they do and you could report them to the Financial Ombudsman Services (FOS).

How do you deal with CCS?

Getting a letter from CCS about a debt could send you into a panic. So, once the dust settles, you should ask the debt collector to ‘prove’ the debt is yours!

That’s the first thing to do before seeking debt advice from an independent, impartial adviser if you’re confused. An adviser from one of the UK’s debt charities could provide essential advice if needed.

Next, find out whether the debt is statute-barred which means it’s unenforceable because it’s six years old or more.

Don’t feel threatened by CCS correspondence. Debt collectors must abide by the law when they contact you. They’re obliged to give you enough time so you can seek advice to establish your best options!

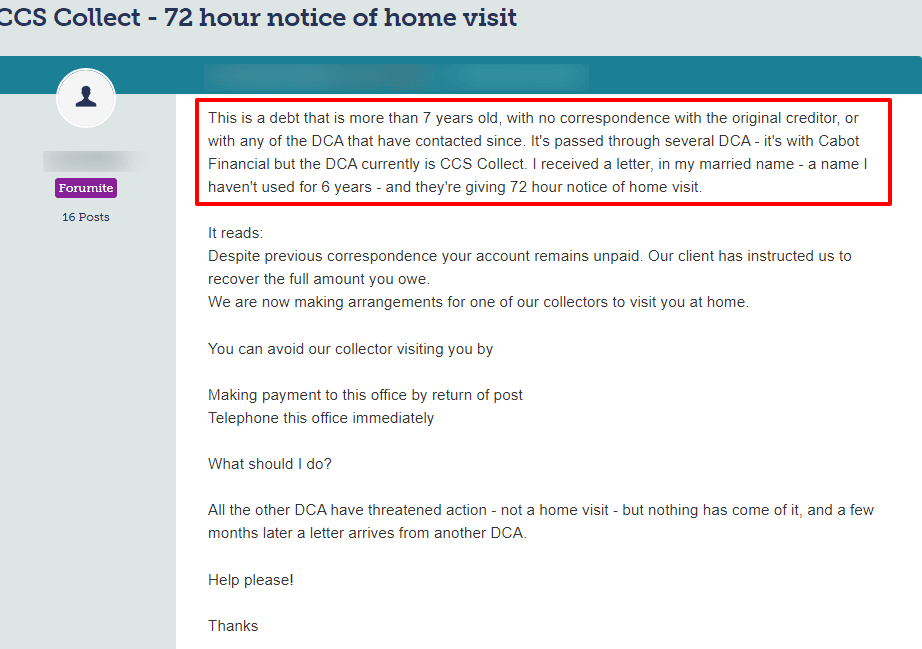

Take a look at what happened to one person who was contacted by CCSCollect:

Source: Moneysavingexpert

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Should you ignore CCSCollect?

No. It’s never a wise decision to ignore CCSCollect letters. Moreover, you could be missing out on the following if you do:

- Finding out the debt is not yours

- Establishing the debt is unenforceable because it’s statute barred

- Being offered an affordable repayment plan you can afford

- Getting some of the debt wiped off

Also, you could end up having to deal with the following:

- Court action was taken out against you

- Receiving a County Court Judgement (CCJ) which ruins your credit rating

- Having Enforcement Agents turn up at your home and seize possessions (with a court order that is)

What happens if I don’t pay CCSCollect?

It’s all too easy to bin a letter from CCSCollect. But it won’t make the debt collector go away because they are persistent and rarely give up!

Moreover, the problem only gets worse.

You could end up facing court proceedings, plus the debt amount would increase. If you still don’t pay, a CCJ is registered on your credit history.

What can CCSCollect legally do?

There are laws that govern what debt collectors can and cannot do. A debt collector can:

- Visit you at home

- Discuss a debt with you politely and discreetly

- Treat you fairly and proportionately

- Discuss the debt in clear and transparent terms

- Treat you with empathy and understanding

- Ask you to pay them directly

A debt collector cannot legally do any of the following:

- Force their way into your home

- Employ confusing/deceptive tactics to coerce you into paying

- Apply pressure for you to take out another loan to pay them

- Imply they have more powers than they actually have

- Harass or threaten you

- Talk to other people about the debt which breaches privacy laws

- Call you on the phone at all times of the day (and night)

- Clamp your vehicle or seize possessions

If CCSCollect visits you at home, you don’t have to open the door. Moreover, you can ask them to leave and they must respect your request.

» TAKE ACTION NOW: Fill out the short debt form

How do I stop debt collectors from contacting me?

You can’t stop a debt collector from contacting you. But you can write to them and ask them to stop contacting you at all hours.

Tell the debt collector how to contact you and when to contact you. If they don’t respect your request, tell them that it’s a criminal offence to harass you!

How do you contact CCS Collect?

I’ve included CCS Collect contact details here:

| By phone | 020 8665 4929 |

| Via email | [email protected] |

| Website: | www.ccscollect.co.uk/ |

| Addresses | CCS Collect Debt Collectors 797 London Road, Thornton Heath, Surrey CR7 6YY CCS Collect Debt Collectors Norfolk House, Wellesley Road, Croydon, Surrey |