Do I have to pay CARS Debt (Creditlink Account Recovery Solutions)?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you dealing with CARS Debt (Creditlink Account Recovery Solutions)? This can be a big worry, but you’re not alone. Each month, over 12,000 people come to this site for advice on debt issues.

In this article, we’ll help you understand:

- Who CARS Debt Collection are and what they do.

- How to lower your repayments with them.

- The correct way to handle a CARS Debt letter.

- How to stop CARS Debt from calling you or visiting your home.

- Ways to get in touch with CARS Debt Collections.

We understand how stressful owing money can be – our team has experience with these situations, and we know how to help you. We’ll guide you on how to handle CARS Debt, so let’s dive in to learn more about what you can do.

Can you ask for a Prove the Debt?

Yes, you can. In fact, it’s a good move to ask for a ‘prove the debt’ letter from CARS Debt! Without proof that you owe the money, you can’t be chased by the debt collection agency!

Should you ignore a CARS Debt letter?

It’s never a good idea to ignore a CARS Debt letter even when you think they’re wrong. You may have to face a court hearing which can add more stress to an already stressful situation.

Instead, try to stay in touch with CARS Debt and sort out the problem. You should be offered a solution which could result in a manageable repayment schedule

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can CARS Debt visit you at home?

Yes. Although a debt collector doesn’t have the same rights under the law as an Enforcement Agent (bailiff). That said, the debt collector should give you a seven-day warning before visiting you at home.

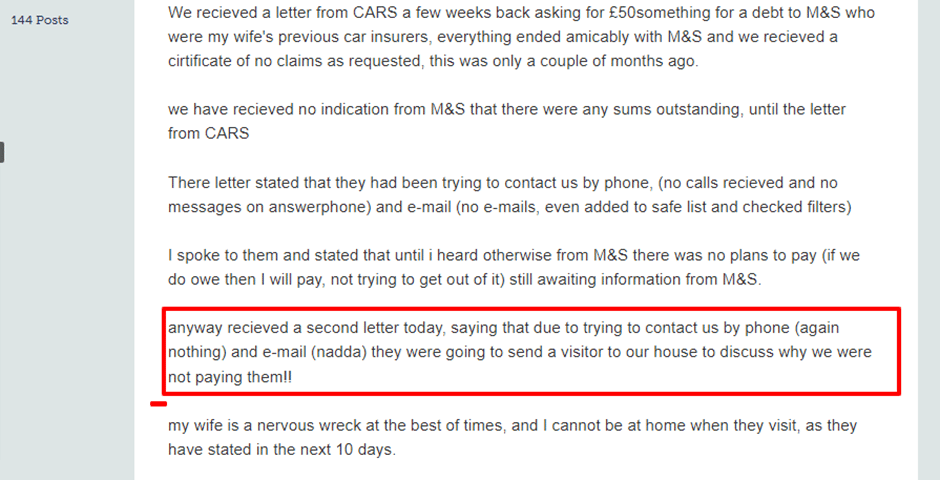

Check out the threat of a home visit by CARS Debt to this unfortunate person.

Source: moneysavingexpert

That said, if there’s a court order for you to pay and you don’t, a bailiff could be instructed to visit you at home. Your possessions could be seized and sold at auction.

But only a bailiff can do this, not a debt collection agency!

How do you deal with intimidating CARS Debt Letters?

Most debt collection agencies which include CARS Debt send out intimidating letters designed to scare you. Don’t panic. Take your time to consider the situation before answering any correspondence.

If necessary, seek advice from an independent debt adviser who could tell you of your options.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can you stop CARS Debt from calling you?

Debt collectors are not allowed to harass you. It’s the law. If you’re being called at all hours, get in touch with CARS and tell them to stop. Do it in writing and send the letter by registered post!

Tell them when they can call you and where they can call you.

Once you’ve made the request, the debt collection agency has to honour your request. If they don’t, they’d be breaking the law!

Can you get out of paying CARS Debt?

There are ways of getting out of paying CARS debt. First, is the debt statute-barred which means it’s over 6 years old. You can’t be chased when a debt is over this time limit!

That said, the debt doesn’t go away, it just means you can’t be forced to pay it! If this is the case, send the collection agency a Statute Barred letter instead of a ‘Prove the debt’ letter!

» TAKE ACTION NOW: Fill out the short debt form

How do you get in touch with CARS Debt Collections?

I’ve listed ways to get in touch with CARS Debt Collections here:

| Online | https://www.carsuk.org/ |

| By post | C.A.R.S. PO Box 6520, Basingstoke, Hampshire RG21 4UY |

| By phone: | 0333 136 3349 – General Enquiries0333 136 8282 – Debit and credit card payment line |

| By email: | [email protected] |