Which Car Insurance Companies Do Not Ask About Convictions?

Searching for affordable car insurance after a driving conviction can be tricky. But don’t worry, we’re here to guide you. Over 1,000 people visit our blog each month for advice on this topic.

In this article, we’ll cover:

- The meaning of a driving conviction and how long it lasts.

- How to find cheap insurance with a conviction.

- The types of convictions that might disqualify you from certain insurances.

- When and how to tell your insurer about your criminal convictions.

- How a criminal record can affect your car insurance.

We understand you might be worried about costs after a conviction. But you’re not alone. We’ll show you that finding reasonable insurance is not impossible, even with a conviction.

Do You Have To Tell Insurance About Criminal Convictions?

Yes. You have to tell insurance providers about current criminal convictions. To explain, you only need to declare unspent convictions!

So, what is an unspent driving conviction? It’s a conviction that’s still currently recorded on your driving record/licence!

You don’t have to tell an insurer about ‘spent’ criminal convictions which are 5 years or older. Although some insurers may ask about driving convictions over 5 years old too!

When should you declare a criminal conviction to an insurer?

It’s worth noting that you don’t legally have to tell a car insurance provider about your criminal convictions. Not unless they ask you about them, that is!

However, all insurers ask the question because it’s what they base their quotes on. For instance, if you have a drink-driving conviction you may not be offered insurance, or the premium is astronomical!

Insurers want to know if you’re:

· A high-risk driver

· Worth insuring and the amount to charge you

So, in short, the only time you’d find a car insurance provider who doesn’t ask you about a criminal conviction is when they forget to ask!

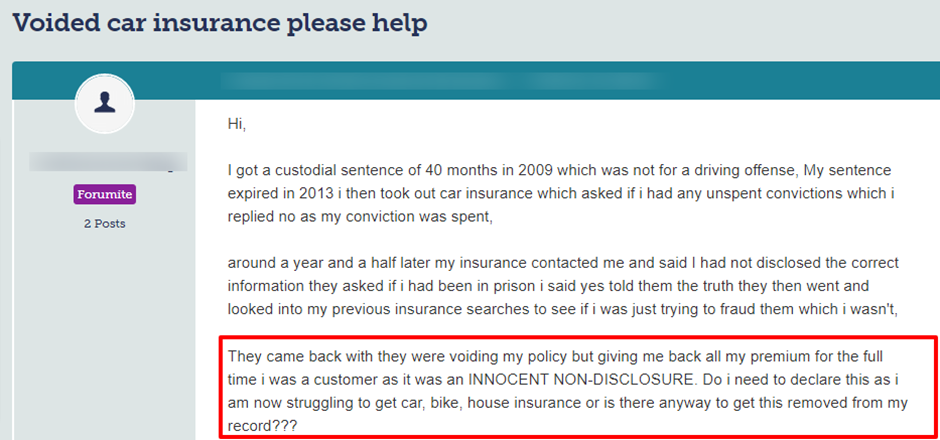

Check out what happened to one person who didn’t declare a criminal conviction to their insurers and it wasn’t even a driving conviction!

Source: Moneysavingexpert

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Which Car Insurance Companies do not ask about Criminal Convictions?

Most car insurance companies, if not all of them, ask drivers about their convictions!

Motor insurance providers always want to know everything about your driving history. They need this information for two basic reasons which are:

- To establish whether you’re a high-risk driver

- To work out how much to charge you

That said, insurers also want to know about your convictions so they can decide whether they actually want to insure you!

What can happen if you don’t tell your insurer about your conviction?

If you choose not to tell an insurer about your convictions when they’ve asked about them, it could seriously backfire on you!

For example, if you’ve been stopped by the police or you’re involved in a traffic accident, you may find you’re not insured.

Why? Because the insurer will invalidate your policy because you failed to declare a conviction when asked!

Plus, you could be prosecuted for being at the wheel of a motor vehicle without insurance and be done for fraud to boot!

Find better convicted driver insurance deals

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Can I put someone else down as the main driver?

No. This is known as ‘car insurance fronting’ and it’s illegal. You can’t pretend someone else is the main driver when in reality, they are not!

Do I need to declare criminal convictions of named drivers?

Yes. You must tell insurers about unspent convictions of named drivers when you want to add them to your policy.

Will a Driving Conviction Have an Impact on Your Vehicle Insurance?

Vehicle insurance companies don’t like high-risk drivers because the chances of them making a claim are higher than someone with a clean licence. That’s it in a nutshell!

If you’ve got a conviction on your record, the chances of finding cheap car insurance simply evaporate.

Your current insurer may not want to provide you with insurance. But you could contact a specialist motor insurance provider to get a quote.

Alternatively, you could approach an insurance broker to see if they can source a competitive quote. But, as previously mentioned, you should be prepared to pay a lot more even then!

Do insurance companies check driving convictions?

Car insurance companies can only check if you’ve got convictions when you give them permission to do so.

Do insurance companies do DBS checks?

Vehicle insurance companies can’t access police records. Therefore, without your consent, they can’t run a check on you. In short, they rely on you to tell them about driving convictions you may have.

How can I save on car insurance with a criminal record?

There are things you can do to reduce the insurance premium you pay. But it depends on the sort of conviction you received.

Plus, if the conviction remains on your record for 11 years, you should be prepared to pay a premium amount for that amount of time!

You could lower the amount you pay by:

- Choosing to drive a vehicle in the low insurance group

- Contacting a specialist insurance company that may offer you a non-standard insurance policy

- Get in touch with a broker who may be able to find you more affordable insurance

Specialist insurers and brokers are used to working with people with criminal convictions and have the necessary means to source insurance coverage for you.

Can I get car insurance with a criminal conviction?

Yes. You may be offered vehicle insurance coverage from a specialist motor insurance company that deals with drivers who have criminal convictions on their records.

In short, there’s more chance of them offering you a better quote than say, a more traditional motor insurance company.

There is another option which is to contact a broker who may be able to source better insurance quotes for you. But these will still be higher than what you may have been paying before the conviction!

How Long Do Driving Convictions Last?

It depends on the type of driving conviction as to how long it remains on your driving record. For example, a record of the conviction remains on your licence for 11 years.

A lesser offence will still remain on your driving record for 4 years!

What’s the difference between spent and unspent convictions?

A spent conviction has reached its ‘sell by’ date and therefore is removed from your record. However, an unspent conviction is still current and therefore still on your driving record.

How do I check if my conviction is spent?

You can find information about your driving convictions by visiting the DVLA website. All details of your driving record are held by the DVLA and you can view them online.

Do I have to declare spent convictions to insurance companies?

No. You don’t have to tell insurers about ‘spent’ convictions which are 5 years or older.

How Can I Get Cheap Vehicle Insurance With a Driving Conviction and reduce car insurance costs?

There are ways to reduce vehicle insurance premiums but finding cheap cover is not going to be an option.

You could choose to drive a vehicle in the lower insurance group. Plus, you could opt for third-party cover rather than comprehensive cover.

That said, you’d be better off talking to a specialist vehicle insurance provider or a broker. Their quotes may still be high and there may be some restrictions on a policy.

But their quotes may be more affordable car insurance than you’d get from another company!

Thanks for reading this post about driving convictions and insurance premiums. I hope the info in the post helps you decide how to deal with a driving conviction so it doesn’t cost you a fortune!