CapQuest Debt Recovery Chasing Old Debt – Know Your Rights!

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve heard from CapQuest Debt Recovery about an old debt, you might be worried. You might not know what to do or what your rights are. This is why we have written this guide:

- Who CapQuest Debt Recovery is and if they are a real debt collection agency.

- What to do if CapQuest contact you about an old debt.

- How to know if the debt is too old for CapQuest to ask for money.

- What your rights are when dealing with CapQuest and other debt collectors.

- How to sort out the debt with CapQuest, even if you can’t pay it all at once.

I know that dealing with debt collectors can be scary. Every month, over 12,000 people come here to learn about debt topics. I understand your worries, and I want to help you find your way through this. Some of our team have been in the same situation as you – they’ve dealt with debt collectors and know what to do. Let’s get started and learn more about dealing with CapQuest Debt Recovery.

Why would CapQuest Debt Recovery contact you?

As mentioned, Capquest Debt Recovery likely contacted you over a debt they purchased in a portfolio. As they own the debt, they may not have all the relevant information about it.

In short, you could be contacted over an old debt that’s not even yours!

Debt collectors have a habit of sending out a ton of emails, texts, letters and messages to lots of people. It’s their way of tracing the right person even though it causes a lot of stress to everyone else!

So, the first thing to check when CapQuest Debt Recovery gets in touch, is whether all the details they’ve got are correct. If they’re not, write to CapQuest telling them to stop contacting you!

Should you pay CapQuest straight away?

No. Not unless you’re convinced the debt is still current and not statute-barred. And as mentioned, you have to make sure the amount is yours to settle and not someone else’s outstanding older debt!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is the debt really yours?

CapQuest may have already sent proof the debt is yours. However, if they haven’t, you have the right to send them a ‘prove the debt’ letter.

It’s not enough for CapQuest to ‘tell’ you that you owe the money! The proof must be an authenticated copy of a contract or credit agreement you had.

Moreover, the proof must be authenticated by the original lender/creditor.

What if CapQuest can’t prove the debt is yours?

If CapQuest can’t prove things, you’re not obliged to pay. Plus, if CapQuest takes you to court, a judge won’t rule against you or issue a County Court Judgement if there’s no proof the debt is yours!

Send all your letters to CapQuest by recorded delivery so you have a record of when they receive them and don’t sign them. Also, always keep copies for your own records!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens when a debt collector proves the debt is yours?

Unfortunately, you’d have to pay what’s owed if CapQuest proves the debt! But you should seek advice before you agree, sign or settle the debt.

You could talk to an independent debt management company or you could approach a debt charity. The latter provides free advice which could be the better option.

Would Capquest Debt Recovery accept a payment plan to settle the debt?

According to the CapQuest Debt Recovery website, the debt recovery company claims to offer people an affordable payment plan to help them out. However, there are things to consider before agreeing to one.

Again, seek advice from one of the debt charities before agreeing to a payment plan with CapQuest Debt Recovery!

Is the debt statute-barred?

A debt can’t be enforced if it’s six or more years old. However, it must meet specific criteria.

A debt collections agency like CapQuest purchases portfolios containing older debts. They gamble on the fact they may be able to convince you to pay even if the debt is too old to be enforced through a court!

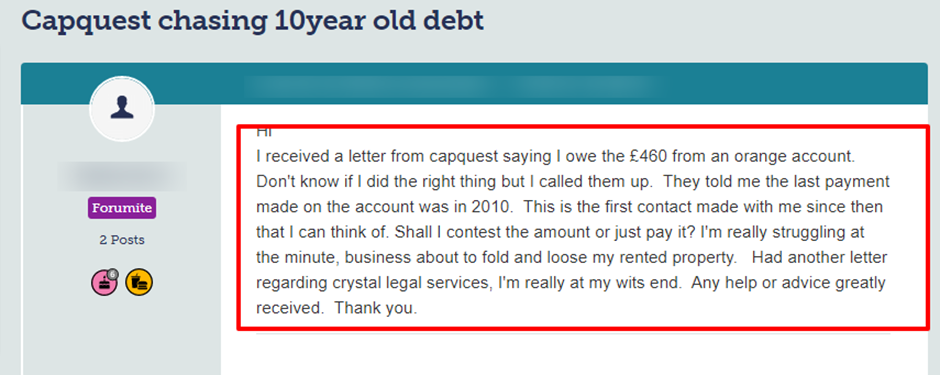

Check out what happened to one person who posted this message on a forum:

Source: Moneysavingexpert

Should you ignore CapQuest Debt Recovery?

No. It’d be a mistake to ignore CapQuest Debt Recovery when they get in touch. Even if the debt is too old to enforce or it’s not even yours.

CapQuest Debt Recovery will just keep contacting you. You’d receive lots of phone calls, emails, messages and letters threatening legal action!

Moreover, ignoring the problem means you’d miss out on the following:

- Discovering the debt is unenforceable

- Finding out that CapQuest Debt Recovery has the wrong information and the debt isn’t yours

Both of the above could get you out of paying an old debt you’re being pursued for. That’s why it’d be a mistake to just bin a letter or ignore phone calls, emails and texts from CapQuest Debt Recovery.

What can debt collectors do?

As a CSA member, CapQuest Debt Recovery agrees to abide by the Credit Association Services code of conduct. Plus, all debt collection companies must abide by UK law when they chase down debtors.

For instance, CapQuest Debt Recovery must follow the UK’s privacy laws and they must respect your rights as a consumer.

However, a debt collector has the right to do the following:

- Contact you by letter, phone, text, or email and they can visit your home

- Discuss an apparent debt with you discreetly and politely

- Ask you to settle the outstanding with them directly

You can’t stop CapQuest Debt Recovery from doing any of the above but the dialogue and approach must show empathy for your personal circumstances when you owe money.

What can’t CapQuest do?

As mentioned, a debt collections agency must abide by the law when they contact you about whether a debt is current or not.

For example, CapQuest or one of their field agents cannot do or say any of the following:

- Tell you they have the same powers as enforcement officers when they do not. A debt collector’s powers are exactly the same as those of an original lender/creditor

- Show you documents that look like a court has issued them when they have not

- Visit you at your place of work

- Talk to your employer about an alleged debt

- Discuss things with your neighbours, friends or even a family member

- Force their way into your property, seize possessions or clamp vehicles

- Harass you with calls, texts, emails and payment demands

- Threaten you

- Use confusing legal jargon to get you to pay

- Prompt you to take out another loan to settle the amount owed

Would CapQuest Debt Recovery visit your home?

Debt recovery companies have the right to pay you a visit at home. But they can’t just turn up! Moreover, they typically send a debt collection agent to your home address when all else fails.

If you’ve ignored letters, emails, texts and phone calls, you could expect a visit from them. But they must let you know before they come.

Also, you don’t have to open the door to a debt collector and they must leave when you ask them to.

You should speak to the field agent through the letterbox or from an open upstairs window!

» TAKE ACTION NOW: Fill out the short debt form

Would Capquest send bailiffs to your home?

No. Not without having won a case against you in a small claims court! Like all debt companies, CapQuest would need to have a County Court Judgement (CCJ) issued against you.

Then a judge could issue an Order to Pay which makes you liable for the debt. If you still don’t pay, enforcement officers are instructed to visit you.

They have the power to seize some of your possessions and sell them at auction. Plus, a judge could be asked to issue an attachment on your earnings or bank account!

It’s far better to stay in touch with CapQuest and let them know you’re seeking advice from a debt expert. Like this, they can’t escalate the matter to the courts.

So the answer to the question “can CapQuest send bailiffs to your home” is no, not without an Order to Pay having been issued.