Can I Ignore My Capital Resolve British Gas Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you struggling to pay bills and have fallen behind with payments to Capital Resolve British Gas? You’re not alone! Every month, over 12,000 people visit this site looking for guidance on debt issues.

In this article, we’ll address the following questions:

- Why would Capital Resolve contact you?

- Should you pay Capital Resolve?

- Is the British Gas debt yours?

- Should you check if the debt is too old to enforce?

- What can Capital Resolve debt recovery legally do?

- Would Capital Resolve take you to court?

Dealing with debt collectors can be hard; some of us have been in the same boat. But don’t worry! With our experience, we’ll help you figure things out.

Ready to find out how to deal with Capital Resolve? Let’s dive in!

Why would Capital Resolve contact you?

You may owe money to British Gas, an energy provider that uses Capital Resolve recovery services. Or you may find that Capital Resolve now owns it.

When it’s the latter, you’d have to deal with Capital Resolve rather than the original creditor which in this case is British Gas.

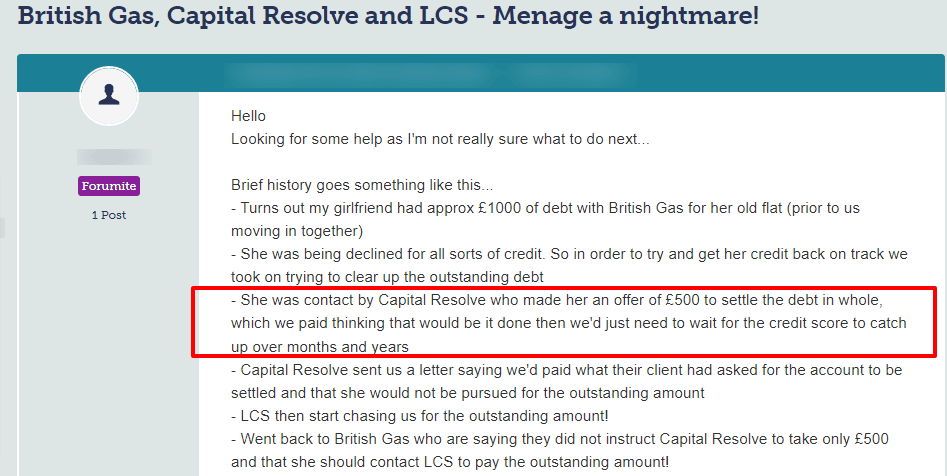

Take a look at what happened to one consumer when Capital Resolve contacted them:

Source: Moneysavingexpert

Should you pay Capital Resolve?

You should only pay a Capital Resolve once you’re happy the debt is yours and not too old to enforce.

However, you should seek independent advice from a debt charity once debt collectors prove the debt is yours. Don’t agree, admit, sign or pay anything without first seeking expert advice.

Their advice could be invaluable when it comes to negotiating how much to pay with a debt collection agency like Capital Resolve Ltd.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is the British Gas debt yours?

Next, you should write to Capital Resolve Ltd asking them to prove you owe money to British Gas. Mistakes happen and a simple clerical error may result in Capital Resolve chasing the wrong person!

Maybe you settled a bill and no record was made of the payment, hence the Capital Resolve is chasing you!

Make sure you send the ‘prove it’ letter by registered mail so you know they received it. You should get a written response from Capital Resolve confirming it is yours!

Don’t just accept their word for it. The proof must be in writing with authenticated copies of an agreement you entered into with British Gas. Plus, all the copies must be authenticated by British Gas or an authorised representative!

Without sufficient proof you owe money, a Capital Resolve can’t make you pay!

Should you check if the debt is too old to enforce?

Yes. One of the first things to check after going through all the details in the letter is whether the debt is too old to enforce.

A debt that’s at least six years old is deemed statute barred. As such, courts won’t take on cases that old. It means you won’t get an order to pay issued by a court!

If Capital Resolve Ltd purchased an older British Gas debt and is chasing you for payment, it may be statute barred! So it’s always worth checking.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What can Capital Resolve debt recovery legally do?

Capital Resolve is a member of the Credit Services Association and should, therefore follow its Code of Practice.

Moreover, debt collection companies must abide by the law when they contact you. A debt collection company can:

- Contact you about an alleged debt to British Gas by phone, text, email, or letter and visit you at home

- Discuss the debt with you politely, and discreetly showing empathy and understanding about your circumstances

- Ask you to pay them directly rather than make a payment/payments to British Gas

- Report you to a credit reference agency if you default on payments

» TAKE ACTION NOW: Fill out the short debt form

Would Capital Resolve take you to court?

If Capital Resolve purchased the debt from British Gas, they could begin legal action against you.

You could end up having to deal with:

- A court order to pay being issued and receiving a County Court Judgment which could affect your credit rating

- Court-appointed enforcement officers (bailiffs) showing up at your home and seizing some of your possessions

- An attachment being placed on your income or bank account

It’s far wiser to respond and to let Capital Resolve know what you are doing. This includes telling them when you’re seeking independent advice! You have the right to seek independent advice from a charity or an independent adviser.

This way, things don’t escalate out of control which could make it harder for you to resolve the problem whether you owe some money to British Gas or not!

How do you complain about Capital Resolve?

You have the right to file a complaint with Capital Resolve when you feel they haven’t followed the law or CSA Code of Practice!

A debt collector must follow the law and respond to a complaint in a timely manner.

You should follow their online complaints procedure which allows debt collectors to make things right.

That said, you can then contact the FOS if you feel your complaint was not dealt with correctly by a debt collector.

You have every right to lodge a complaint against a debt collection company. Especially when they act unlawfully by threatening you, harassing you or pretending they have more powers than they do.

The FOS should launch an investigation into the debt collectors actions which may result in them being ordered to compensate you!

How do you contact Capital Resolve Limited?

I’ve listed ways to contact Resolve Ltd below:

| Debt collection address | Capital Resolve LtdFountain Court, Vale Park, Evesham Worcs WR11 1LS |

| Telephone | 01386 421995 |

| Complaints | [email protected] |

| [email protected] | |

| Website | https://www.capitalresolve.com/ |

| Phone numbers used to call you from: | 0138 642 54250138 642 54000138 642 5406 |