Can My UK Visa be Denied Because of Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about how your debt might affect your UK visa? You’ve come to the right place. Each month, over 12,000 people visit this website for advice on topics just like this one.

In this article, we’ll cover:

- How your UK visa application could be affected by debt.

- What happens if you have debts but need to travel.

- How to manage your repayments and deal with debt collectors.

- What happens when you return to the UK with outstanding debts.

- How moving abroad could impact your debts.

We understand that dealing with debt can be stressful; some of our team members have been in your shoes.

We’re here to provide you with clear, straightforward advice to help you manage your situation and make informed decisions.

Let’s take a look at your questions about debt and UK visas.

Could your UK visa application be denied due to debt?

Just because you’re in debt doesn’t necessarily mean a UK visa application will be turned down. With that said, it could be a contributing factor to why a visa application is denied, but not the sole reason. Moreover, it rarely happens.

Then there’s the question of the type of visa you’re applying for whether it’s an immigration visa or a tourist visa that could be taken into consideration.

The most common reasons why UK visas are denied include incomplete declarations or because a person overstayed a previous visit.

» TAKE ACTION NOW: Fill out the short debt form

Who do you contact about a UK Visa application?

I’ve listed ways to find out about the UK Visa application process in the table below:

| the visa application process on UK Visas and Immigration’s (UKVI | [email protected] |

| By telephone | +44 1243 213 322 |

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you be stopped at an airport for being in debt?

No. You can’t be stopped at an airport just because you’re in debt. That said, if there’s a conviction on your record over a fraudulent debt, you could be arrested and detained!

Could you go to prison for debt?

No. You can’t be sent to prison because you’re in debt and owe money. That said, if there’s a hint of fraud involved, you could receive a custodial sentence if convicted!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Could you apply for a US green card when in debt?

Your US green card application could be denied if you’re in debt. Why? Because US Immigration Services take into account your financial status when you apply for a green card since a new law was introduced in 2019.

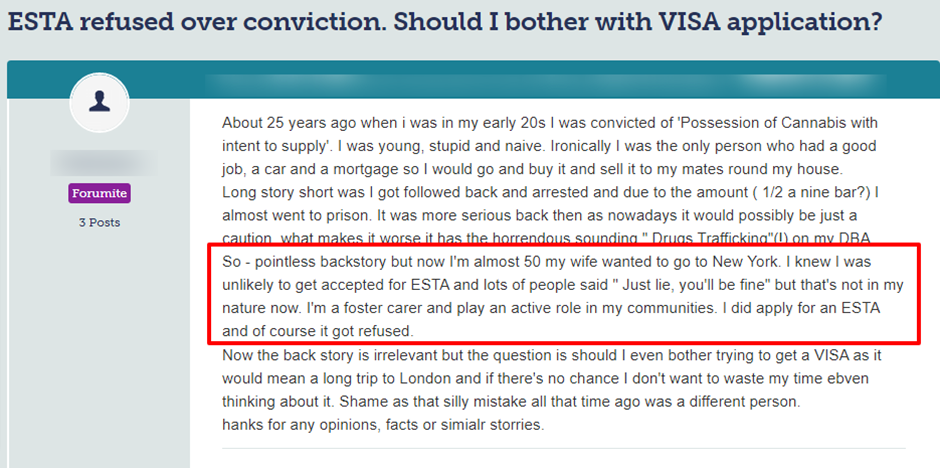

That said, if you have a drug-related conviction on your record, you’d be denied a visa to visit the States.

Check out what happened to one person years after they were convicted:

Source: Moneysavingexpert

Will my debts follow me if I move abroad?

No. Your debt won’t follow you if you move abroad. Your creditors have no legal right to file a legal lawsuit against you in another country.

However, creditors could seize assets you own in this country if they win a case against you by default!

Also, your debts will exist for 6 years and will appear on your record until they expire! The problem is that debts that get written off could negatively impact your creditworthiness.

More so than any late payments!

How long does it take for debt to be statute barred?

The Limitations Act makes debts that are 6 years old or more statute barred. Therefore, the debts are unenforceable. But for this to be the case, specific criteria must be met.

Although creditors can no longer make you pay what’s owed, the debt still exists!

Also, worth noting is that if a debt is still ‘secured’ and you still live in a property with a mortgage or other secured loan, the debt cannot be statute barred!

If there’s a County Court Judgement against the debt, there’s no time limit on how long the debt can be enforced. But if the CCJ is over 6 years old, a creditor could get permission from the courts to enforce it!

Another thing to bear in mind is that if it’s a tax debt it’s not likely to be statute barred!

Lastly, can your UK visa be denied because of debt?

It’s highly unlikely that a UK visa application will be denied purely because you’re in debt.

There’ll be other contributing factors why an application is turned down but not solely because you owe money. Maybe you overstayed a previous visit or the type of visa you’re applying for means a deeper dive into your financial stability.

You may like to find out how to get out of debt before applying for a visa to avoid disappointment.

All in all, a UK visa application correctly filled out and submitted with all the relevant details provided should be granted. But each and every application is assessed on its own merits!