Do I have to pay Arvato Financial Solutions Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with debt can be a big worry. Not knowing how to handle debt collectors can make life feel even more stressful. If you’re worried about Arvato Financial Solutions Debt, don’t fret you’re not alone. Each month, over 12,000 people visit this site looking for guidance on topics similar to this.

In this article, we’ll provide useful information on:

- Who Arvato Financial Solutions are and if they are a real business.

- How you can possibly lower your repayments to Arvato.

- What happens if the debt is proven to be yours.

- Steps to take if you can’t or don’t wish to pay Arvato.

- How to block communication from Arvato.

We really understand what it’s like to have money worries, as some of us have been in your situation before, dealing with debt and feeling unsure what to do. Read on to find out how you can best handle your Arvato Financial Solutions debt.

Do you have to pay Arvato?

No. Not immediately. But you shouldn’t ignore their correspondence either. If you ignore things, the problem just gets worse (and more expensive!).

You should respond to an Avarto letter by asking the company to ‘prove the debt’ is yours.

Arvato must respect your request!

Don’t accept verbal confirmation from the debt collector. Instead, ask them to provide proof you owe the money by sending the original credit agreement you signed.

Again, Arvato Financial Solutions must respect this request!

If the debt collection agency can’t prove the debt is yours, they can’t chase you for payment. Nor can they continually attempt to contact you!

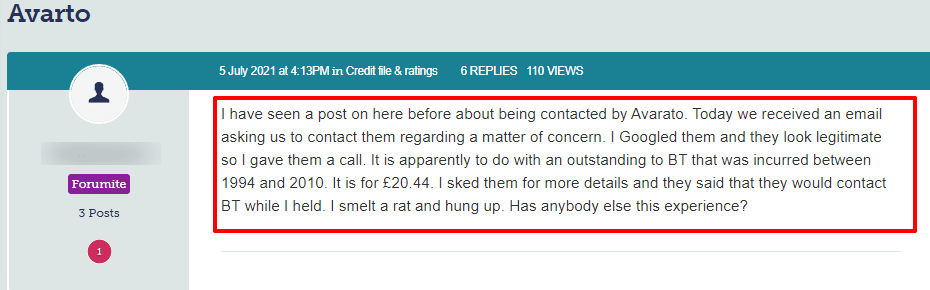

Check out what happened to one unhappy person who was contacted by Arvato here:

Source: Money Saving Expert

What happens if Arvato proves the debt is yours?

Arvato may be able to prove you owe the money. In which case, you should enter into negotiations with Arvato. But not before seeking debt advice from an independent debt charity!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if I don’t pay Arvato?

Things escalate relatively quickly when you don’t pay Arvato and they’ve managed to prove you owe the money. In short, if you ignore their correspondence and you don’t pay, Arvato could start legal proceedings.

However, first, you’ll get threatening letters which may be a tactic to get you to pay. That said, if a debt collector threatens court action, they should follow through although it doesn’t always happen!

In short, it’s a gamble as to whether Arvato will sue you or not!

If you don’t attend court, a judgement (CCJ) is registered against you and it’ll appear on your credit history! Enforcement agents otherwise known as bailiffs could show up at your door.

Bailiffs could seize your possessions, and sell them at auction. Or you could have a lien attached to your earnings! Otherwise known as a ‘consolidated attachment of earnings order’.

Can you get out of paying an Arvato Financial Solutions debt?

There are a couple of reasons why you may not have to pay an Arvato Financial Solutions debt which I’ve listed here:

- First, check the debt is yours by requesting Arvato prove it is!

- Second, establish the debt is not statute-barred because if it’s over 6 years old, Arvato can’t chase you for payment

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What can Arvato do when they contact you?

There are laws that debt collection firms must follow which are set out by the Office of Fair Trading (OFT). So, basically, when a representative from Arvator contacts you, they can:

- Visit you at your home

- Discreetly discuss a debt with you

- Ask that you pay the amount owed directly to them

- Only contact you at the times you prefer and how you’d like to be contacted

That said, a debt collector cannot legally do any of the following when they contact you:

- Force entry into your home, seize your possessions or clamp your vehicle

- Pressure you to take out another loan to pay off what you owe the original creditor

- Talk to you aggressively or in a threatening manner

- Threaten you with court proceedings when they know they won’t or can’t

- Pretend they are enforcement agents otherwise known as bailiffs. It’s a criminal offence if they do!

- Contact you at all times of the day which would be deemed ‘harassment’

- Discuss your debt with other people namely your family, friends, neighbours or employer. This is deemed to breach your privacy!

- Contact you or visit you where you work

- Talk to you in a confusing way with the intent of misleading you

» TAKE ACTION NOW: Fill out the short debt form

How do I block Arvato?

The only way to block Arvato from contacting you is to:

- Pay off the full amount owed

- Negotiate a payment plan with Arvato

- Agree on a settlement figure with Arvato

- Take out an IVA or bankruptcy in which case Arvato will deal with your Insolvency Practitioner

How do you contact Arvato Financial Solutions?

I’ve listed the various ways you can contact Arvato Financial Solutions here:

| Website: | https://finance.arvato.com/en/ |

| Via email: | [email protected] |

| By telephone | +49 7221 5040 6151 |