CST Law Letter Before Claim – Do I Ignore or Appeal?

Have you received a CST Law Letter Before Claim? Don’t worry, you are not alone. Every month, over 32,000 people visit this site seeking guidance on such letters and fines.

In this article, we’ll help you understand:

- Why a CST Law Letter Before Claim is sent

- The rights of CST Law and what happens if you ignore their letter

- If you can beat your ticket and if CST Law can take you to court

- The time frame within which CST Law can chase you for money

- How and where to lodge a complaint about a debt collection agency

We know how it feels to receive a letter before claim, and we’re here to help you understand your options. So, take a deep breath, and let’s find out how you can deal with a CST Law Letter Before Claim.

Remember, it’s important to know your rights and the best steps to take in such situations.

Do You Have to Pay?

In some circumstances, you might have a legitimate reason not to pay your fine.

It’s a bit sneaky, but the last time I needed legal advice, I paid £5 for a trial to chat with an online solicitor called JustAnswer.

Not only did I save £50 on solicitor feeds, I also won my case and didn’t have to pay my £271 fine.

Chat below to get started with JustAnswer

In partnership with Just Answer.

Why would CST Law send you a Letter Before Claim?

Maybe you’ve got an unpaid parking charge notice you’ve ignored or forgotten about. If so, CST Law will chase you for the money. In fact, CST Law is part of a debt collection agency known as Credit Style Limited.

It’s also the company’s trading name which is regulated by the Solicitors Regulation Authority (SRA).

CST Law will send you a Letter Before Claim (also known as a Letter Before Action), as a warning you’ll be taken to court.

How to avoid paying CST Law parking tickets

If you want to avoid paying a CST Law parking ticket then you’ll need an airtight appeal.

The best way to perfect your appeal is getting a little advice from a Solicitor. I’d 100% recommend spending a fiver to get a trial of JustAnswer.

You can explain your situation in their chat and they’ll connect you with a Solicitor who can advise you and give you the best chance to win your appeal.

Click here to get the trial offer with JustAnswer.

CST Law Letter Before Claim. What do people say?

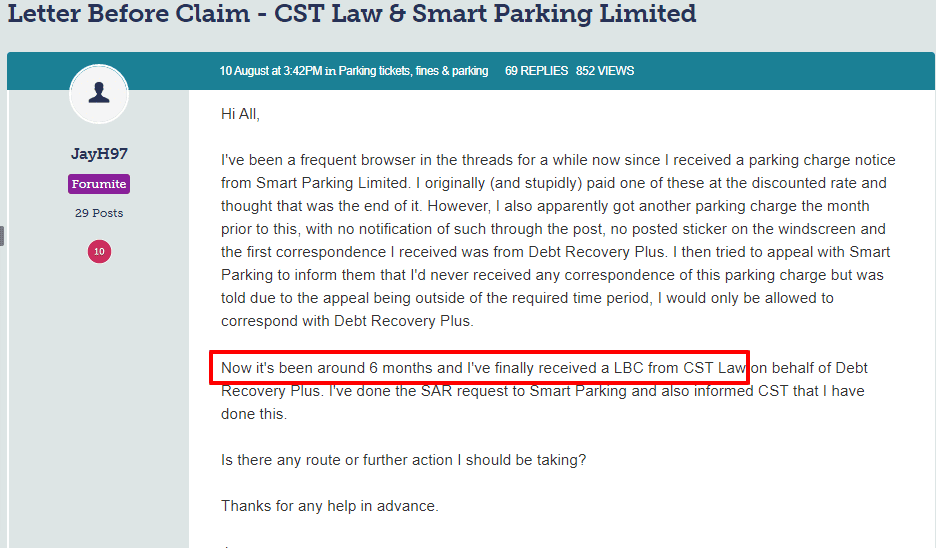

Many people who receive a Letter Before Claim from CST Law are left speechless. As an example, I’ve included one message from a confused person below:

Source: https://forums.moneysavingexpert.com/discussion/6378467/letter-before-claim-cst-law-smart-parking-limited

Can CST Law take me to court?

Yes. CST Law could take you to court over an unpaid fine when the issuer agrees to start legal proceedings against you. A judge could order you to pay a parking charge and if you don’t, you’d get a CCJ and a visit from enforcement agents (bailiffs).

How long can CST Law chase me for the money?

You could be chased for payment by a debt collector for 6 years. That said, if you make a part payment, the 6-year time period starts from the date of that payment! So, it’s not a good idea to pay a little amount and then not make any further payments.

That said, without a court order for you to pay, the debt can’t be enforced!

Successful Appeal Case Study

Situation

| Initial Fine | £100 |

| Additional Fees | £171 |

| Total Fine | £271 |

The Appeal Process

Scott used JustAnswer, online legal service to enhance his appeal. The trial of this cost him just £5.

| Total Fine | £271 |

| Cost of legal advice | £5 |

JustAnswer helped Scott craft the best appeal possible and he was able to win his case.

Scott’s fine was cancelled and he only paid £5 for the legal help.

In partnership with Just Answer.

What rights does CST Law have?

It can be disturbing and stressful when CST Law starts contacting you. So, it’s essential to know your rights and what a debt collector can and cannot do! For instance, you may be worried a debt collector could:

- Take your belongings?

- Take you to a small claims court?

- Harass you?

- Threaten you?

- Enter your home?

- Call you at unearthly hours of the day and night?

All debt collectors must follow the law and certain actions and behaviours are prohibited under UK law.

That said, a debt collector does have specific rights when they’re trying to recover money. But you have rights too! For example, a debt collector can contact you:

- By phone

- In-person

- By post

However, if you write to a debt collector asking them to only contact you by post, they can’t continue to phone you. Moreover, if a debt collector shows up at your door when you asked them not to report them to the FCA (Financial Conduct Authority).

I’ve listed what CST Law doesn’t have the right to do here:

- Harass you in any way. For instance, a debt collector is prohibited from threatening you, causing you distress or humiliation

- Contact you at work or during the weekends

- Threaten you with legal action. For example, threatening to send in the bailiffs

- Breach of your data privacy

- Charge you more than it costs them to provide a service or add interest to a debt

- Tell you lies

Join thousands of others who got legal help for a £5 trial

Getting the support of a Solicitor can take a huge weight off your mind.

Reviews shown are for JustAnswer.

What happens when you ignore a CST Law Letter Before Claim?

Ignoring a CST Law Letter Before Claim will not make the problem go away. More often than not, ignoring things just makes matters worse. For example, if you don’t pay and continue to ignore things, the debt collector could:

- Threaten to pay you a visit at home

- Report you to a credit reference agency

- Sue you for non-payment

- If a court orders you to pay the amount outstanding and you don’t, bailiffs could get involved

» TAKE ACTION NOW: Get legal support from JustAnswer

How do you complain about a debt collection agency?

You have several options when it comes to lodging a complaint against CST Law or any other debt collection agency.

I’ve listed a few reasons why you could complain about the debt collector here:

- The debt is not yours

- The amount allegedly owed is incorrect

- You’re being harassed by the debt collector

- You’re struggling financially but the debt collector refuses to set you a fair and affordable repayment schedule

- The amount owed is not legally enforceable

CST Law Letter Before Claim. What should you do?

You may opt to pay a parking fine when you get a Letter Before Claim from CST Law. On the other hand, you could challenge things. For example, you should check if you owe money before paying anything!

If there’s no court order for you to pay, contact the creditor and discuss things. The one thing you shouldn’t do is ignore an unpaid parking charge if the Letter Before Claim is about one!

It could get more expensive if you do.

I hope the information provided in my post about a CST Law Letter Before Action helps you deal with the situation you’re faced with. The main thing is to remain calm and check you owe the money before you do anything which includes making a payment!

Hire a Parking Solicitor for less than a coffee.

If you’re thinking about appealing your parking ticket then getting some professional advice is a good idea.

Getting the support of a Solicitor can make your appeal much more likely to win.

For a £5 trial, Solicitors from JustAnswer can look at your case and help you create an airtight appeal.

In partnership with Just Answer.