Must You Declare Spent Convictions to Insurance Companies?

Understanding the ins and outs of car insurance after a conviction can be confusing. This article is here to help answer your questions.

Every month, over 1,000 people visit our site looking for guidance on how to find affordable car insurance, even with a conviction. You’re not alone.

In this article, you’ll learn about:

- What driving convictions are and how they differ from criminal convictions.

- The difference between spent and unspent convictions.

- How to check if your conviction is spent.

- The impact of convictions on your car insurance.

- How to find affordable insurance even with a conviction.

It’s normal to worry about the cost of car insurance after a conviction, but we’ve got your back. Remember, it’s not impossible to find affordable insurance, even with a conviction.

Do I have to declare convictions to insurance companies?

I was recently discussing car insurance with a friend and they asked a really important question… “Do I have to declare spent convictions to insurance companies?”

This is an interesting topic for any motorist with a previous driving conviction.

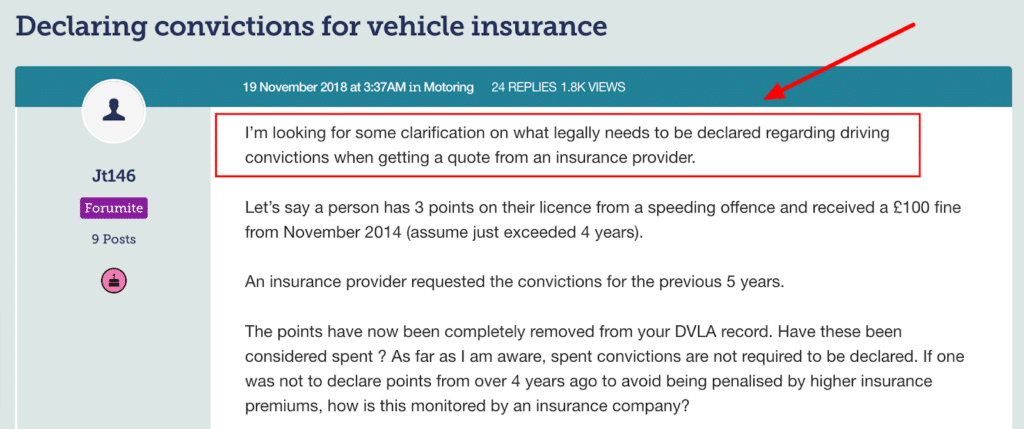

There is some confusion about what’s required and what’s not, which has resulted in people turning to popular online forums for clarification:

Source: https://forums.moneysavingexpert.com/discussion/5926065/declaring-convictions-for-vehicle-insurance

You must disclose unspent driving convictions, i.e. driving convictions that were accumulated in the previous five years. You only need to do this when asked by the insurance company.

If you receive a driving conviction, you might need to inform your current car insurance company straight away.

Whether you need to do this or not will depend on the policy you agreed to. You may need to check the policy documents or call your insurer to find out your obligations.

Don’t delay doing this. If you need to make a claim without updating your insurer about a conviction, you might be rejected and be left out of pocket.

When do you have to declare unspent convictions to an insurance company?

You must declare unspent driving convictions to an insurance company when you apply or when you try to renew a policy.

You might need to declare unspent convictions straight away with some car insurance providers. However, the MoneyHelper website states this isn’t likely.

Do I have to declare spent convictions to insurance companies?

No, you don’t have to disclose convictions for a driving offence that originated more than five years ago, i.e. spent driving convictions.

However, some insurance providers will still ask about previous driving convictions from more than five years ago. You don’t have to disclose these, but if you do, the insurance company cannot increase your car insurance premiums due to these spent convictions.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Do I have to declare a criminal conviction to insurance companies?

Yes, when asked you should declare any unspent criminal convictions to the insurance company.

It’s not just driving convictions that can affect your car insurance premiums. If these aren’t declared then the policy could be invalid.

Do I need to declare criminal convictions of named drivers?

Yes, everyone on the vehicle insurance policy should be disclosing unspent convictions for driving and criminal convictions.

It’s easy to forget about named drivers’ non-motoring convictions. Try not to make this mistake as you will still be committing insurance fraud.

Do insurance companies check convictions?

Yes, insurance companies are known to check for convictions to make sure applicants haven’t lied to try and get an affordable insurance deal for you.

They might not check immediately, but they might check a few days, weeks or even months after you take out the policy.

If they haven’t checked previously and you make a claim, they might check now to see if they can get out of having to cough up.

What happens if I don’t disclose a conviction?

If you don’t disclose a driving conviction when you were supposed to, which will be at the time of application or possibly during the term of a policy, your insurance could be invalid.

Driving without valid insurance puts yourself and named drivers on the insurance policy at risk. Any claim you make could be rejected and might have serious financial consequences.

The insurance company could even ask you to pay a lump sum amount to cover the cost you should have been paying as part of previous insurance premiums.

What impact do convictions have on your vehicle insurance?

Unspent convictions can increase your car insurance premiums. In other words, they can make your car insurance monthly payments more expensive.

Why do convictions have an impact on your vehicle insurance?

Driving convictions have a negative impact on your vehicle insurance because they indicate that you’re not always a safe driver. If you’re deemed a less safe driver, the insurance provider will want you to pay more for them to insure you.

This has created a market of insurance companies trying to cater for high-risk drivers, or even for specific driving convictions, such as drunk driver insurance.

I’ll come back to this a little later!

Are there any special insurers who deal with convicted drivers

As I mentioned a little earlier, there is a vehicle insurance market tailored towards drivers with previous driving convictions. You might need to do some extra digging to find these more affordable car insurance policies or even use specialist insurance brokers who specialise in helping convicted drivers.

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

What’s the difference between spent and unspent convictions?

A driving conviction is classified as unspent from the date of the conviction for a period of time. Thereafter, it’s known as a spent conviction.

A driving conviction is usually classed as unspent for five years before it becomes a spent conviction.

How do I check if my conviction is spent?

The easiest way to check if your driving conviction is unspent or spent is to check your driving record using the government’s online service found here.

To use this service, you’ll need your driving licence number, the postcode on your licence, and your National Insurance number.

An alternative way to find out if your driving conviction is spent is to contact the DVLA. You’ll also need your driving licence information so the DVLA can verify they’re giving the information to the right person.

Do you have to declare spent convictions to insurance companies? (Quick recap!)

No, you’re never obligated to declare spent driving convictions, which will become spent after five years.

Some insurance companies will ask for details of spent driving convictions. But you don’t have to give them this information. And if you do disclose this information, they cannot use it to increase your insurance premiums.

Does a DBS check include spent convictions?

Yes, a basic criminal record check-called a DBS check will include both unspent and spent convictions.

Do you have to declare a DR10 after 5 years?

Driving convictions become spent after five years, so you won’t need to disclose a DR10 after five years have passed.

A DR10 remains on your driving licence for 11 years from the date of conviction. This can make things confusing but the five-year rule still applies.

Where can I ask you my own question?

I answer a wide range of questions about driving convictions, criminal convictions, car insurance, getting out of debt and related topics. I welcome questions from you, the general public.

You can read some of the recent questions I’ve answered on my Ask Janine page. Simply hit the contact tab on my website to ask yours!