How Much Does Car Insurance Go Up After Drink Driving Ban?

Are you worried about car insurance after a drink driving ban? This guide is here to help! Every month, over 1,000 people visit our blog to find answers about convicted driver insurance. We understand your concerns about finding affordable coverage after a conviction or points.

In this guide, we will:

- Explain how much car insurance may increase after a drink driving ban.

- Share tips on how to find the cheapest insurance with a conviction.

- Discuss different drunk driving codes and penalties in the UK.

- Answer whether you can insure your car while banned.

- Provide strategies on how to reduce the cost of car insurance after a conviction.

Our team knows the worries and questions you might have. Rest assured, we’re here to provide clear, useful advice. So, let’s explore the answers together and help you find the best path forward.

What are the drink-drive alcohol limits in the UK?

Drink-driving laws are extremely strict in the UK. If you’re caught drunk driving by the police and you’re over the limit, it’s an automatic disqualification. The same is true if you’re involved in an accident and alcohol contributed to the incident.

In England, Wales and Northern Ireland the legal limit is as follows:

- 80 milligrams of alcohol per 100 millilitres of blood, or

- 35 micrograms of alcohol per 100 millilitres of breath

Are you still insured if drunk driving?

Your current insurance policy will likely be invalidated as soon as you tell your insurer of the conviction. That said, you’re legally obliged to inform the insurer straight away when you get a drink driving conviction.

So when it comes to insurance, vehicle insurance companies recognise they have a legal duty to pay out for third-party damages under the Road Traffic Act.

In short, even if you have comprehensive insurance coverage, your policy will be downgraded to third-party insurance.

Failure to have valid insurance will result in a fine and the police could seize your car!

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Do I have to tell insurance about drunk driving?

Yes. It’s a legal requirement to inform insurance companies about a drunk driving conviction.

Furthermore, a motor insurance company views your failure to disclose the conviction as an attempt to defraud them.

The police could be called and you could be arrested and prosecuted for fraud!

How long do I have to declare a drunk driving conviction to insurance providers?

Motor insurance providers will ask you about any driving convictions you received in the last 5 years.

They want to know about all driving convictions so they can assess how high-risk you are and whether they want to insure you.

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

Will I lose my current car insurance after a drunk driving conviction?

In most instances your current car insurance will be terminated after a drunk driving conviction. The offence is deemed serious enough for insurers to void an existing policy you have with them!

When is a drunk driving conviction spent?

When you’re banned from driving for 5 years, it is spent five years after you receive the conviction. However, if the ban lasts longer than five years, it is spent at the end of the term of disqualification.

How much more will I pay for drunk driving car insurance?

You’ll likely have to pay 100% more on car insurance once your ban from driving ends. That’s the minimum that your premium could go up. In short, you may find that it goes up a lot more and is, therefore, unaffordable!

So, finding cheaper convicted driver car insurance is likely no longer an option.

How can I reduce the cost of car insurance if I have been convicted of drunk driving?

As mentioned, you could try to reduce the cost of your car insurance after you’ve been convicted of drunk driving by:

- Choosing to drive a vehicle that’s in the lower insurance category

- Opting for third-party insurance coverage rather than comprehensive coverage which is always less expensive

- Think about taking out telematics insurance cover

- Enrol in an advanced driver course

- Go on a drunk driving rehabilitation course although some insurers won’t factor this in to lower a premium

Tips to reduce the cost of car insurance after a drunk driving conviction

I’ve included a few tips on how to reduce the cost of car insurance after a drunk driving conviction here:

- You could take out telematics insurance which means insurers can assess how you drive and whether it could result in a lower annual premium

- Agree to reduce your annual mileage which lowers the risk of you being involved in a road traffic accident

- Increase the amount you pay for your excess

- Take out third-party driver insurance and limit how many named drivers are on the policy

- Go on an advanced driver course

- Make sure your vehicle is secure at all times

- Enrol in a drunk driving rehabilitation course

Can you get insurance after a drunk driving ban?

You can get car insurance coverage after a drunk driving conviction but it will cost you a lot more than before you were banned! Insurance premiums automatically go up where drunk driving convictions are concerned.

So, you’ll likely find it challenging when it comes to finding cheap car insurance with penalty points on your licence,

In the eyes of mainstream and even specialist insurers, you’d be seen as a high-risk driver. In short, insurance companies consider you to be a liability and a motorist who is more likely to file a claim!

You could contact a few specialist insurance companies and brokers. They could come up with more competitive quotes although these may still be higher when providing cover for drunk driving convictions.

Does a driving ban increase insurance?

Yes. A drunk driving ban will automatically raise car insurance costs. Mainstream insurers may not be willing to offer you convicted drunk driver insurance coverage.

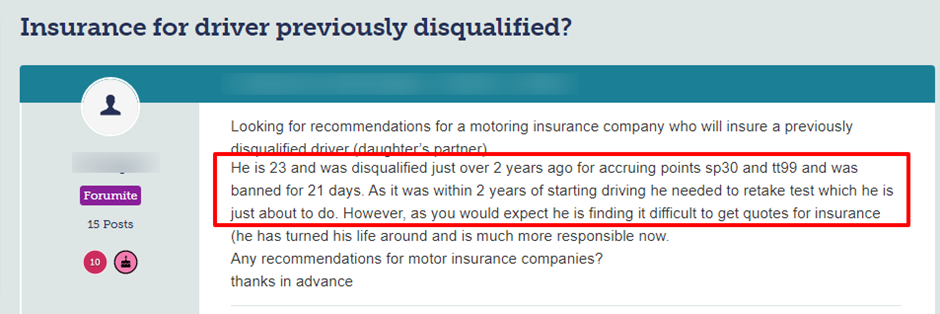

Source: Moneysavingexpert

But specialist insurers could be more accommodating as they provide cover for motorists with drink driving convictions on their driving record.

How do I lower my car insurance after a drunk driving ban?

You could do a few things to lower the cost of insuring a car after a drunk driving ban which I’ve listed here:

- Shop around by contacting specialist insurance companies

- Use comparison sites

- Pay a higher voluntary excess on your policy

- Take out third-party cover

- Take an advanced driver course

- Do not include any named drivers on the policy

- Try to do less mileage

- Ensure your vehicle is secure at night

- Install a car alarm and/or immobiliser

- Drive a vehicle that’s in the lower insurance group

What is the cheapest car to insure after a ban?

You could try to lower a drunk driving insurance premium by choosing to drive any of the following cars:

- Volkswagen Up

- Vauxhall Corsa hatchback

- Skoda Citigo

- Chevrolet Spark

- Citroen C1

- Nissan Micra

- Fiat Panda

- Smart ForFour

Can someone else drive my car if I am banned?

Your insurance policy will likely be cancelled once the insurer knows you’ve been banned for drunk driving. As such, any named drivers on a policy won’t be insured.

The only way for someone else to drive your car while you are banned is for them to take out a new car insurance policy in their name. Plus, they must be the main driver and live at the same address as the one registered with the DVLA.

Do you need more information on drunk driving bans?

If you need more information on drunk driving bans and how they affect driver insurance premiums, why not check out our latest post?