Can Debt Collectors Follow You to Another Country? UK Laws

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Moving to a new country? Worried about UK debt collectors following you? This article will answer your questions:

- Do UK debts become a problem if you live in a different country?

- Will you still need to pay your debt?

- What happens if you don’t pay?

- Can debt collectors reach you in another country?

- Is it possible to lower your repayments?

Each month, over 12,000 people visit this site for advice on tough topics like debt. So, remember, you’re not alone.

We deeply understand how worrying debt can be; some of us have been there too. That’s why we’ve created this guide that will help you figure things out.

Can UK debt be enforced abroad?

Can debt follow you to another country? I’ve been asked this question by people in debt who are considering fleeing the UK to try and end their debt nightmare.

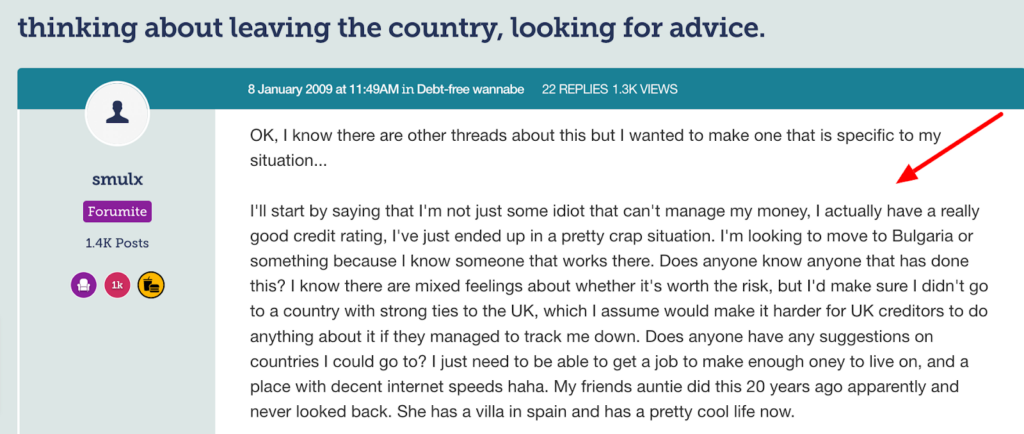

Outsiders to the situation might think this is a bit extreme, but it’s actually a really common thought process among some debtors. There are lots of forum posts on the subject, just like this one:

Source: https://forums.moneysavingexpert.com/discussion/comment/17441825#Comment_17441825

The answer is: Possibly. But it’s quite complex and not always an option. It depends on the country you’ve moved to and the type of debt.

StepChange states that creditors could employ a debt collection company in your new country to chase you for payment. But remember, these groups aren’t bailiffs.

Some countries will allow creditors to start legal action in another country to try and recover a debt. But this is an extremely complex area and the rules differ between countries.

Consequently, there is a chance that creditors won’t chase you for debts owed in the UK when you move abroad, but there is no guarantee of this and it’s probably not worth the lack of sleep.

It’s most likely that the creditor will try to enforce the debt in the UK despite living abroad. I’ll explain this in detail below.

Can debt collectors follow you to another country?

A UK debt collection agency may still try to contact you and ask you to pay a debt if you move abroad.

There are even some UK debt collection agencies that claim to chase global debts, such as Global Debt Recovery. Or the UK company has a partner or sister firm in other countries. However, it’s unlikely that they will know your new address, so it might give you some breathing space before you hear from them again.

If the debt collection company doesn’t know your new address overseas, they might instead pass on the debt to a debt collection agency in your new country.

The debt collection group in your new home country may then use data and local resources to track down your new address to send you debt letters. This agency might even be able to purchase the debt and start chasing you.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you get stopped at the airport for debt?

A debt collection company can request you give them a forwarding address before moving abroad, but they cannot stop you from getting on the plane.

What happens if I don’t pay my credit card and move to another country?

If you don’t pay a credit card debt and move abroad, the credit card issuer could still take legal action against you in the UK. They could apply to have a County Court Judgment (CCJ) issued against you to pay the debt.

The court forms will be sent to your last known address and without a response, a default judgment could be awarded in favour of the credit card company. And if you don’t then pay the debt, they could take debt enforcement action.

You probably wouldn’t even be aware of the CCJ at this time, unless someone you know still lives at your last known UK address.

» TAKE ACTION NOW: Fill out the short debt form

The enforcement action they can take will be limited because you won’t be in the country. However, if you still own assets in the UK they could use these to recover the money. If you own a property, the creditor might decide to have a Charging Order placed on the property, which stops you from selling or remortgaging without paying off the debt.

And one last thing to consider… All of the above adds fees and probably interest to the debt. So you end up owing much more.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Moving abroad to escape UK debt – summary!

Moving abroad to escape UK debts and arrears isn’t a great idea. There are some debtors that will get away without paying, but this is a game of chance and could backfire.

There are better ways to deal with UK debts, whether you want to stay in the UK or plan on leaving anyway. You may benefit from the following debt solutions, and some of them will even write off some or all of your debt:

- Debt Management Plan

- Debt Relief Order

- Individual Voluntary Arrangement

- Bankruptcy

- Scottish equivalents to the above

You can discuss these options by getting tailored advice from a debt charity. There are some superb organisations out there and willing to help for free. StepChange and National Debtline are two of the very best. Get in touch with them today to start your debt-free journey.