Can You be Stopped at the Airport for Debt in the UK?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about travelling because you have a debt in the UK? You’ve come to the right place. Every month, over 12,000 people visit this site to get advice on debt topics.

In this article, you’ll find out:

- Can you go on holiday when you have debt?

- Do you need to settle your debts before leaving the UK?

- What happens if you move abroad when you’re in debt?

- How to deal with debt when you’re abroad?

- What happens when you return to the UK with debt?

We understand how tough it is to deal with debt; some of our team have been there too. With our experience, we’ll help you understand your options.

Let’s dive in!

Going on holiday with debt

You won’t get stopped at the airport when you go on holiday and you’re in debt. The same is true on your return to the UK.

The authorities won’t stop you at an airport simply because you’re in debt. Most people have some debt or another these days, so it’s not something that should play on your mind.

That said, although you can’t be stopped at an airport for debt alone there are some reasons why you could be. In short, there have to be other contributing factors to getting stopped, arrested or detained at the airport for debt.

If there was any fraudulent activity involved in the debt you accrued, that’s a different matter. You could be stopped, detained and arrested when trying to leave the country.

Should you settle your debts before leaving the UK?

If you’re planning to emigrate to another country, you should consider settling your debts before you leave.

Your debts won’t vanish just because you’ve gone abroad. In fact, the amount you owe will just increase over time which makes it harder to settle what’s owed.

Debt collection agencies are very persistent and won’t give up chasing you for the money you owe even if you’re on the other side of the world.

That said, if you’re just going on holiday, that’s a different story. A short time abroad won’t affect how you pay off any money you owe.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens when you return to the UK with debt?

If you’re just returning to the UK from a short holiday, you don’t have to worry about being stopped at the airport. You may have missed a payment but this can be put right on your return.

If, however, months have passed and you return to the UK without having settled a debt, more fees would have been added to the debt. It makes it harder to pay the amount you owe.

What happens if you leave the country when in debt?

Although a debt collection agency can’t chase you for debt when you leave the UK, they can pass your details to a debt collection agency they have links to. That said, it depends on which part of the world you move to!

Also, it’s worth noting that a UK debt collector could win a case against you by default. It means an order to seize any possessions or assets you have in the UK can legally be seized!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Dealing with debt when you’re abroad

If you’ve moved abroad permanently, you can still service a debt when you live in another country. In fact, you should continue paying what you owe until the debt is settled.

As mentioned, just because you live in another country doesn’t cancel out your debts.

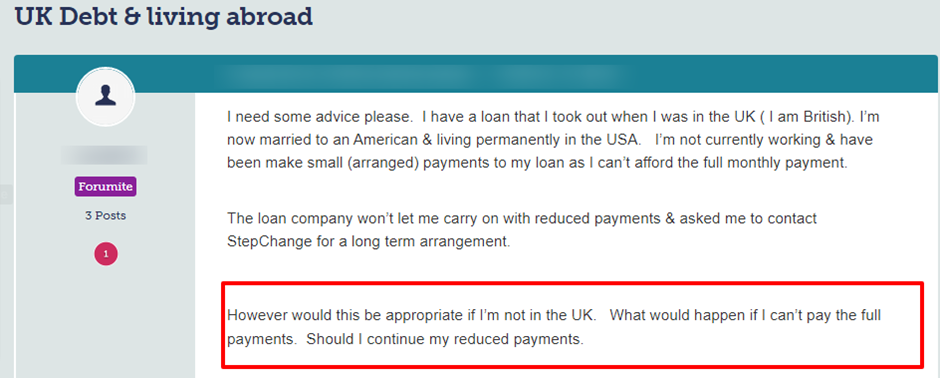

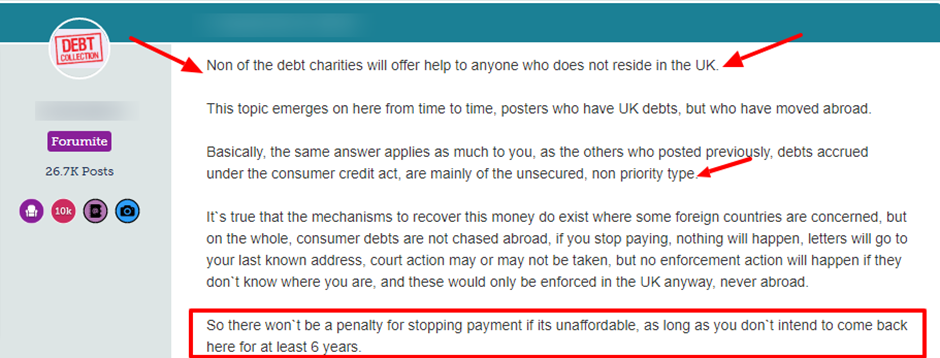

Check out this message someone posted on a popular online forum:

Source: Moneysavingexpert

Do debt collectors chase debts when you’re abroad?

Although a debt collection agency may not have a legal right to chase you for a debt abroad, they won’t give up.

Furthermore, some debt collectors have links to international debt collection agencies! In short, your debt could be handed to them which means they could track you down.

Plus, it’s a legal obligation to let a debt collection agency know if you’re relocating abroad. It means you’re obliged to give them your address!

What happens if you don’t give debt collectors a forwarding address?

If you don’t provide a debt collection agency with a forwarding address when you move abroad, they could sell any assets you have in the UK.

Plus, if you move to a country where a debt collector has links, a local debt collection agency could start chasing you. It could get very complicated, not to say expensive!

What can’t debt collectors legally do?

Debt collection agencies must follow the law when they chase you for an outstanding debt.

For example, a debt collector cannot harass or threaten you. They can’t pretend they have more powers than they really do either.

Other things a debt collector cannot do includes:

- Visit you where you work

- Cause a disturbance or intimidate you

- Force entry into your home

- Refuse to leave when you ask them to

- Clamp your vehicle or seize your belongings

- Pretend to be enforcement agents which is a criminal offence

- Discuss what you owe with your employer, neighbours or family members

What can debt collection agencies do?

Debt collectors have a legal right to do the following when you owe money:

- Tell you that they plan to visit you at home

- Ask you to pay them directly

- Discuss the debt with you politely

- Be willing to set up a repayment plan if you can’t pay the full amount

There are ways to negotiate with debt collectors (LINK TO YOUTUBE) so the outcome is more positive and less stressful.

YouTube link: https://www.youtube.com/watch?v=u3MMCoYriks

When is a debt too old to enforce?

Creditors know there’s a time limit attached to debts which is why they’ll typically begin legal action pretty quickly. They could pass your details to a debt collector for this reason.

The time limit attached to debt is often referred to as the ‘limitation period’ which for the majority of debts is set at 6 years.

However, there are specific criteria that must be met for a debt to be statute barred. These are:

- That you had no contact with a creditor in six years

- That you didn’t pay anything towards settling the debt in six years

- There isn’t an existing County Court Judgement against the debt

The time limit for mortgage debt is longer and rather more complicated. For example, if a home is repossessed with money still owing on it, the time limit on the interest on a mortgage is 6 years.

But it’s 12 years on the main mortgage!

Lastly, can you be stopped at the airport for debt in the UK?

No. You can’t be stopped at a UK airport just because you are in debt alone. There have to be other contributing factors!

That said, if you’re planning to immigrate abroad, it’s wiser to let your creditors or debt collectors know where you’re going. In short, you should give them a forwarding address.

Debt collection agencies have ways of finding addresses in the UK and could find you when you’re abroad.

Some debt collection agencies have links with foreign debt collectors, so depending on where you move to, the debt might well follow you.

If you’re just going on holiday for a short break, being stopped at the airport because you’re in debt shouldn’t play on your mind. It just won’t happen.