What is Debit Finance PLC IP on Bank Statement? Debt Scam?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering about a different name on your bank statement? The name is Debit Finance PLC IP. You may think, what is this? Don’t worry; this is a common thought. This guide will help you understand:

- Who Debit Finance PLC is and what they do.

- Why they might be taking money from your bank.

- How to get in touch with Debit Finance PLC.

- Ways to make smaller payments to them.

- What to do if they are taking money when they should not be.

Many people are worried when they see a name they don’t know on their bank statement. It can be scary. You may think you are being tricked. You may also worry about how this will change your day-to-day life, but you’re not alone. Every month, over 12,000 people come to this site for guidance on such issues.

Our team knows how hard it is to deal with money problems as we’ve been there too and we want to help you.

Let’s dive in.

Why Is Debit Finance PLC on Your Bank Statement?

The name Debit Finance PLC may appear on your bank statement if you are a member or subscriber to a gym, leisure facility, or other organisation that collects payments through its services. They act as a third-party collection company and process membership payments on their behalf.

Regular membership payments may continue to be deducted from your bank account if you have not cancelled your membership correctly. When cancelling your Direct Debit, it is recommended to follow the cancellation policy of your specific facility and inform Debit Finance PLC or the facility directly. You can contact Debit Finance PLC through their provided contact information for further assistance or clarification.

Is Debit Finance PLC Trying To Scam You?

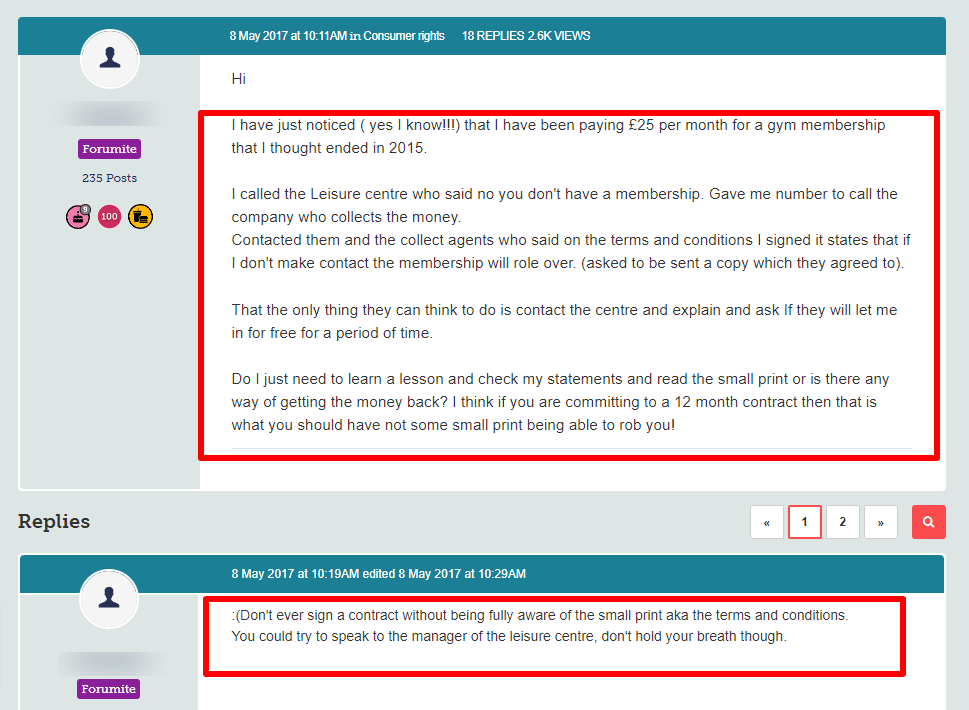

This is the million-dollar question. A quick bit of research has uncovered the fact that the company seems to work somewhat unethically at times. Here are a few examples I found that support this opinion.

- One person had a gym membership with a gym that closed down. When the gym reopened under a new name with different management, Debit Finance PLC began taking a monthly membership from the person’s bank account again, even though they had never taken out a subscription with the new gym.

- Another person explained that even though they had asked Debit Finance PLC to cancel a membership, the company continued to take the money from their bank account for a further two months, explaining that this is how long cancellation took.

- I found multiple examples where the company took the wrong amount from a bank account (too much), or took multiple payments in a single month.

So, is it a scam? Yes and no. Your gym membership is not a scam, but Debit Finance PLC is acting in a pretty shady way when collecting it from your bank account.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do You Really Need To Pay Debit Finance PLC?

As I already said. Debit Finance PLC isn’t a debt collector in the same vein as Global Debt Recovery, PRA Group or Lowell Portfolio. But if you do owe money to a gym for a subscription, the company does offer basic collection services. So you can expect them to act very much like any other debt collector in this case. They will constantly contact you, and keep harassing you, even if you move to a new address.

If you do owe money that Debit Finance PLC is trying to collect, they do have the option of legal action to try and recover the debt, which I will explain in the next section.

How to Stop Debit Finance PLC Taking Money from Your Bank

There are three primary ways you can stop this company from taking money from your bank account. However, two of them rely on a third-party acting ethically to stop the payment from being taken. Here are your options:

- Contact your bank and cancel the direct debit, so that the company cannot take money from your bank account anymore.

- Ask your gym or fitness centre to cancel your membership. When they do this, they should instruct Debit Finance PLC to stop collecting your subscription. However, I did find examples where people cancelled their membership directly with the gym, and Debit Finance PLC still kept taking the subscription, sometimes for months afterwards.

- Contact Debit Finance PLC and ask them to stop collecting the subscription. But as I already mentioned, there are reports of the company dragging their feet over this, so that they can grab an extra one or two payments.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can Debit Finance PLC Take You to Court and Send Bailiffs to Your Home?

Whether Debit Finance PLC takes you to court, will very much depend on how much they think you owe them. For small debts, such as a couple of months of gym membership, it might not be financially viable for them to do so. However, they would likely still send you a letter before claim, to try and scare you into paying.

Debit Finance PLC can’t send bailiffs to your home. Only the local court can do this. So Debit Finance PLC would need to apply for and get a County Court Judgement (CCJ) before this happens.

How to Contact Debit Finance PLC

If you need to get in touch with this firm, I’ve checked their website for contact information and reproduced it here for you.

- You can reach their client support team at 01908 752 079, or their member support team at 01908 752 078.

- Existing clients can submit an online enquiry by visiting their website and filling out the contact form, providing as much information as possible.

- If you have any general inquiries, you may contact them via email at [email protected]

- The registered office address is 1st Floor, Central Square South, Orchard Street, Newcastle upon Tyne, NE1 3AZ.