Free Prove It Letter Template – Don’t Pay Up Yet!

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Struggling with a debt and not sure if it’s yours? This can be a big worry, but remember, you’re not alone. Each month, over 12,000 people visit this website looking for guidance on debt matters.

In this easy-to-understand guide, we’ll cover:

- Understanding your rights with debt collectors

- Ways to show a debt is not yours

- How a creditor must prove a debt you owe

- Tips to lower your repayments

- Steps to take if the debt belongs to someone else

Having a debt can be hard; we’ve been there too. That’s why we’re here to help you understand how to handle your debt situation.

In this guide, you’ll find useful tips and a free letter template to help you ask for proof of your debt. Let’s tackle this together.

How do you prove a debt is not yours?

You may genuinely believe the debt is not yours for a number of reasons. More often than not, many people don’t recognise the company who contacts them. It’s a common dilemma that you may have to face too.

If you want to prove the debt is not yours, ask the debt collection agency to ‘prove’ it is. Also, gather as much proof of any payments you made before they contacted you.

Does a creditor have to prove the debt owed?

All debt collection agencies must mark a debt as ‘settled’ unless they can prove it isn’t! So basically, it’s up to the debt collector to prove you owe the money, not the other way around.

If this is the situation you face, you could send the debt collection agency a letter that goes something like this:

Dear Sir/Madam

Reference:

I write regarding your letter dated (date).

The debt to which you refer is not mine and would ask you to establish the opposite.

Please refer to the Financial Conduct Authority (FCA) Consumer Credit sourcebook for the following:

- Pursuing and recovering repayments (7.5.3)

- Settlements, disputed and deadlocked debt (7.14.1), (7.14.3), (7.14.4), (7.14.5)

When the debt is disputed, and payment is sought by neither an owner nor lender, the firm must:

- Provide information given by the customer to an actual owner or lender, or

- When an owner or lender has given the firm the authority to investigate a dispute, the firm must notify the owner or lender of the outcome of their investigation (7.14.6)

I, therefore, request evidence proving I am liable for the debt. Or please confirm that no further communication regarding the debt will be sent to me.

If I am pursued for the debt without having received evidence that I am liable, I’ll deem it as unfair and deceptive. As such, it could amount to psychological and/or physical harassment.

A failure to provide evidence that I am liable for the debt, or confirmation that you will no longer contact me, will result in my lodging a complaint with Trading Standards and the FCA.

Awaiting your prompt reply,

Yours faithfully

Make sure you don’t sign the letter. Why? Because there are some disreputable debt collection agencies out there. They could scan your signature and use it on a credit agreement without your consent!

Moreover, debt collectors must provide:

- Authenticated proof the debt is yours

- Provide full details of who the money is owed to

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What constitutes proof of a debt?

An original creditor must authenticate a proof of debt. However, an authorised person can also authenticate it. So, a debt collector can’t just say they ‘know’ you owe the debt.

They must produce authenticated proof of debt!

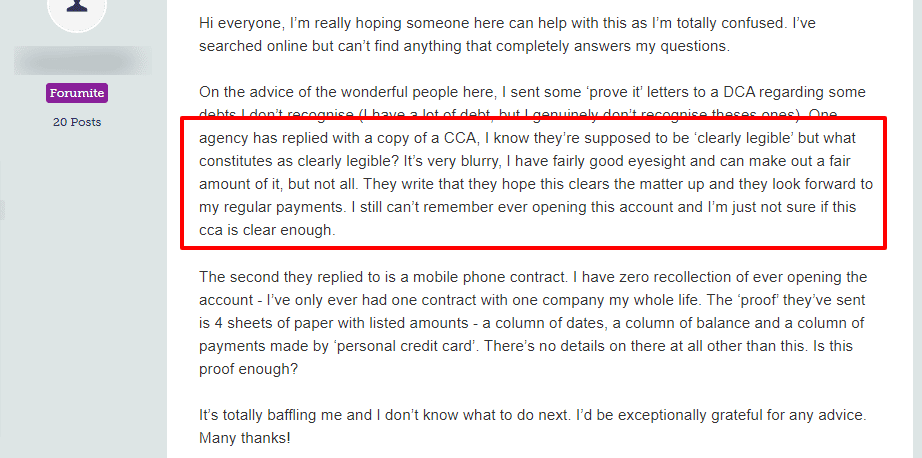

Take a look at what happened to one person when they received a blurry document which was supposed to ‘prove’ the debt:

Source: Money Saving Expert

What should you do if it’s someone else’s debt?

You may get a letter from a debt collection agency sent to your address that’s not in your name. It often happens because a previous occupant forgot to update personal details with a lender.

You’re not obliged to respond if you get a letter addressed to someone else that’s sent to your address. Your credit history won’t be affected because the debt applies to the person, not the address.

That said, it’s better to reply to the debt collection agency to stop them from contacting and hassling you. Just let them know the person doesn’t live at that address anymore.

I’ve included a template of what you could say here:

Dear Sir/Madam

Reference details

I moved into the above address on (date) and confirm the person whose debt you are referring to, no longer lives here.

As I don’t have a forwarding address, I’m unable to inform you where they now live.

Please refrain from sending harassing letters to my address which I deem is harassment.

Kindly update your records and confirm this as soon as possible.

Yours faithfully,

Don’t sign the letter

It’s also worth noting that some debt collection agencies may ask you for proof that the debtor doesn’t live at that address. But you are under no legal obligation to provide them with this information!