Who Sent Me PO Box 140 Normanton WF6 1YA Debt Letter?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Receiving a debt letter from PO Box 140 Normanton WF6 1YA can be confusing and scary. But don’t worry; we’re here to help you understand what it means and what to do next.

Every month, over 12,000 people visit this site for advice on debt issues, just like this one. You’re not alone.

In this article, we’ll explain:

- Why you might be getting letters from debt collectors

- Who uses PO Box 140 Normanton WF6 1YA

- What you can do if you get a letter from there

- How to lower your repayments

- What to do if you’re not sure the debt is yours

We know how worrying it can be to deal with debt collectors; some of us have been there too. Don’t worry; with the right information, you can handle this situation well.

Ready to find out more about how to handle debt letters and protect your rights? Let’s get started!

Who uses PO Box 140 Normanton WF6 1YA?

It seems that several businesses, companies and organisations use the PO Box 140 Normanton WF6 1YA return address for their mail.

I’ve listed some here:

- Banks and other financial institutions

- Credit providers/lenders which includes Britannia Personal Lending

- PPI companies

- Debt collection agencies

It’s worth noting that Lloyds Banking Group is one of the major banks to use the return address too.

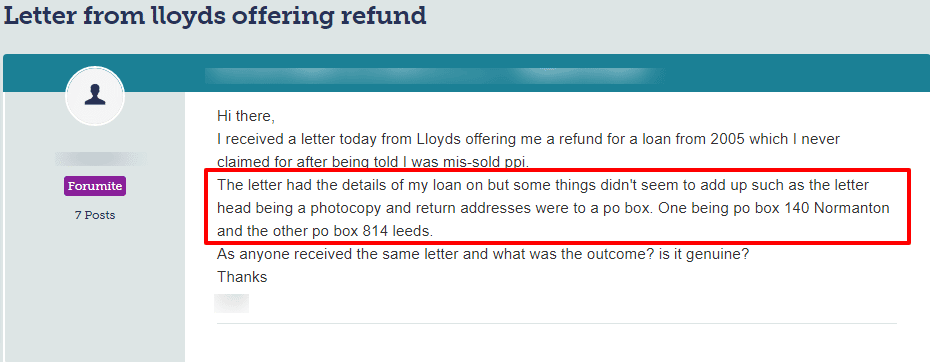

Lots of people ask if letters with this address are a scam or not. Check out the question someone asked below:

Source: Moneysavingexpert

How should you respond to these letters?

First, open the letter with the PO Box 140 Normanton WF6 1YA return address and discover what it’s about. Then deal with the situation by contacting the sender.

If the letter is addressed to someone else, tell the sender the “person does not live at this address”. Just cross out the name on the envelope and write ‘not known at this address’ across the envelope and pop it back in a post box. The sender should update their records once they receive the letter.

You don’t have any obligation to tell the sender anything else if they ask you to!

That said, reach out to the sender if the letter is addressed to you. Get in touch with the sender and deal with the problem head-on. Ask the sender to ‘prove’ the debt is yours!

Don’t admit, sign or pay anything to the sender until they prove you owe the money!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do you owe money on a debt?

As mentioned, ask the sender to prove the debt is yours by sending a ‘prove the debt’ letter to them. Whether the letter is from the lender or a debt collection agency, dealing with the situation early makes for a better outcome.

Don’t just take their word for it! Whether it’s the original lender or a debt collector, they must provide hard proof you owe the money.

In short, they must send you an authenticated copy of the agreement/contract you signed.

What happens if the sender can’t prove the debt is yours?

You shouldn’t have to fork out any money to the sender if they can’t provide you with proof the debt is yours. Moreover, the sender should stop contacting and if they don’t, it could be seen as harassment which is against the law!

Is the debt statute-barred?

Debt collection agencies often buy older debts and then try to collect on them. Write back to the sender telling them the debt is statute-barred if it’s at least six years old because it falls under the Limitation Act.

The sender should stop contacting you although they may still ask you to pay which you can refuse to do. Plus, courts won’t hear cases about statute-barred debts so you won’t get a CCJ!

However, although the debt is unenforceable, it still exists. In short, the debt would still remain on your credit history.

Also, there are criteria attached to whether a debt is statute-barred or not which I’ve listed here:

- First, you mustn’t have paid anything to pay off the debt in the last six year

- Second, the creditor hasn’t got a CCJ against you over the debt during that period

- Third, you never admitted owing the money or contacted the creditor in the last six years

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens when the debt is proven?

You should try to negotiate a fair, and affordable repayment plan with the creditor if they prove the debt is yours.

If needed, contact one of the debt charities for advice before you do anything else. Their advice could be invaluable when you’re dealing with debt issues and finding it hard to get back on track.

Debt collection agencies and creditors must allow you the time to assess your situation. It means you have the time to sort out the best options to resolve the problem.

Should you ignore letters from PO Box 140 Normanton?

No. Even though you may not recognise the return address or think it’s junk mail, don’t bin the letter. Instead, check out who sent it by opening the letter. Maybe it contains important banking information that needs your attention.

Ignoring a letter about an unpaid debt doesn’t mean the problem goes away. In fact, the problem just gets harder to resolve! Moreover, you’d just keep receiving these letters until you deal with the situation.