What is eui ltd prem tr on my Bank Statement? Debt Warning

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Has a puzzling entry ‘eui ltd prem tr’ popped up on your bank statement, leaving you worried and confused? Fear not; you’re in the right place for answers. Every month, over 12,000 people just like you visit this site seeking guidance on such debt-related topics.

In this friendly guide, we’ll explore:

- Who EUI Ltd are and why they might appear on your bank statement.

- How to deal with EUI Ltd debt collection and lower your repayments.

- Your rights when dealing with debt collectors and how to protect them.

- The steps to take if you suspect the debt isn’t yours.

- How to contact Admiral Financial Services Limited for help.

Dealing with unknown debt collectors can be scary, but remember, you’re not alone. We understand the fear and worry that comes with such a situation, as some of our team have been in your shoes. They’ve dealt with debt and navigated their way out.

So, we’re here to help you do the same. Let’s dive into the information you need to tackle this head-on.

Why would EUI Ltd take money from you?

You may find that EUI Ltd takes payment from your bank for a number of reasons. Moreover, they could be taking payments on behalf of their clients.

The debt collection company should have sent you a letter to inform you of the impending transaction. The letter should have detailed the amount they’ll take from your bank and the date of the transaction.

You’ll probably discover the amount taken is in relation to a late or missed payment to Admiral!

Is the debt about missed admiral insurance payments?

The debt could be related to a missed Admiral payment. If so, you should check all your statements to see if one or two didn’t go through.

It happens, especially these days when so many people are struggling with their finances!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do you respond to eui ltd debt collection?

It can be disturbing to find a statement with a EUI Ltd debit on it and when EUI debt collectors contact you. However, once you’ve regained your composure, there are things you check before doing anything else which I’ve listed here:

- How old is the debt?

- Is the debt yours?

- Why has eui taken money from your account?

Is the debt too old to enforce?

Some debts are too old to enforce because they are at least six years old. It means courts won’t hear cases that involve debts this old which are deemed statute barred.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is the debt really yours?

The next step to take once you’re satisfied the debt is not too old to enforce is to write to the debt collector asking them to prove the debt is indeed yours!

Mistakes happen, whether clerical or other so it’s important to check you actually owe the money!

Debt collectors are obliged to prove the debt and if they can’t, you won’t have to pay. Moreover, a judge wouldn’t rule in their favour if there’s no hard proof the debt is yours!

How to deal with a eui ltd prem tr bank statement issue?

You should contact EUI Limited as soon as possible if you feel a mistake has been made and the money shouldn’t have been taken from your account.

You’d need to provide proof to support your claim that a mistake was made. Make sure you send all letters by registered post and keep copies for yourself. Like this, you know the letters have been delivered and you have records to prove things.

Can you ignore EUI Limited?

No. It’s never a good move to ignore debt collectors. Things can escalate quite quickly making the situation that much worse.

It’s far better to respond in writing to Admiral Insurance and let them know what you are doing. For example, if you’re seeking debt advice, let the debt collection agency know!

» TAKE ACTION NOW: Fill out the short debt form

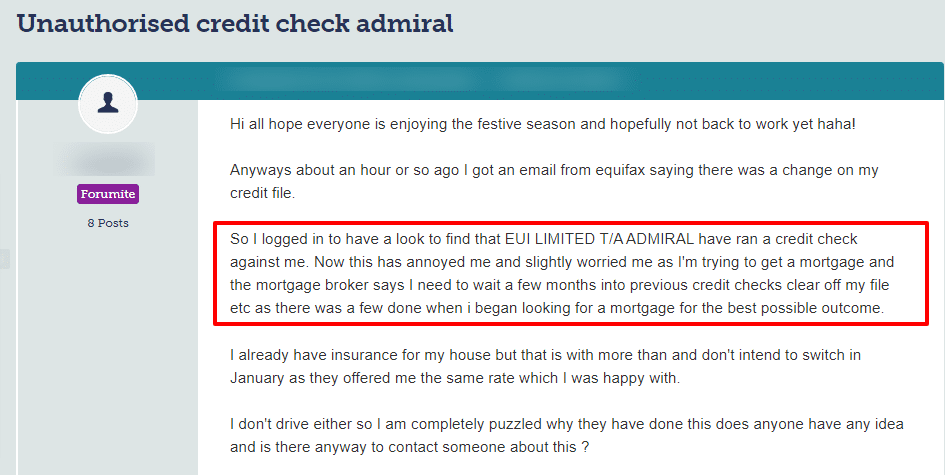

Will EUI Limited run a credit check on you?

They may run a credit check on you. Check out what happened to one unfortunate person who found that Admiral had run a credit check on them:

Source: Moneysavingexpert

Can you prevent EUI ltd from contacting you?

No. As mentioned, debt collection companies have the right to contact you over an alleged debt. But you can stop them from calling you at all hours. How? You can write to the debt collector telling them when and how they can get in touch with you.

So, for example, you may wish for them to only contact you in writing. It’s a good idea because you have a record of everything they say and want from you!

What if EUI Ltd continues to phone you when you asked them not to?

EUI Ltd must oblige when you ask them to only contact you in writing. It’s always worth sending letters to debt collectors by registered post because not all of them act ethically!

If a debt collector continues to contact you in other ways and at all hours of the day, it could be deemed harassing unlawful behaviour.

How do you complain about EUI Limited?

You have the right to complain to Admiral Insurance if you feel you’ve been treated unfairly or the debt collector acted inappropriately.

After this, you can lodge a complaint with the Financial Ombudsman Service (FOS) if you believe Admiral didn’t deal with you correctly!

Thanks for reading this post. I hope the information helps you deal with an Admiral debt and answers the question, what is eui ltd prem tr on my bank statement!

How do you contact admiral financial services limited?

I’ve listed ways to contact Admiral Financial Services Limited and EUI limited in the table below:

| Website | https://admiralgroup.co.uk/ |

| Phone | 0330 333 5888 |

| [email protected] | |

| Address | Ty Admiral, David Street, CF10 2EH |