Can You Be Defaulted Twice for the Same Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about what happens if you can’t pay a debt? Do you wonder if you could be defaulted twice for the same debt?

You’re not alone. Every month, over 12,000 people visit this site looking for guidance on debt worries.

In this article, we’ll answer your questions:

- What it means to default on a debt

- If you have to pay a debt if you default

- What happens when you default

- How a default affects your credit score

- If you can be defaulted twice for the same debt

We understand how worrying debt can be. Our team has experienced the fear of debt collectors and the stress of unpaid debt. We’re here to offer clear, simple advice.

Remember, even if you’re in debt, there are ways to make it manageable.

What happens when you default on the debt?

Defaulting on a loan has serious consequences. For instance, debt collection agencies get involved which can be stressful as they are notoriously persistent. Moreover, some of them use questionable tactics.

Then there’s your credit score that’ll be negatively impacted by the default. This, in turn, impacts your ability to borrow money further down the line. You’d even have trouble getting a mortgage.

On top of this, defaulting on a debt means more fees and then there’s always the possibility of having your personal property seized!

In short, it’s never a good idea to default on any money you owe to lenders!

What happens when you default on a debt?

A creditor will typically ask you to pay the full amount when you default on a loan or other type of debt. It means that any payment agreement they had with you gets cancelled.

That said, you have the right to ask creditors to let you pay back what you owe in instalments. But it’s at the discretion of the creditor whether they agree to let you or not!

But that’s not the end of it because a creditor may decide to:

- Pass your details to a debt collection agency

- Begin legal proceedings against you to recover what’s owed them

- If the defaulted debt was for an item on ‘hire purchase’, the creditor could apply to the court to seize the item

The Financial Conduct Authority provides a ton of useful information on how to deal with a default notice you receive from a creditor.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you be defaulted twice for the same debt?

You may have read somewhere that you could be defaulted twice for the same debt. However, you can’t have 2 defaults on the same debt although it does happen!

That said if an original creditor registered your account in ‘default’ and then sells the debt to a collection agency it could happen.

If you don’t meet the agreed repayments with the debt collection agency, they could record your account as being in default too!

In short, the same debt is recorded in default twice but by two different entities because you ‘defaulted’ twice on two different agreements!

Can an old debt reappear on your credit file?

No. An old debt is unlikely to reappear on your credit file provided the debt is 6 years or more old. In this instance, the debt is statute-barred, but you must meet specific criteria as set out by the Limitations Act 1980.

What should you do if the same debt is defaulted twice?

Although it’s not supposed to happen, having the same debt defaulted twice does occur. In fact, the same debt may show up more than twice!

However, when this happens it’s usually down to a clerical error. You have the right to contact a credit reference agency (CRA) when it does.

The 3 credit references in the UK are as follows:

All three CRAs hold your credit reports all of which show up in your credit history which will impact your credit score.

You should contact the original creditor and the CRA when a debt shows up twice on your credit report. The first default should be cancelled by the original creditor so it no longer appears on your credit file.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Why do creditors register a default?

Creditors typically register a default because they think you’re unable to get your finances back on track and repay them. They cancel your credit agreement which means you’d have to pay back the full amount!

Under normal circumstances, you have two weeks to catch up on a missed payment or instalment. If you manage to pay, the default is removed and that’s it. Your account continues to operate as normal.

The problem begins when you’re unable to pay the missed payments within two weeks and your account remains in ‘default’.

In short, the creditor sends you a ‘notice of default’ if you failed to pay or paid less that the agreed full amount for 3 to 6 months.

However, it’s well worth noting that ‘default notices’ only apply if the debt is regulated under the Consumer Credit Act.

» TAKE ACTION NOW: Fill out the short debt form

Is a default serious?

Yes. Defaulting on a debt is serious because it means you have not paid the creditor for a long time. In short, all payments are seriously ‘past due’ which then sets in motion serious consequences.

You risk having to deal with a debt collection agency!

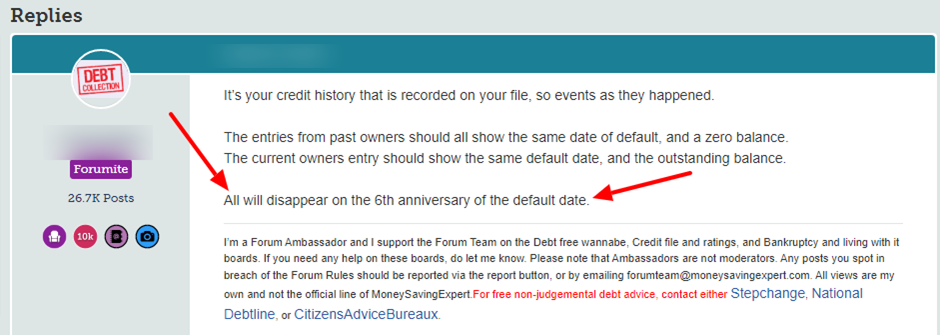

Check out what one person asked about older debts and when they expire on a popular online forum:

Source: Moneysavingexpert

Lastly, can you be defaulted twice for the same debt? Recap

Yes and no. In theory, you should not be defaulted twice for the same debt. But unfortunately, it does happen. The original debtor may have registered your account in default and then sold the debt.

Lenders and creditors often sell debts to third parties, in particular to debt collection agencies!

When you default on an agreement with a debt recovery company, they could register the debt again. In short, the same debt appears twice on your credit file.

You can, however, resolve the matter by contacting both the original creditor and the Credit Reference Agency. One of the defaults should be cancelled and if not, you could take the matter further.

Thanks for reading my post. I hope you found the information helpful in resolving things when the same debt is registered twice on your credit file.

Do you need more debt advice?

If you’d like more advice on solving an issue with a debt collection agency, then why not check out my other post on how debt collectors can find your address?