Do I Pay or Ignore C.A.R.S Debt (Credit Link Account Recovery)?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with a debt from C.A.R.S. (Credit Link Account Recovery) can be a worry. You might be stressed about how to handle the debt collectors. You might also be concerned about how this situation could affect your daily life. But remember, you’re not alone. Every month, over 12,000 people visit this site to find helpful advice on debt issues.

In this article, we’ll explain:

- Who C.A.R.S Debt Collection is and why they might contact you.

- How to know if the debt collector is regulated.

- Steps to lower your repayments.

- How to find out if the debt is too old to enforce.

- Ways to handle contact from Credit Link Account Recovery.

We know how hard it can be to owe money, as some of our team members have faced the same problem. They’ve dealt with owing money and not knowing what to do, so they know how to help you. Let’s dive in and find out more about what you can do if you owe money to C.A.R.S.

Why would C.A.R.S Ltd contact you?

Creditlink will contact you if you defaulted on a payment to a company and they passed your details onto the debt collection agency. The original creditor would instruct CARS to chase you for payment.

So, when you get a debt letter from them, it’s best not to bin it. Instead, find out whether the debt is still current or is it statute barred. Next, check whether you really owe anything to the company concerned!

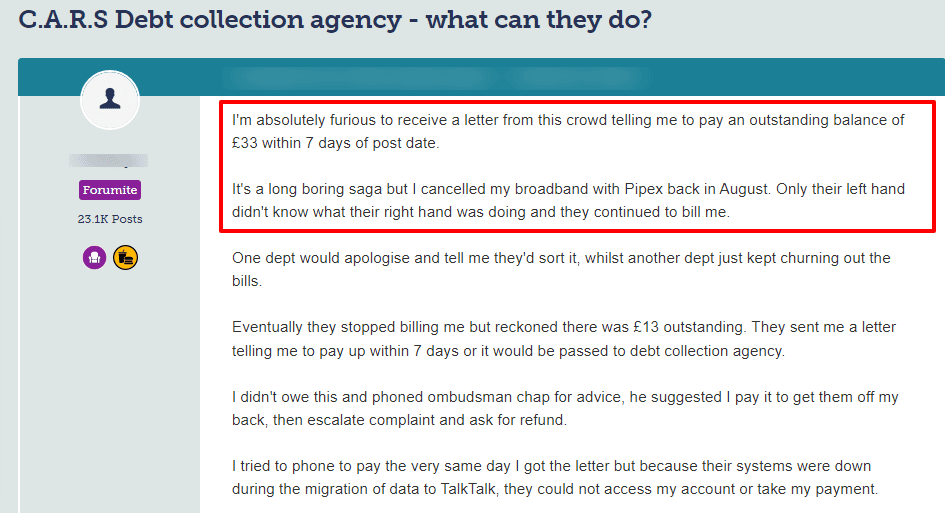

Source: Moneysavingexpert

Should you pay the debt collection agency?

You shouldn’t pay a debt collection agency straight away. But you shouldn’t wait too long either. You should check a few things out first. For example, is the debt yours and is it still current, or is it too old to enforce?

Make sure you let Creditlink know what you’re doing and when you’re seeking debt advice otherwise, they could escalate things!

You should only pay when you’re satisfied with both of the above. But you should seek independent advice from an expert before admitting, signing or paying anything to debt collection companies.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is it a good idea to ask CARS to prove the debt?

It’s always a good move to ask a debt recovery company to prove you owe the money. If the debt is yours, you gain a little time by making the request.

Moreover, CARS is obliged to respect the request and must send you written confirmation you owe money to their client!

Another advantage is that Creditlink can’t do anything until the debt is proven!

What happens when CARS can’t prove a debt?

If CARS can’t prove you owe the money by providing you with hard evidence, they can’t take you to court! A judge wouldn’t rule in their favour if CARS can’t show proof you owe the money.

In short, with no proof against you, a court won’t issue an order to pay.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens when the debt is proven?

You’ll have to pay if Creditlink can prove you owe money to their client. However, don’t sign, admit, agree or pay any money to debt collectors until you’ve sought independent advice.

You could contact an independent debt adviser or you could seek advice from one of the leading debt charities. Independent debt advisers will charge for their advice.

However, UK charities provide free debt advice which could be the better option if you’re already struggling financially.

What happens when you ignore CARS Limited?

Things escalate quite quickly if you choose to bin debt letters from Creditlink. Plus, you may not find out the following:

- That the debt is not yours or that it’s too old to enforce!

- The chance to have some of the debt wiped off could make it that much easier to settle

- Creditlink wins a court case against you which results in a CCJ being recorded on your credit file

- Bailiffs appointed by the court (enforcement officers) calling at your home and seizing some of your possessions

- Finding an attachment has been placed on your earnings or bank account

To put it in a nutshell, ignoring Creditlink Limited could have serious consequences even if the debt isn’t yours!

What can Credit Link Account Recovery do?

Credit Link is governed by the CSA Code of Practice and several UK laws. So, when they contact you over an alleged debt, they must abide by the ‘rules’.

For example, a debt recovery company can:

- Get in touch with you whether it’s by phone, text, letter, email or by sending a field agent to visit your home

- Talk to you about the debt but they must remain polite. They must show understanding and empathy towards your specific circumstances

- Ask that you pay them the amount owed rather than their client

» TAKE ACTION NOW: Fill out the short debt form

What can’t Creditlink do when they contact you?

Creditlink can’t threaten or harass you when they contact you about a debt you allegedly owe one of their clients.

Moreover, they can’t do any of the following because it’d be unlawful if they do:

- Tell you they are bailiffs and have the same powers as court-appointed enforcement officers

- Use documents and papers that look like they’ve been issued by the courts

- Force entry into your home, seize your possessions or clamp your vehicle

- Discuss things with your neighbours, a family member, friends or employer

- Visit you at work

- Harass you with constant phone calls

- Pressure you into taking out a loan to pay the debt

When debt collectors do any of the above, you should file a formal complaint with their head office. Wait to see if they make amends and if they don’t, lodge a complaint with the Financial Ombudsman Service (FOS).

Can you prevent Creditlink from contacting you?

You can’t stop Creditlink from contacting you, whether the debt collectors send you a letter, email, text or phone you. You can’t prevent them from visiting you at home either but you can ask them to leave.

But you can dictate how and when Creditlink can get in touch with you about an alleged debt!

You should write to the debt collectors telling them to contact you in writing and to stop phoning you! Creditlink must respect your request and if they don’t, it could be seen as them harassing you.

Harassment is against the law!

Plus, it’s always better to have as much correspondence with debt collectors in writing so you have a record of what they say and want! It could be a great asset if the case against you goes to court!

How do you complain about Creditlink?

You should first write a letter of complaint to Creditlink’s head office if you feel Creditlink has acted unlawfully when they contacted you. This allows them to put things right.

However, if debt collectors don’t deal with the problem straight away, you have the right to lodge a complaint with the Financial Ombudsman Service!

How do you contact Credit Link Account Recovery Limited?

I’ve listed how you can contact Credit Link Account Recovery Ltd below:

| Website | https://www.carsuk.org/ |

| Post | C.A.R.S. PO Box 6520, Basingstoke, Hampshire RG21 4UY |

| Phone | 0333 136 3349 – General Enquiries0333 136 8282 – Debit and credit card payment hotline |

| Opening hours | 08:30 am – 07:00 pm Monday, Tuesday and Thursday 08:30 am – 05:30 pm Wednesday 08:30 am – 04:00 pm Friday08:30 am – 12:30 pm Saturday |

| [email protected] |