Who Sent Me PO Box 300 Northampton NN1 2TX Debt Letter?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you got a letter from PO Box 300 Northampton NN1 2TX about a debt? It can be worrying, but you’re not alone. Every month, over 12,000 people visit this site for guidance on debt matters.

In this article, we’ll answer:

- Who sent you the PO Box 300 Northampton letter?

- Are all letters from this PO Box genuine?

- How can you check if the letter is real?

- Should you reply, and what happens if you don’t?

- How can you manage your debt in the UK?

Dealing with debt collectors can be scary. You might be worried about how it affects your daily life, your rights, or if you’ve been tricked by a fake debt firm.

We understand these worries.; some of our team have been in the same boat. So we know how to help you find out how to handle this situation in the best way.

Who sent you the PO Box 300 debt letter?

Northampton County Court Business Centre sends out letters with the address PO Box 300 to inform you that a legal claim has started against you!

In short, a creditor claims you owe them money and is taking you to court over the debt!

Are all PO Box Northampton NN1 2TX genuine?

No. There are reports on the Government website warning people that certain debt collection agencies use fake letters!

The agencies send out these fake letters to scare people into paying a debt to avoid being taken to court.

It’s a tactic that’s totally against the law!

So, when you receive a PO Box 300 Northampton NN1 2TX debt letter, the first thing to do is check that it’s legit!

How do you check if the PO Box 300 Northampton letter is legit?

You can check if the PO Box 300 Northampton debt letter is legit by contacting Northampton County Court Business Centre directly.

That said, the letter is FAKE if it demands immediate payment and it doesn’t include a form allowing you to defend the claim!

A legit debt letter from Northampton County Court will never ask for immediate payment. Moreover, it will also include a form so you can respond and defend the claim against you!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Why would you get a County Court Letter?

Chances are a creditor has tried to contact you and failed. Maybe you defaulted on a credit card payment or loan instalment. Are you behind on paying utility bills or did you bin a parking ticket?

When you don’t keep up with payments and a creditor can’t get hold of you, they’ll chase you for the money through the courts!

Moreover, CCJs are issued by default if you don’t turn up at court when summoned!

What happens when you get a county court letter?

Once you receive a county court debt letter which is referred to as a County Court Judgement you should take it seriously. Why? Because a court has ordered you to pay what you owe.

If you ignore the letter, it could lead to further action being started against you and you could have to deal with bailiffs!

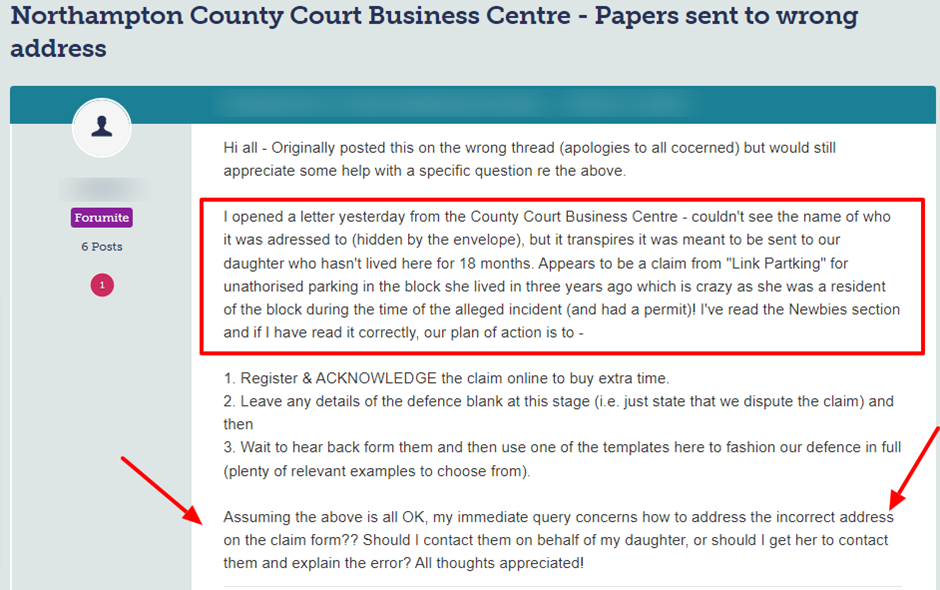

Check out what happened to one person who posted this message on a popular online forum:

Source: Moneysavingexpert

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Should you reply to a PO Box 300 Northampton debt letter?

You should respond to the PO Box 300 Northampton NN1 2TX debt letter within 14 days of receiving it. However, if you respond by post, it’s 16 days!

That said, the first thing you should do is check the debt letter is genuine by contacting Northampton County Courts Business Centre! And you should check the details in the letter.

If it doesn’t include details on how to deal with the CCJ but it demands you pay immediately, it’s a scam!

How should you admit to owing the money?

When you respond to the PO Box 300 Northampton debt letter, it allows you to provide information on your financial circumstances. A judge will take the information into account and could help set up an affordable repayment plan.

You’d have to complete Form N9A which is included in the County Court letter you’re sent. The form is known as an Admission Form.

You have to send the N9A Form to the claimant, NOT the court.

The claimant or their solicitors’ address is found on Form N1 that’s also included in the County Court Letter.

That said, if a claimant rejects your proposal to pay what’s owed in instalments, it’s up to the judge to make the final decision on a ‘fair’ repayment plan.

How do you contest the claim?

You’ll find there’s another form included in the County Court letter you receive. It’s a Form N9B which is the form you can use to contest things.

However, you should seek legal advice before you contest the claim so you get it right. In short, you should contact one of the leading UK charities that provide free debt advice!

You have another option which is to accept that you owe the money to the claimant, but that the amount is incorrect.

You can do this by completing forms N9A and N9B and sending both back to the court.

What address do you send the Forms back to?

I’ve listed the addresses that form must be sent back to in the table below:

| Form Reference | Where to send the form |

| Form N9A – Admission Form | Send back to the claimant of their legal representatives details found on Form N1 |

| Form N9B | Send back to the court |

What happens after you lose a case?

A judge issues a CCJ if you lose a case against you. The judgement may be either of the following:

- Judgement Forthwith which is an order to pay the full amount immediately

- Judgement by Instalments which is an order to pay what’s owed over time

If you don’t respect an order to pay, you could end up having to deal with bailiffs (enforcement agents)!

Moreover, if you owe more than £600, the case could be escalated to High Court Bailiffs who charge a lot more!

What happens if you don’t respond to a County Court Letter?

A judgement is still entered against you when you don’t respond to a County Court debt letter. As mentioned, a ‘default’ judgement is made against you.

This could allow a creditor to demand full payment of the amount owed!

How should you respond to a Northampton County Court debt letter?

Once you’re satisfied the debt letter is genuine, you should respond in the following ways:

- Admit you owe the money

- Contest the amount of the claim

- Contest the debt