Should I Pay or Ignore my Debt with TNC Collections?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with TNC Collections may make you feel uneasy. You might be unsure about how to handle debt collectors or worried about their impact on your daily life. If you’re feeling overwhelmed, we’re here to help. Each month, over 12,000 people visit us for advice on dealing with debt, just like you are now.

In this article, we’ll explain:

- Who TNC Collections are and if they are a legitimate business.

- How to deal with debt collectors and understand your rights.

- Steps to take if you believe you’ve been scammed by a fake debt collector.

- Methods to lower your repayments and deal with the situation effectively.

- What to do if TNC Collections can’t prove you owe the debt.

The fear of debt can be heavy, but remember, you are not alone. Our team understands what you are going through, as some of us have faced similar situations. We are here to support you, offering guidance to help you navigate this tricky situation.

Let’s dive in and discuss how you can deal with TNC Collectors.

Should you pay TNC Collections?

No. Not straight away. Instead, check all the details on the debt letter you received to make sure they are correct.

Then, check how old the debt is because if it’s at least six years old, it may be too old to enforce.

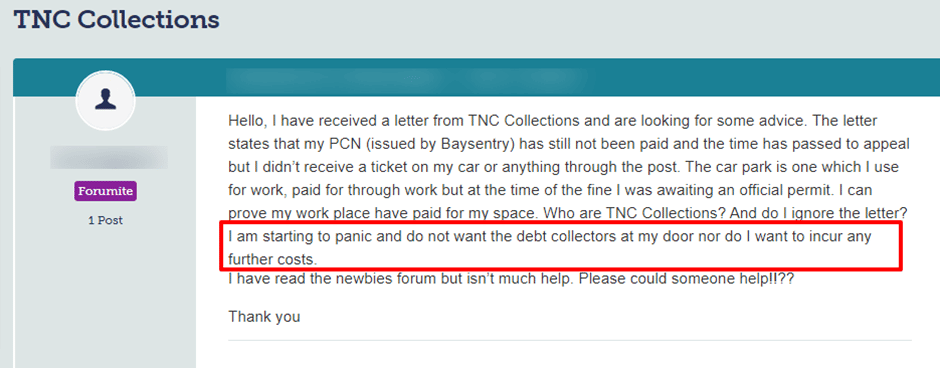

Next, find out if TNC is chasing the right person because mistakes happen especially where parking tickets are concerned.

Source: Moneysavingexpert

You shouldn’t admit, agree, or fork any money out to a debt collector until you’re satisfied the debt is yours!

Should you ask TNC Collections to prove you owe the money?

It’s always worth writing to TNC Collections asking them to prove you owe the money. Even when you know the debt is yours!

First, it gains you a little time to sort out how you’re going to pay. Second, TNC Collections may not have adequate proof you owe the money!

In short, if the debt collector can’t prove the debt is yours, you can’t be made to pay. Even if the case goes to court, without hard evidence a judge would find it hard to rule in the debt collector’s favour!

Moreover, you can’t get a CCJ either!

That said, you shouldn’t just accept a debt collector’s word that you owe the money. They must provide you with authenticated evidence in the form of a Credit Agreement or other form of contract.

For example, it could be a parking ticket issued on private land with your details on it.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if TNC Collections can’t prove the debt?

The short answer is you won’t have to pay. When a debt collector can’t provide authenticated proof you owe the money, they can’t make you pay!

As such, they should stop contacting you and if they don’t, you should file a complaint with TNC Collection through their website. If they continue to harass you, file a complaint with the Financial Ombudsman Service (FOS).

What happens when you ignore TNC Collections?

Things escalate relatively quickly if you bin a letter from TNC Collections and continue to ignore things!

For example, you may not find out the following:

- TNC Collections is chasing the wrong person because the parking ticket isn’t yours, thanks to an ANPR error. It happens far too often!

- The debt is statute-barred and therefore too old to enforce!

- Having part of the debt wiped off could make it that much easier to settle

Then of course you could also have to deal with:

- Court action (even if the debt isn’t yours)

- Getting a CCJ on your credit file which will make it harder for you to borrow money for six years

- Having enforcement officers (bailiffs) visit you at home and seizing some of your possessions

- Coping with an attachment on your bank account or earnings

So, as you can see, ignoring a debt letter from TNC Collections could make your life a lot harder and you’d have to deal with a lot more stress too!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can you prevent TNC Collections from contacting you?

Unfortunately, TNC Collections has the right to contact you about an alleged debt. Even when they’re chasing the wrong person.

» TAKE ACTION NOW: Fill out the short debt form

Debt collectors can contact you by:

- Phone/text

- Letter

- In-person

The good news is that you can write to a debt recovery company telling them when and how to contact you. Moreover, once they receive your letter, a debt collector must respect your wishes!

It’s always a good idea to send your letter by registered mail so you know TNC Collections received it. Like this, you have a record of your request should you need it!

You should get a response in writing from TNC Collections agreeing to your request. But if they bombard you with constant phone calls, it would be deemed harassment which is unlawful behaviour!

How do you complain about TNC Collections?

You must file a complaint with the debt collection agency before contacting the Financial Ombudsman Service (FOS). This allows TNC Collections to deal with your complaint and resolve things.

However, if you feel the debt collector hasn’t treated your complaint fairly, you can then contact the FOS and report them!

How do you contact TNC Collections?

I’ve listed TNC Collections’ contact details below:

| Address | Suites 358/359 Central Chambers, 93 Hope Street, Glasgow, G2 6LD |

| Phone | 01242 214645 |

| Complaints | https://www.tnccollections.com/complaints-policy/ |

| Website | https://www.tnccollections.com/ |