Should I Pay Newlyn PLC Baliffs Debt Collectors or Appeal?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you concerned about a debt with Newlyn PLC Bailiffs Debt Collectors? Not sure if you should pay them or make an appeal? If so, this article is for you.

Every month, more than 12,000 people visit this website for advice on debt topics, so rest assured, you’re not alone.

In this article, we’ll guide you through:

- Understanding whether you need to pay Newlyn PLC debt collectors

- Learning if an appeal against Newlyn is possible

- Ways to deal with Newlyn bailiffs and debt collectors

- How to stop Newlyn from sending you letters and making calls

- Checking if Newlyn can enter your house

We know how concerning debt issues can be; some of us have been in your shoes. Don’t worry; we’re here to help you understand how to deal with Newlyn PLC Bailiffs Debt Collectors.

Are Newlyn bailiffs or debt collectors?

Newlyn operates in the debt recovery industry as a debt collection agency and as a private enforcement agency, more commonly known as bailiffs. Debt collection agencies and enforcement agencies aren’t the same.

There is a big difference between a debt collection agency and an enforcement agency. A debt collection agency works for its clients to trace debtors and ask them to pay in writing or over the phone, taking commission or a fee for their work.

Whereas an enforcement agency is a private company that works to make debtors pay after a court warrant has been issued to make them pay. When working as bailiffs, Newlyn’s enforcement agents have additional powers to recover the debt owed to their clients.

Newlyn debt collection proved my debt, what now?

If Newlyn debt collection proved your debt, there are three ways to respond but not all of them are recommended by debt charities:

- You could ignore them, but there is a high probability the client will take you to court where the debt will grow bigger.

- You could speak with Newlyn about a repayment plan based on your income to ensure the repayments are affordable while you maintain essential living costs.

- You can get personalised debt advice from a debt charity and use the breathing space scheme still, as explained in the section above.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to deal with Newlyn bailiffs and debt collectors

How to deal with Newlyn depends on whether they’re chasing you in the capacity of a debt collection agency, or whether they’re chasing you as bailiffs.

Some of the steps you can take to fight back against debt collection agencies won’t benefit you if they’re acting as bailiffs – and vice versa.

I’ll start by explaining your options when dealing with Newlyn as a debt collector, and then I’ll move on to how to deal with Newlyn as bailiffs. You can jump ahead if you know you’re dealing with them as bailiffs.

» TAKE ACTION NOW: Fill out the short debt form

How do I stop Newlyn debt letters and calls?

I’ve been asked this question a lot, and there is something you can do. You cannot block all forms of communication from Newlyn because they’re allowed to communicate with you about payment.

But you can provide them with your communication wishes, which they must then respect. FCA rules state how debt collection agencies must engage with debtors. One of the rules states that they must adhere to debtor communication preferences, but your preferences must be reasonable.

Most people prefer to have all communication in writing to keep a paper trail and evidence of everything. This can be a smart move.

If Newlyn doesn’t respect your communication preferences, you could make a complaint about their behaviour. You can also make a complaint if they break other rules, such as harassing you or threatening you.

I’ll explain how to make a complaint about Newlyn Debt Collection towards the end of this post.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can you appeal a Newlyn debt?

You can’t appeal a Newlyn debt, but you can reply to their payment request letters in ways to push back and possibly avoid paying.

I should add that if they did take you to court, you can fight the debt as part of the court process, but this isn’t the focus of our discussion here.

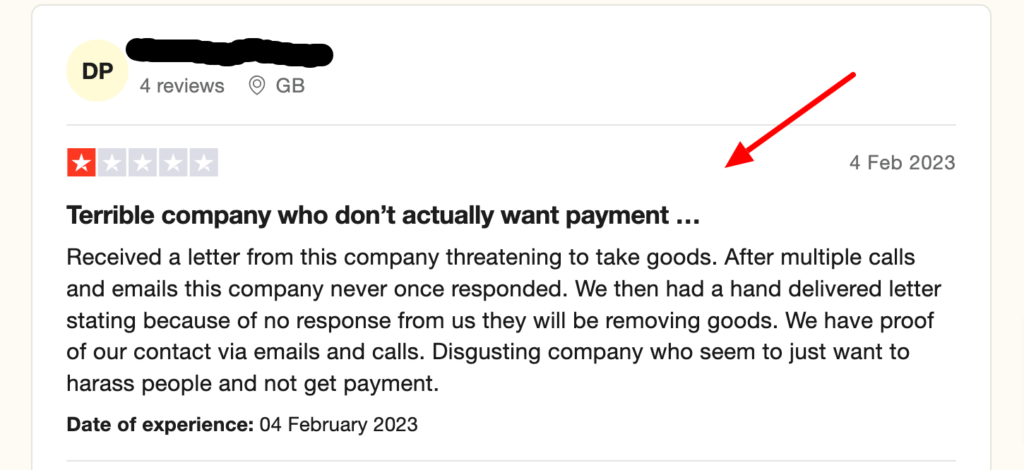

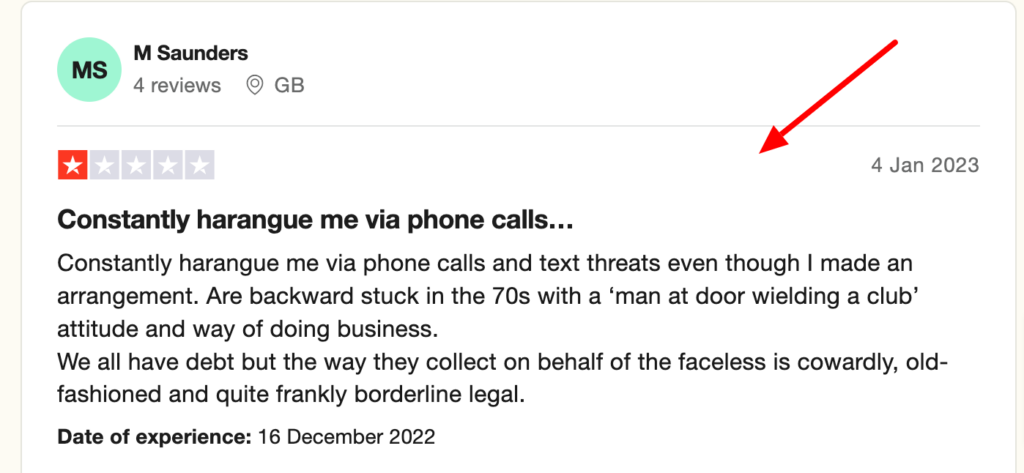

Newlyn bailiffs reviews

I had a look at the Newlyn bailiff reviews online and they were as I expected.

On Trustpilot, the company has an average rating of 1.1 stars with over 150 reviews recorded. This includes 98% of all reviews as one-star reviews.

This isn’t uncommon for debt collection agencies and bailiffs as many people try to take their frustration out on them online. But that isn’t to say their poor reviews aren’t unwarranted.

Here are some examples of what’s being said about Newlyn:

Source: https://uk.trustpilot.com/review/newlynplc.co.uk

Source: https://uk.trustpilot.com/review/newlynplc.co.uk

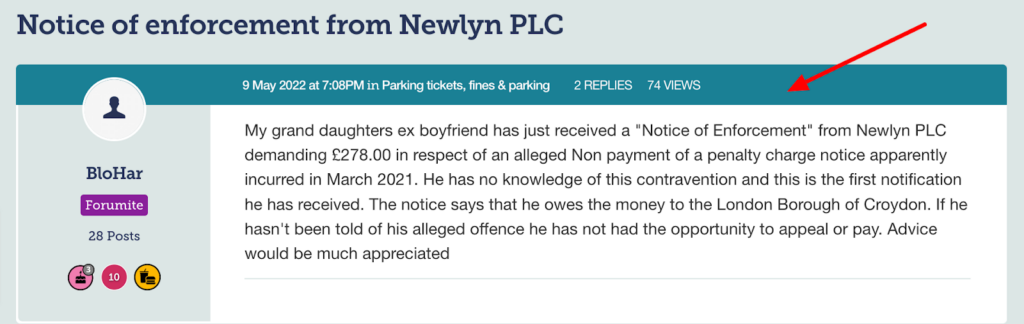

Newlyn Bailiffs Notice of Enforcement letter

The first you’ll hear from Newlyn bailiffs is when they send a Notice of Enforcement letter. This letter tells you they’re in charge of recovering the debt.

They’ll tell you to get in touch with them to make a payment arrangement, possibly a Controlled Goods Agreement (CGA) whereby your assets are used as security within the payment plan.

Here is a common story of someone getting contacted by Newlyn PLC bailiffs:

Source: https://forums.moneysavingexpert.com/discussion/6356767/notice-of-enforcement-from-newlyn-plc

Newlyn aren’t obligated to accept a payment plan of any kind. They will be instructed by their client on what they can accept. Seven clear days after receiving this letter, they’re allowed to come to your home to ask for payment or take your possessions.

How to deal with Newly bailiffs

Newlyn bailiffs can only get involved after a court has issued an order for you to pay the debt. This might be a County Court Judgment (CCJ), but in regard to council tax arrears and other local authority debt, it might be a liability order or another type of order without a hearing.

Unfortunately, after you’re subject to a court order to pay a debt, and then a warrant is issued for bailiffs to get involved, your options to fight back are limited. This is also why it’s a risk to allow the matter to escalate in the earlier stages.

To understand what you can do now, you need to know the processes that bailiffs use to recover money in this situation. It starts with a Notice of Enforcement letter

How much are Newlyn bailiff fees?

Bailiff fees are fixed and set by legislation, specifically Schedule 12 of the Tribunal, Courts and Enforcement Act 2007 and Taking Control of Goods (Fees) Regulations 2014.

If you think you’ve been charged more than what you’re supposed to be charged, you can make a complaint. Either way, bailiff fees are very expensive and can cause your debt to shoot up.

For sending the first letter, they charge a £75 fee. They then charge a fixed fee of £235 for their first visit to your home – if required.

They also charge 7.5%of debts that are valued above £1,500. To remove your goods they charge £110, and again, 7.5% of the debt’s value above £1,500. There can even be storage fees and auction costs to cover as well.

Can Newlyn Bailiffs force entry?

In most cases, Newlyn bailiffs cannot force entry into your home. They can make peaceful entry by entering an open or unlocked door. They cannot climb through windows or kick down your doors.

They can force entry with the use of a locksmith if you default on a Controlled Goods Agreement and the assets secured by that agreement are inside your home.

What will Newlyn bailiffs take?

Newlyn can only take goods belonging to the debtor.

They mostly take valuable items such as electronics or vehicles. But they cannot take a vehicle when it’s not in the debtor’s name, when it’s on a vehicle finance agreement, or when it’s required for work (in some cases).

There are other possessions they cannot take, such as some furniture, consumables and possessions necessary for employment.

These goods will then be stored and sold at an auction to raise funds. The funds will be used to pay the debt off and to pay the bailiffs fees, which are passed on to you.

Can you stop Newlyn bailiffs?

Sometimes you can stop bailiffs if you’re considered a vulnerable person.

Bailiffs aren’t able to visit the homes of people classified as vulnerable. But the vulnerable person list includes more people than you might expect.

It’s best to see if you qualify with the help of Citizens Advice or a debt charity. And then notify Newlyn bailiffs as soon as possible to stop them from visiting.

But note, this won’t stop you from owing the money; it just means they won’t come to your home until you’re no longer classed as vulnerable.

Newlyn bailiffs complaints

Throughout the earlier stages of my post, I told you that you can complain about Newlyn if you’re unhappy with their behaviour. This might be related to the way they communicate with you, or anything else they might do which is unprofessional and against the rules.

Whatever the problem is, you must make your first complaint to Newlyn directly. Follow their complaints procedure. If they don’t respond as you would have liked or if the situation doesn’t improve, you can then escalate the complaint to the Financial Ombudsman Service (FOS).

The FOS is an independent body that can look at the facts from both sides to decide whether a breach of rules has occurred. If the FCA decides that Newlyn debt collectors or bailiffs did breach rules, they can be severely punished and it might benefit your debt situation.

You stand a better chance of making a successful complaint if you can supply evidence, such as call records or call recordings etc.

Newlyn Bailiffs contact info

I have rounded up the most up-to-date contact information for Newlyn bailiffs debt collectors below. Here is the key contact info you might need to use. Use this unless otherwise stated by Newlyn.

Newlyn bailiffs contact number

Call Newlyn on 01604 633001. They’re opening hours are between 8am and 7pm on weekdays, and between 9am and 1pm on Saturdays. They’re closed on Sundays.

Newlyn bailiffs email address

The Newlyn email address is [email protected]. Alternatively, you can send them a message through their online contact form.

Newlyn Bailiffs address

Respond to Newlyn in writing unless otherwise directed to the following address:

Newlyn PLC

PO Box 933

Northampton

NN1 9DX

Dealing with Newly debt collection agency (Summary)

If you don’t wish to pay Newlyn debt collectors straight away, you can:

- Check whether the debt can be enforced by a court or whether it’s too old. If it is too old for enforcement, you can tell Newlyn PLC that you won’t be paying.

- Ask Newlyn to prove you owe the debt with a prove-the-debt letter.

- Agree on a repayment plan with Newlyn, or get personalised debt advice from a debt charity while also using the breathing space scheme to stop further action from being taken.

How to deal with Newlyn bailiffs (Summary)

You have fewer options to deal with Newlyn bailiffs than you do when dealing with them as a debt collection agency. The court has already had its say and your hands are somewhat tied. Nevertheless, you could:

- Agree on a payment plan or Controlled Goods Agreement within seven days of receiving a Notice of Enforcement Letter. This will help you come to a resolution without having bailiffs at your door. It will also mitigate the bailiff fees added to your debt.

- Enquire to see if you’re a vulnerable person by speaking with Citizens Advice. You might be able to stop them from visiting you at home.

- Communicate with bailiffs at your home through an upstairs window. You should try to find a resolution to avoid further fees and growing debt.

Real escape routes out of debt!

If you have other debts you need help with, don’t hesitate to make the most of free debt advice from charities like National Debtline and StepChange.

Their advisers can provide you with 100% confidential advice and tailored support based on your real finances.

They might end up recommending one of many different debt solutions. Some solutions can even write off some of your debt. Find out more now by visiting my How to Get Out of Debt page.