Moorcroft Debt Recovery Settlement Figure – How Much To Offer?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve had a letter from Moorcroft Debt Recovery, you might be feeling worried. You might be asking, ‘How much should I offer to settle my debt?’

You’re not alone. Every month, over 12,000 people visit this site for advice on debt issues.

In this article, we’ll explain:

- What Moorcroft Debt Recovery is and what they do.

- How to make a fair offer to settle your debt.

- The steps to take if you can’t pay the full amount.

- Your rights when dealing with debt collectors.

- What to do if the debt isn’t yours.

We understand that dealing with debt collectors can be scary; some of our team have been in your shoes. Don’t worry; we’re here to help you understand your options.

Why would you offer a full and final settlement?

You may have been paying off a debt in small increments over a period of time. Then, your financial situation improves, say through an inheritance or job change where your earnings are higher.

The extra money you earn or inherit could be used to pay off the debt. Moreover, being debt-free is a liberating feeling.

What happens if the debt isn’t proven?

You won’t be liable if a debt collection agency can’t prove you owe the money. The proof must be in writing and it must include an authenticated copy of a credit or other agreement.

It’s not enough for Moorcroft to simply tell you over the phone or in person the debt is yours!

The proof must be authenticated by the original creditor or someone who is authorised to authenticate the document as a true copy of the original.

What if the debt collector proves the debt is yours?

There’s no getting out of paying if Moorcroft proves you owe the money. That said, you should seek advice before admitting, agreeing or offering a settlement figure to the debt collector.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is it a good idea to offer a partial settlement straight away?

Not always. For example, if you offer to pay a chunk of the debt off in one go straight away, a creditor or debt collector may think you have enough money to pay the full amount!

You should seek advice from a debt specialist before offering to pay a lump sum to your creditor or a debt recovery company.

Their advice could be invaluable when it comes to working out how much to offer and how much you can afford to pay in one go.

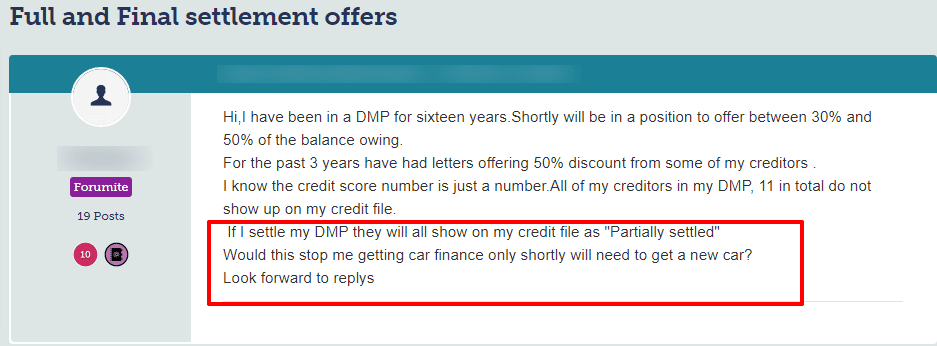

Take a look at the sort of question many people ask about partial settlements on a popular forum:

Source: Moneysavingexpert

Would a debt collection company accept less?

A debt collection agency or creditor could accept less than the amount you actually owe. The main reason would be to get the ‘debt’ settled as quickly as they can. It saves them time and money.

As such it’s often the better option because accepting the lower amount involves less time and effort than organising a payment plan.

These can take months for you to pay off and there’s always a risk of a default on an instalment.

That said, many debt recovery agencies purchase debts for a fraction of their true value. So, when they’re offered less than the full amount in a final settlement, they’re more likely to accept it!

This includes Moorcroft Debt Recovery, a company that’s known to purchase debts for far less than their true value and which makes massive profits when they do!

In short, the debt collector’s profit margin on a purchased debt is still huge when they take less from you in a final settlement!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How should you make a settlement offer?

You could make a debt settlement offer yourself without seeking advice. But it’s always wiser to speak to a debt adviser first. If you’re struggling with your finances, several charities provide free debt advice when you need it.

Their advice could be invaluable when you’re trying to work out how much you can afford to pay and what a creditor may accept!

For example, an expert could offer advice about making a ‘partial settlement’. You’d need to provide details of your earnings and outgoings to show what you can realistically afford to pay.

What is a fair debt settlement offer?

A fair debt settlement offer is typically around 75% of what the debt is valued at. So, if the debt stands at £10,000, you could offer to pay £7,500 to clear the debt in full.

However, a creditor should always take into account your circumstances and what you can realistically pay!

If you’re struggling with your finances and falling behind with bills, offering too much could make your financial situation worse!

Can creditors refuse an offer of payment?

Yes. Creditors or debt collection companies could refuse your debt settlement offer. More especially if they think the amount offered is too low.

If you find this happens, you should seek advice from a debt expert who will help you work out a higher amount that’s still affordable.

There’s a drawback, however, which is that having made one offer, and then a second higher one, could leave the creditor wondering whether you could pay in full.

What happens when the offer is accepted?

If the creditor or debt collection company accepts your settlement offer, it means you’ll be debt free. However, you must get the ‘acceptance’ in writing because it’s always wise to have proof the settlement figure was accepted.

Do not send any money to the creditor or debt collector until you have the acceptance in writing!

Don’t accept verbal acceptance over the phone.

Not all debt collectors are ethical and some may deny they accepted your offer further down the line. They may insist the full and final settlement offer was never agreed upon.

So, in short, the money you paid to the debt collector was taken as an instalment rather than to settle the debt.

Plus, the “settled debt” may be sold to another debt recovery company which could happen. They could chase you for payment and you’ll need the acceptance letter as proof the debt has been paid off!

When should you pay a settlement amount?

Make sure you pay the amount as soon as you receive written confirmation that a creditor or debt collector has accepted your settlement offer.

Payment must be made on the date you’re instructed to make it.

If you miss the date, the agreement could be null and void. The settlement amount may not be seen as a final settlement payment but simply an instalment!

Should you keep records of your settlement payment?

Yes. You should keep records of all your correspondence with a creditor or debt collector. This includes making a full and final payment to them.

As mentioned, some debt collection companies are unscrupulous and may deny they received the payment on the due date. Therefore, the amount you paid was an instalment and not a final settlement!

What happens when a settlement offer isn’t accepted?

There are things you can do if Moorcroft Debt Recovery doesn’t accept your settlement offer. First, you may want to make a second, higher offer. But you should seek advice from a debt expert before you do.

As previously mentioned, Moorcroft may think you might have enough money to pay the full debt when you increase the amount in a second offer!

In short, they may not believe you can’t pay the full amount.

It may be wiser to make a higher offer in the first place to avoid this from happening. Or you could continue to pay off the debt in instalments for a few months before offering a second settlement figure.

Moorcroft Debt Recovery may then accept the second offer but there is never a guarantee they will.

What happens when you settle a debt?

Once you settle a debt, the outstanding balance is set at zero. However, your credit file will show that the account was settled for less than what was owed.

In short, settling a debt doesn’t help improve your credit score whereas paying off the full debt would.

Settling a debt could reduce your ability to borrow money further down the line.

Does Settled Debt stay on your credit file?

Yes. A settled debt stays on your credit file for six years once it’s partially settled. So, creditors will see you only paid some of the debt and not the full amount for the whole six years it’s on your credit file.

» TAKE ACTION NOW: Fill out the short debt form

Can you just ignore Moorcroft Debt Recovery?

No. It’s never a wise move to ignore Moorcroft Debt Recovery. Even when you know they’re chasing the wrong person, or that the debt is statute-barred.

There are several reasons why binning a debt letter could have serious consequences which I’ve listed below:

- You may know the debt isn’t yours but that won’t prevent a debt collection agency from escalating a recovery process

- You could face court proceedings over a debt that’s not even yours

- A County Court Judgement (CCJ) could be registered on your credit file without you knowing it

- An attachment could be placed on your income or bank account

- Court-appointed enforcement officers (bailiffs) could be instructed to visit you at home which they can do three times

- You could lose some of your assets/possessions which an enforcement agent has the right to seize and sell at auction

It’s best to stay in touch with Moorcroft and ask them to prove the debt if it’s not statute barred than it is to ignore their debt letter.

Can you pay the original creditor instead of a debt collector?

Yes. It’s always better to deal with the original creditor rather than a debt collection agency if you can. Unfortunately, it’s not always an option with debt collectors like Moorcroft.

Original creditors are more likely to accept a reasonable repayment plan and could even stop charging interest on the debt.

The debt collection agency could be recovering an outstanding debt for any of their clients which includes:

The debt collection agency could be recovering an outstanding debt for any of their clients which includes:

- HMRC for tax debts

- Local authorities for unpaid council tax

- Npower

- United Utilities

- O2

- Virgin Media

- Private car park management companies

- Many other types of unsecured debts

So, if you have an outstanding debt with any of the above, chances are the original creditor has instructed Moorcroft Debt Recovery to recover the money owed!

You may be able to sort things out with the original creditor and it’s always worth trying because it does offer the advantages mentioned above!

But as mentioned, if Moorcroft Debt Recovery has purchased the debt, you’ll have no choice but to deal with them.

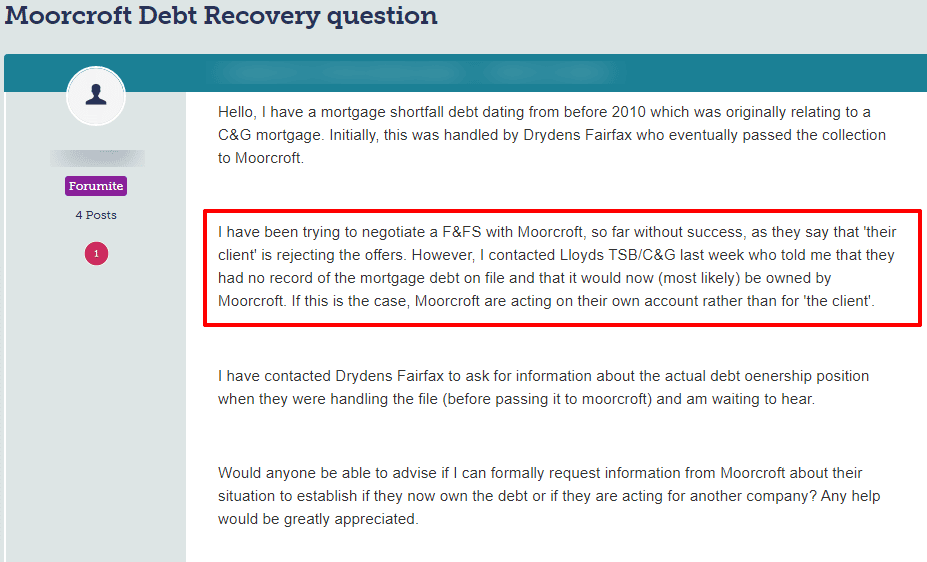

Take a look at what one person asked on a popular forum about Moorcroft Debt Recovery:

Source: Moneysavingexpert

The one thing you shouldn’t do is ignore a debt letter because things can quickly escalate out of control.

Can you stop Moorcroft Debt Recovery from contacting you?

No. Moorcroft Debt Recovery has the right to get in touch with you over an alleged debt. A debt collection agent can call you on the phone, text you, send you an email or visit you at home.

You can’t prevent them from doing any of the above!

However, you can dictate when and how a Moorcroft Debt Recovery agent contacts you. For example, you may prefer to be contacted in writing which is a good move. Like this, you always have a record of things!

Having written records of everything you discuss with a debt collection agency can be used if they take you to court!

Plus, it takes the pressure and stress out of the situation when you don’t have to speak to a debt collection agent over the phone!

But you must respond to their letters in a timely manner and always let Moorcroft know what you’re doing. For instance, if you’re seeking advice from a debt expert, let the debt collector know.

If you don’t keep them apprised of what you’re doing, they may escalate a recovery process!

How do you contact Moorcroft Debt Recovery

I’ve listed ways you can contact Moorcroft Debt Recovery in the table below:

| Website | https://www.mdrl.co.uk/ |

| Phone number | 0161 475 28890161 475 2827 |

| Email address | [email protected] |

| Address | Po Box 17, 2 Spring Gardens, Stockport, Cheshire, SK1 4AJ |

You can file a complaint directly to Moorcroft Debt Recovery using their Customer Helpline which is 0330 123 9765. The lines are open between 8 am – 6 pm Monday to Friday and 9 am – 2 pm on Saturdays.

Thanks for reading my post on how much to offer when considering a Moorcroft Debt Recovery settlement offer. I hope the information in the guide helps answer any questions you have about settling a debt and whether it’s worth it.