2 Legal IVA Loopholes in the UK – What Can You Do?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you trying to understand more about Individual Voluntary Arrangements (IVAs) in the UK? You’re in the right place. Every month, more than 12,000 people visit our site to learn more about debt matters, including IVAs.

In this article, we’ll explain:

- What an IVA is and how it works

- If you need to pay and how much

- Two legal ways to make your IVA easier

- How to end your IVA early or get it written off.

We know that dealing with debt can be hard and scary — you might be worried about not being able to pay or what will happen if you can’t. We have been there too.

Ready to learn about IVAs and how you can use them to help with your debt? Let’s get started!

What can you not do with an IVA?

While using an IVA you will live under several restrictions. You won’t be able to:

- Save significant amounts of money

- Because you can’t save, it’s hard to go on holidays or pay for luxury/non-essential items

- Take out further credit without permission

- Keep any financial windfalls as these might need to be paid into the IVA as per a windfall clause in the IVA agreement

IVA loopholes you need to know!

People are always looking for clever ways to beat the system, and there are some people who want to try and use an IVA to their advantage.

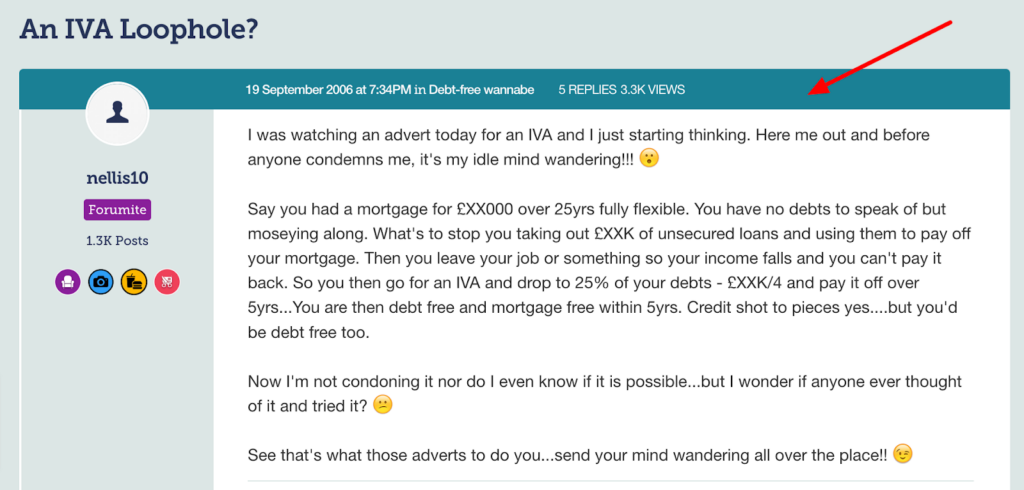

Have a read of this proposed IVA loophole from a respected forum:

Source: https://forums.moneysavingexpert.com/discussion/267301/an-iva-loophole

The above is quite clever but not something I would recommend. There are flaws in this plan and probable legal implications too.

But what about legal IVA loopholes for people who are already using an IVA? Well, I do have some of those to share – you’ve waited long enough if you’ve read up until this point.

IVA Loophole #1: Additional income threshold

The best IVA loophole is the additional income threshold. This is a legal threshold that allows you to earn a certain amount of money above your usual income.

The threshold is usually set at 10%. So, for example, if you earned £350 per week, you are allowed to earn another £35 in most cases and be allowed to keep this money. You can even keep some of the money you earn above this threshold, often 50%!

This money could then be saved and then used to pay for luxury items or even a holiday.

IVA Loophole #2: You can still get a loan

It’s completely legal for you to take out a loan worth up to £500 without having to ask permission from your insolvency practitioner. You only need permission if the amount you want to borrow is more than £500 unless otherwise stated in your IVA agreement.

This money can be used as you need, but you will need to repay. It may not be wise to use this IVA loophole as it could create further debts. Some creditors won’t approve you due to the IVA, so you may need to search for bad credit lenders instead.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How can I finish my IVA early?

The only way to finish your IVA early is to make a full and final settlement offer to all creditors. It will end your IVA and the IVA restrictions you’re currently living under. Any remaining debt will be wiped giving you a fresh start.

This will only be possible if you have come into money during the IVA as it won’t be possible to save a significant sum during the IVA itself.

You may have enough money to make a full and final settlement offer if you have a windfall from inheritance or a lottery win. However, a windfall clause within the IVA will mean you have to pay this into the IVA anyway, but it could still help you end the IVA early.

Alternatively, someone may offer to finance your full and final settlement offer.

Can I hide money from IVA?

No, you shouldn’t hide money during the IVA application process or once the IVA is set up. There can be serious consequences for hiding money during an IVA, and there is even the possibility of being sent to jail.

If your financial situation improves during the IVA you have an obligation to tell your insolvency practitioner managing your IVA. Your repayments may increase as a result. On the other hand, you can tell them if your income decreases, which may result in an IVA repayment decrease.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I get my IVA written off?

You can only end your IVA early and potentially have some of the debt written off by making a full and final settlement offer.

There are no other ways of ending the IVA and writing off the debt. If you default on your IVA, your creditors could then petition to make you bankrupt.

More of my debt help!

If you’re struggling with your IVA it’s best to discuss your situation directly with your IVA management company. But if you or someone you care about is struggling with other debts, I recommend giving my Get Out of Debt page a quick read!