How Much Do Debt Collectors Buy Debt for in the UK?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you curious about how debt collectors work in the UK? Wondering about how much they buy debt for?

You are not alone. Every month, over 12,000 people come to this site seeking advice on debt topics.

In this article, we aim to explain all you need to know about this process. We’ll explore:

- Why debt collectors buy debts and why people sell them

- How you can lower your repayments

- How to find out if your debt has been sold

- What happens when the debt is proven to be yours

- The rights you have when your debt is sold

We understand that dealing with debt can be tough and scary; many of us have been through it. We hope that by sharing our knowledge and experiences, we can help you manage your situation better.

Why do debt collection agencies buy debts?

Debt collecting is big business in the UK. Especially these days when more people are finding it difficult to make ends meet. It means that debt collection agencies make even more money from other people’s hardships than ever before!

Moreover, there’s more money to be made in ‘buying’ debts from creditors than just chasing you for a payment on their behalf!

For example, a debt collection agency could buy a third-party debt for a fraction of its actual value. So, a successful debt collection could bring in a huge profit for them!

» TAKE ACTION NOW: Fill out the short debt form

Debt collectors never buy debt for its true value because there’s no money in doing that! They can pay 10p for every pound when they purchase a debt depending on its value.

In short, creditors are good at lending but not so good at ‘chasing’ debtors! They prefer to take less money on a debt to resolve the problem rather than invest more time and money in taking you to court!

Debt collection agencies are experts in recovering money that’s owed and their tactics are often questionable!

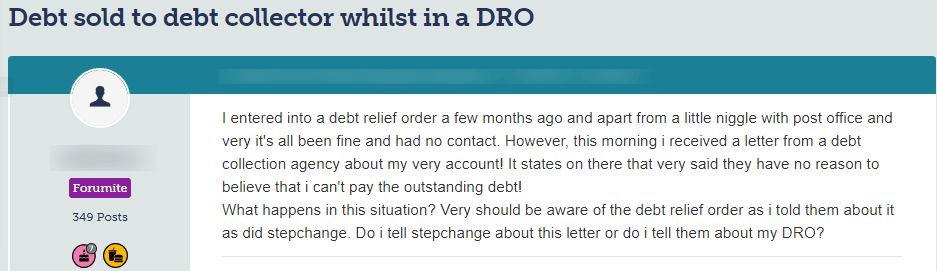

Check out what happened to one person below:

Source: Moneysavingexpert

How do you know if your debt is sold?

Chances are the company you owe money to will write telling you the debt is now owned by a collection agency. It’s a legal obligation for the original creditor to let you know they’ve sold the debt.

Following this, you’ll likely receive a letter from the debt collection agency telling you they own the debt! Their letter should provide the original creditor’s name and your account reference details.

If you feel the information regarding the debt is wrong, write back to the debt collector as soon as possible. Ask them to ‘prove’ the debt is yours in writing.

Don’t just accept the debt collector’s word for it!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do your rights change because a debt is sold?

No. You have the same rights whether it’s the original creditor or a debt collector who’s chasing you for payment. Debt collectors have no more power than the original creditor.

Moreover, debt collectors must abide by the law and are governed by the Financial Conduct Authority (FCA). In short, your rights remain ‘protected’ when a debt collector buys a debt from an original creditor.

» TAKE ACTION NOW: Fill out the short debt form

Do you have to pay the debt collector?

No. Not before they’ve provided written and authenticated proof that you owe the money! You shouldn’t admit, sign, or pay any money to the debt collector until you receive written proof!

So, the first thing to do is ask a debt collector to ‘prove’ the debt is yours when they first reach out to you!