How to Get My Water Debt Written Off? Quick Answer

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering how to get your water debt written off? This worry is shared by many. In fact, more than 12,000 people visit our site seeking advice on topics just like this one.

In this article, you’ll find out:

- If you really must pay your water bill

- What happens when you can’t pay your water bill

- How to lessen your repayments

- What a County Court Judgement (CCJ) is and what to do if you get one

- What is the Watersure Scheme and how it could help you

I know it’s tough to face debts, especially when it comes to basic needs like water. But take heart; there are ways to deal with it, and I’m here to guide you through them.

We’ll explore how to get your water debt written off, or at least partly written off. We’ll also look at how to reduce future water bills to help you stay on track. So, let’s get started!

Can I refuse to pay my water bill?

You can refuse to pay your water bill but this isn’t the best way to deal with water bills and water arrears.

By refusing to pay your water bill, you could end up being taken to court. I’ll be sharing some other ways to deal with water bills when you’re financially struggling to stay afloat.

What happens if you can’t pay your water bill?

Your water company will send you reminder notices when you don’t pay your water bill.

If you still don’t pay, the water company might pass on the account to a debt collection agency, which will then chase you for payment.

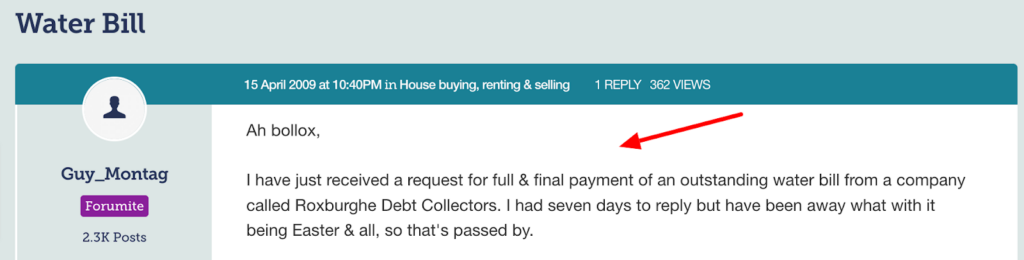

There are lots of debt collection companies they could use. For example, they might use Lowell Debt Collection. These companies are not bailiffs and cannot take your possessions. Here is one of many examples of this happening:

Source: https://forums.moneysavingexpert.com/discussion/1628495/water-bill

Benefit recipients may have some of their bills paid from their payments under a programme called Waterdirect.

Your water debt may also be increased with penalties, fees and interest.

» TAKE ACTION NOW: Fill out the short debt form

Can my water company turn my water off?

No, by law water companies cannot disconnect your water supply even if you haven’t paid your water bill.

Safe running water is considered a human right, so your water supply won’t be turned off when you don’t pay your water bill.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can a water debt be written off?

Yes, there are ways in which your water debt could be partially or fully written off.

How to get your water debt written off

You might be able to get all your water debt written off by:

- Asking the water company to write off the debt because of your financial situation

- Using the statute-barred loophole as discussed above

- Using a Debt Relief Order to stop all communication for one year and write off all your debt if your situation hasn’t improved

How to get your water debt partially written off

You might be able to get some of your water bill arrears written off by:

- Asking the water company to wipe some of the water debt due to your situation

- Using an Individual Voluntary Arrangement

- Applying for bankruptcy

Write off backdated water bills

You might have received a new water bill for a water supply that occurred many months or even years ago. This is more common if the water company didn’t realise significant changes had occurred at the property. For example, one property might have been split into two properties or more.

In these cases, Citizens Advice recommends trying to come to an agreement with the water company due to the unusual situation. They even say you can try to arrange a repayment plan and even ask to have some of the debt written off.

Although, water companies don’t have to agree to this!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How long can a water company chase you for debt?

Six years.

Water companies can only chase you for water bill arrears until the debt becomes statute barred under The Limitations Act and you’ve told the company you won’t be paying.

I know what you’re thinking. What does that mean?

The law states that some debts can only be enforced in court for so many years. After this time, the court won’t entertain any claims for the debt and the debtor can never be legally made to pay. Instead, the debtor can then tell the company they won’t be paying and the matter ends.

Water bills in England and Wales become statute-barred after six years, provided that:

- The debt hasn’t already been subject to a CCJ

- The debt hasn’t been acknowledged in writing in the last six years

- The debtor hasn’t made any contribution towards the debt in the last six years

If a debtor acknowledges or contributes to the debt, the six-year time limit restarts. In Scotland the situation is even better, The time limit is five years and the debt automatically no longer exists afterwards.

What is the Watersure Scheme?

The Watersure Scheme is a scheme that helps people with their water bills by capping how much they have to pay and allowing them to pay less if they use less water than the capped billing amount.

It’s available to people who receive some state benefits but need to use a lot of water because of a medical condition or due to young children living at the property.

The Watersure Scheme is a great way to reduce water bills for some people, but there are other ways as well…

What to do if you can’t pay your water bill on time

If you won’t be able to pay your water bill in full or on time you should let the water company know as early as possible. Most water suppliers are able to help people through difficult periods and avoid the use of debt collection agencies and court action.

Keeping communication open and honest can really work in your favour. The company may reduce your payments and allow you to pay them back in the future over many months.

You can get a good idea about how your water company will handle this situation by reading their code of practice, which is usually available through their website.

You might also be able to get help by using the WaterSure Scheme.

What happens if you ignore the debt collection agency?

If you ignore the debt collection agency and refuse to pay your water bill arrears, the water company might make a County Court claim for the debt.

They will ask the court to issue you with a court order to make you legally obligated to pay.

What happens if you ignore a CCJ?

If you don’t pay a CCJ as instructed, the water company can ask the court for permission to enforce the debt. They could ask to:

- Use bailiffs to collect payment or take your valuables, which will then be sold to raise money to clear the debt.

- Have money taken from your wages, state benefits or state pension.

- Have a Charging Order placed on a property you own, which would prevent you from selling the property without first repaying the debt.

How to reduce your water bills

You don’t get to choose your water supplier as they’re the supplier for the area you live in. But some water companies do have different tariffs that they can put you on based on your individual circumstances, and not enough people know about them.

You can call your water supplier and ask if they have any cheaper water tariffs for people on benefits or in your situation. This alone could save you a lot of money each year, if available.

The only other way to reduce your water bill is to reduce your water consumption. Most water companies provide help to do this, but they mainly cover things like:

- Spend less time in the shower.

- Fill the sink rather than letting the water run

- Add a smart metre to help you monitor water consumption

My free debt help page!

My debt help page is free for you to read and help you deal with your (water) debts. But I also recommend you get personalised debt advice, which is also available for free from debt charities like StepChange and National Debtline.