What Banks Accept IVA Customers? Updated List

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you looking for banks that accept IVA customers? You’re in the right place. Each month, over 12,000 people visit our site for advice on debt topics.

We understand that you might be feeling stressed about paying a debt or concerned about the results of unpaid debt. But don’t worry; we’re here to help.

In this article, we’ll cover these main points:

- A quick recap on what an IVA is

- The need for a new bank account with an IVA

- The best banks that accept IVA customers

- Accessing your bank money after the IVA is approved

- Tips on how to lower your repayments

We know the worries that can come with debt and IVAs because we have experienced them too. We are here to help you find the best way forward.

Let’s dive in!

Why do I need a new bank account with an IVA?

You will be recommended to close existing accounts and open a new bank account prior to your IVA being approved.

This is usually the case if you owe money to the bank you currently hold an account with, including but not limited to the following debts:

- Unauthorised overdraft debt

- Unauthorised overdraft fees

- Fees relating to missed direct debit payments

- Credit arrears with the same bank, such as an unsecured loan or credit card debt

If you owe money to a bank that also holds your money and receives your income, it’s illegally allowed to take money from your bank accounts to clear debts. But in doing so, it could cause you to struggle to repay debts elsewhere or manage essential living costs.

In a nutshell, it gives the bank an edge to get its money back before any of your other creditors. This goes against the ethos of using an IVA where all creditors are treated equally and gets money proportional to the debt you owe them.

By changing banks to “neutral territory” you can help your cause to get an IVA approved as no creditor has an unfair advantage over your money before the IVA voting rounds.

If you don’t change banks in preparation for the IVA, your bank might vote against the IVA because it can recover money from you much easier than other creditors, which could result in the IVA proposal failing.

The practice of taking money from your current account to pay other debts you have with the same bank might seem unfair. But this process, which is called “setting off” is entirely legal as per the Financial Conduct Authority’s rules.

And if the IVA is rejected anyway, changing banks still stops your current bank from setting off to collect the debt.

Do you have to get a new bank account with an IVA?

Your Insolvency Practitioner could recommend that you close your existing accounts and open a new one before your IVA is approved.

There is a good reason why this would be in your best interest…

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Another reason to switch banks

Another reason to change to a neutral bank where you have no debt is to avoid your account being frozen or closed by your current bank.

This could happen before your IVA gets approved if the bank decides it’s the only solution, and it could even happen after an IVA is approved if you do stay with the same bank.

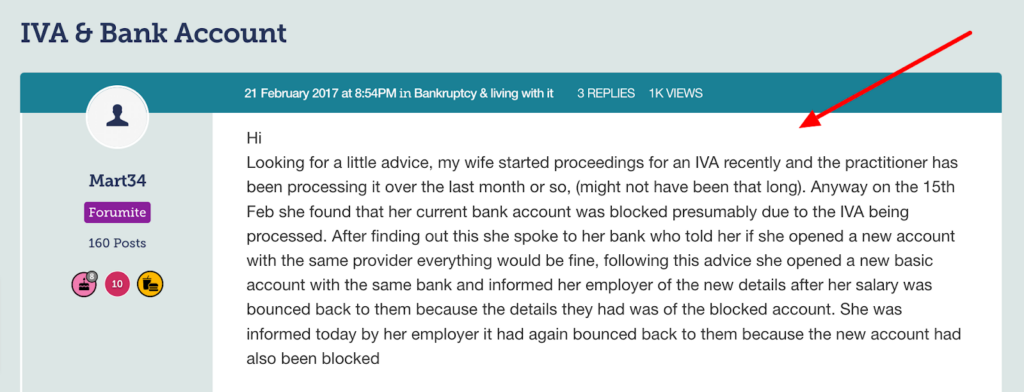

Here s a typical story:

Source: https://forums.moneysavingexpert.com/discussion/5606889/iva-bank-account

Having your account frozen after an IVA is approved can be very troublesome. You will need a bank account to make payments into your IVA on time. And it can be time-consuming to open a new bank, especially with an existing IVA.

Could your IP get your bank account unfrozen?

It’s certainly possible to get an IP to convince a bank to unfreeze or re-open a closed account.

But the process for this can take days, if not many weeks, which is time you probably don’t have if you need to keep up with IVA payments.

Missing IVA payments can have serious consequences. IVAs are legally-binding agreements that must be kept to. If you don’t keep to the payments, creditors can take legal action and even make you bankrupt in some instances.

So it could just be better to get a new bank account quickly and avoid this potential situation.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Getting a new bank account before an IVA

There is one issue when you want to open a new bank account. The bank will complete a credit check even when you’re just opening a current account – not just when you’re applying for credit.

It’s better to do this before the IVA has started because the IVA won’t yet be recorded on your credit file yet. However, people considering an IVA usually have multiple arrears due to missed repayments, which will already have been recorded on your credit file.

These records on your file might mean you’re rejected for the account you prefer. But there is always the option of a basic bank account.

Can I access my bank money after the IVA is approved?

You will have access to your bank account money once the IVA has been approved, provided that your current bank account hasn’t been frozen.

You will need the money in your account to manage essential living expenses and the IVA repayments each month.

However, if you had any savings, this money may need to be paid to creditors as a lump sum as part of the IVA proposal. Thus, the money you have will be enough to cover the essentials and repayments, as per your specific spending restrictions set down by the IP.

As mentioned above, you can avoid potential issues with your bank account after the IVA has been approved by moving to a bank where you don’t owe them any money beforehand.

What bank can I open with an IVA?

There are no legal requirements for you to have a certain type of bank account with an IVA. But some bank accounts may not be available to you due to your credit score and credit history.

You might get approved for a standard bank account, but your most likely option is going to be a basic bank account aimed at people with poor credit.

Can you have a savings account with an IVA?

The only thing stopping you from opening a saving account with an IVA is the bank’s credit check. But many people have managed to open some type of savings account while using an IVA, and they use this account to help them budget for IVA repayments.

What banks accept IVA customers?

I can’t say for certain which banks accept IVA customers seeking a regular current account. Each bank and building society applies its own lending criteria in regard to credit scores and IVAs.

But all banks offering a basic bank account will accept IVA customers as long as they haven’t been convicted of fraud.

Some of your many options include:

- Barclays

- NatWest

- Ulster Bank (Northern Ireland)

- Santander

- Royal Bank of Scotland

- Nationwide

- HSBC

- Co-operative Bank

- TSB

- Lloyds Banki

- Halifax

- Bank of Scotland

- Metrobank

Does your IP check your bank account?

Your IVA provider won’t actively check your bank account. But there are ways for them to find out if you’ve been concealing income which should have been disclosed so you make larger IVA payments.

Need more debt support?

For further help with debt solutions and choosing the right one, it’s best to speak with a debt charity that can provide free advice based on your exact situation. For general information and support, my How to Beat Debt guide is worth reading!