Latest Ways to Check Debt Against a Property

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you trying to find out about debts against your property? You’re in the right place. Each month, over 12,000 people visit our site to understand debt topics just like this one.

In this article, we’ll cover:

- How to find out what debts you owe

- If you must pay these debts

- Ways to check your debts for free

- Different types of debts against your property

- How a Charging Order works

We understand that you might be worried about not being able to pay a debt. You might also be scared of what could happen if you don’t pay, such as dealing with bailiffs or debt collectors. We’ve been there, and we’re here to help.

With this article, you’ll find out how to check debts against your property and how to sort out any issues. Let’s get started!

How can I find out what debts I owe?

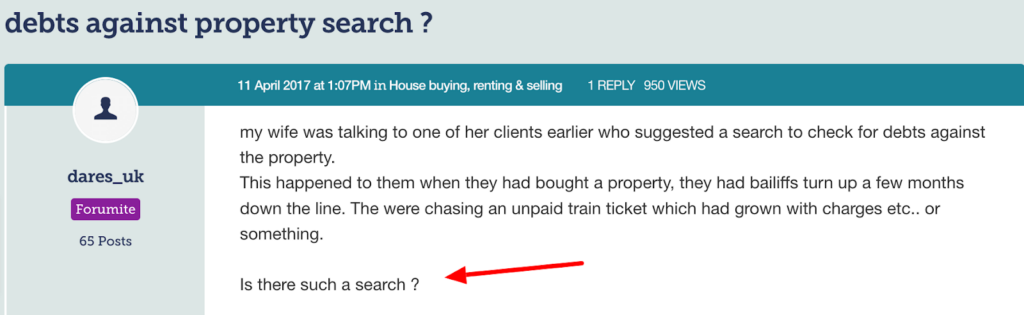

If you want to know how to search for any debt against your property, you’re certainly not the only one:

Source: https://forums.moneysavingexpert.com/discussion/5632404/debts-against-property-search

Searching your credit report is one of the best and easiest ways to find out what debts you owe and any arrears you may have.

Creditors and companies you pay bills to will report to credit reference agencies when you take out credit or miss payments. So you should be able to find information on all debts owed just by searching your credit file online.

However, checking your credit file won’t show any Charging Order that have been placed on your property. I’ll be coming back to this later.

How can I check my debts for free?

You can check what debts you owe for free by getting a free credit report from any of the three credit reference agencies, namely Equifax, Experian and TransUnion.

Sometimes credit reference agencies are known for providing initial free services, but you may have signed up for a subscription that costs you money later. Always check to see if you need to cancel any subscription after getting your first free credit report. This won’t always be the case.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How do I find out if I have debt against my property?

You can check all debts that have been secured against a property via the Land Registry.

You can contact the Land Registry using either of these options:

| Telephone | 0844 892 111 |

| Email address | [email protected] |

How long does a Charging Order stay on a property?

There is no time limit. It will remain in place until the debt has been repaid, either directly or as part of the process of a property sale.

When you pay off the debt in full, you then need to contact the Land Registry to ask for the Charging Order to be removed.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I see Charging Orders on my credit report?

No, a Charging Order that is placed on a property you own won’t show up on your credit report.

Your credit report will show the County Court Judgment and the defaults that led to the CCJ in the first place. These will seriously damage your credit score. But Charging Orders won’t show up.

Can creditors apply for a Charging Order without a CCJ?

No, they must have taken you to court first and you must have been issued a CCJ. Even then you might be able to get the CCJ set aside to stop further action.

What types of debts can you have against your property?

Before I start answering this question, I need to clear something up.

Sometimes people think that their property has a debt, but that’s never the case. It’s people who have debt, and that debt is sometimes secured by property. The most common example is a mortgage.

When you buy a property with a mortgage, you take out the loan as an individual or couple. The loan amount is secured by the property, so if you don’t pay the property can be forcibly sold to pay off the debt.

Another common example of debts against a property is second-charge mortgages, also known as home equity loans. These are loans that are secured by the property based on available equity, which is often used for home renovations etc.

Another example – albeit less common – of a debt against your property is when a creditor places a Charging Order on the property. This requires some further explanation…

» TAKE ACTION NOW: Fill out the short debt form

Are debts written off after 6 years?

Some types of debt get written off after six years in Scotland. Others do not.

In England and Wales, many types of debt become statute-barred after six years when no payment has been made within those six years. As long as you also haven’t admitted owing the debt in writing during that time.

When a debt is statute-barred, the creditor isn’t able to take any legal action. In other words. Their chance to take you to court has passed.

Therefore, you can never be forced to legally pay. This isn’t exactly the same as the debt being wiped because it still exists; you just don’t have to pay!