How Much Does 6 Points Increase Car Insurance Costs?

Having 6 penalty points on your licence can feel worrying, especially when thinking about car insurance costs.

You’re not alone. Every month, over 1,000 people visit our blog for advice on car insurance with a driving conviction.

In this article, you’ll learn:

- What penalty points are and how they can affect your licence.

- How penalty points can change your car insurance cost.

- How to find cheaper car insurance, even with a conviction.

- What happens if you get 6 points on your licence.

- The steps you need to take if you get 6 penalty points.

We understand your worries about finding affordable car insurance after a conviction. You might feel it’s hard to get insured with 6 points, or you’re worried your insurance will cancel. But we’re here to show you it’s not impossible.

How Do Penalty Points Affect My Licence?

When you have penalty points on your licence, you are in danger of getting a statutory ban if you accrued 12 or more points. The number of penalty points you have is printed on your driving licence. In most cases, when you are convicted of a driving offence, you will need to send your driving licence back to the Driver and Vehicle Licencing Authority (DVLA) for it to be updated.

The number of points you are given relates directly to the seriousness of the offence you were convicted of. Some offences, such as minor speed limit infractions only carry three points. Other, more serious driving offences such as careless driving causing a death, or being found to be driving on a provisional licence with no supervision, can carry up to eleven points.

What Happens if I Get 6 Points on My Licence?

How many penalty points you have, will directly impact your ability to get cheap car insurance. If you have from three points up to six points, you won’t be seen as high of a risk as a driver who has recently come back from a driving ban, for example. As a driving ban would indicate the driver is a much higher risk to insure.

Will points ruin my insurance?

| Points | Insurance increase |

|---|---|

| 3 Points | 5% |

| 6 Points | 25%+ |

| 10-12 Points | 80%+ |

The best way to find better deals is to use companies who specialise in insuring drivers with convictions and points.

To see if you can improve you insurance with a free quote, click the button below.

In partnership with Quotezone.

Will My Car Insurance Go Up if I Have 6 Points?

Unfortunately, if you have 6 points on your driving licence, for offences such as driving over the speed limit, for example, the cost of your car cover will go up. All motoring convictions, even if they give the minimum 3 points, will result in higher insurance premiums.

How Much Does 6 Penalty Points Add to Insurance?

Finding cheap car insurance with 6 points isn’t going to be easy. In general, you can expect the cost of your vehicle cover to go up by at least 100%. And this increase will remain for up to 5 years.

Find better convicted driver insurance deals for you

Quotezone helps thousands of drivers get insurance that suits their needs every year.

Reviews shown are for Quotezone. Search powered by Quotezone.

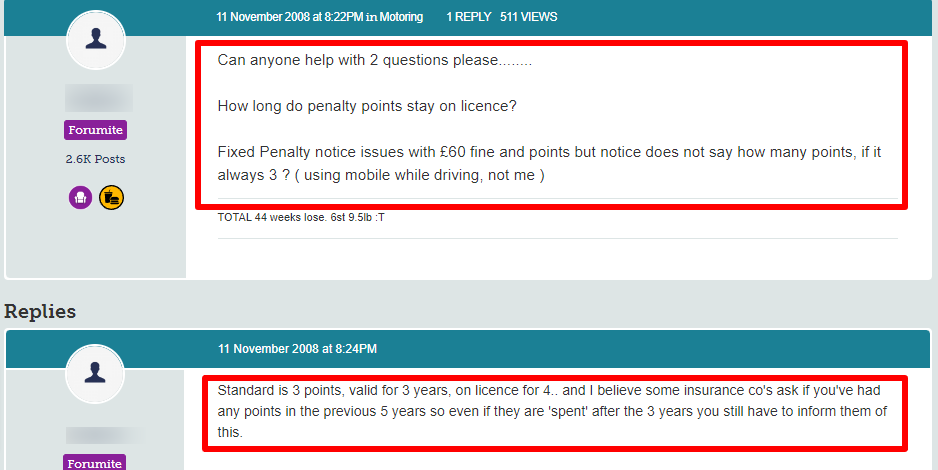

How Long Does 6 Points Stay on Your Licence?

This depends entirely on the offence that the points given. Some offences are deemed spent after 4 years, others are deemed spent after 11 years. Check your driving licence to find out.

Can You Still Drive With 6 Points?

Yes, as I mentioned in a previous section, as long as your licence has not been revoked, you can still drive. However, I have to add a caveat here. You need to let your insurance company know about the additional points, to find out if your insurance will be able to pay an increased cost to keep your insurance active.

Is It Hard To Get Insured With 6 Points?

If you are convicted of a driving offence, such as getting a speeding ticket for travelling over the speed limit, and this results in the points you have totalling up to 6, then you can expect to find it more difficult to find cheap insurance premiums. But a traditional insurer will likely still cover you, and you won’t have to go to a subprime insurer.

What About When My Penalty Points Expire?

If your points expire, you can return your licence to the DVLA to have it updated. Next time you renew your insurance, you won’t need to tell your insurer about these spent points.

How Do I Check My Penalty Points?

This information is printed on your licence. If you did not send your licence back to the DVLA for it to be updated when you were convicted, you may need to do so to check accurately.

Can Learner Drivers Get Penalty Points?

Yes, learner drivers can get penalty points in the same way that qualified drivers can. These penalty points would remain, even when the learner has passed their driving test in the future.