Intrum Debt Collection Chasing Old Debt? What Are Your Rights?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about Intrum Debt Collection chasing an old debt? You may have many questions and fears. Do you need to pay? What are your rights? Is the debt too old to enforce?

We understand these worries, and we’re here to help. Each month, over 12,000 people visit our site for guidance on debt topics just like this, so you’re not alone.

In this easy-to-understand article, we’ll share answers to your questions:

- Who is Intrum, and what do they do?

- How to respond if Intrum contacts you.

- What happens if you ignore a debt collection company.

- Is the debt too old to enforce?

- How to make a fair settlement offer.

We know how it feels to be chased for an old debt; some of us have been in your shoes But don’t worry; we’re here to help you understand your options.

Why would Intrum contact you about an old debt?

Intrum will contact you when they are working on behalf of another creditor, or because they purchased a debt with your name on it.

So, if you owed money, to say, eBay and failed to pay, you could get a call or letter from Intrum debt collectors. They collect older purchased debts!

When a debt collection company buys debts, they pay a fraction of the price. It means that Intrum stands to make a massive profit when they recover an outstanding debt successfully.

Should you ignore a debt collection company?

No. It’s never wise to the bin and ignore a debt collection company when they contact you. It won’t make the problem go away and an Intrum debt collection agent could be persistent.

In short, you’d likely receive lots of threatening phone calls, texts, emails and letters!

A debt collection agent could show up at your home to discuss things with you! But they must let you know they’re coming beforehand.

Even when you are certain the debt isn’t yours, it’s still best to respond to Intrum when they get in touch. You should tell them they’re chasing the wrong person but do so in writing.

Also, send the letter to their head office by registered post and don’t sign the letter either!

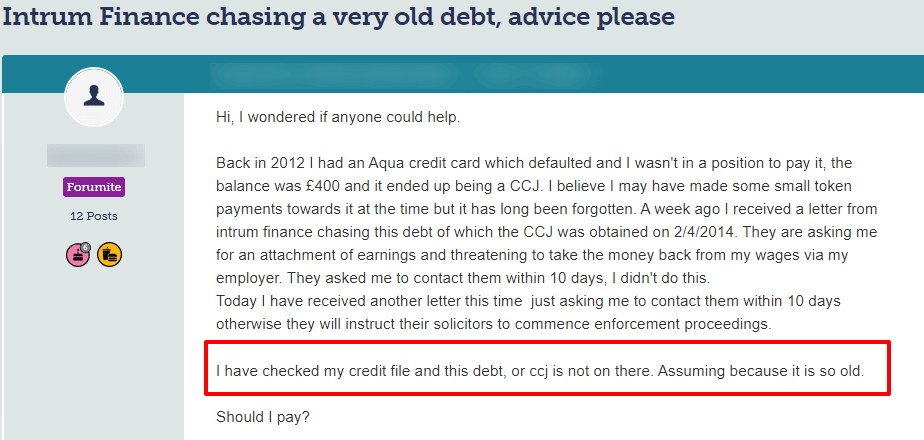

Check out what happened to one person

Source: Moneysavingexpert

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens when you ignore Intrum?

Things get complicated and a lot more stressful when you ignore letters from debt collection companies.

You’ll receive letters threatening legal action. There’ll be lots of phone calls, and texts demanding payment for money owed.

You may also not be made aware of vital information which includes:

- Discovering the debt is too old to enforce through the courts because its statute barred but Intrum is still chasing you for payment

- Finding out Intrum has contacted the wrong person because the outstanding debt has nothing to do with you

Will Intrum take you to court?

You could face legal action whether Intrum purchased the debt or they’re acting on behalf of a client. Debt collection companies always threaten to take you to court.

But often it’s a scare tactic to get you to pay!

However, a debt collection agency may not start legal action to recover an outstanding debt that’s too old to enforce.

Before Intrum can start legal proceedings, they must send you a Letter Before Action (LBA). It’s a notification of intended court action if you ignore or refuse to settle an outstanding debt.

You shouldn’t ignore a Letter Before Action because things could escalate and you may get a County Court Judgement recorded on your credit file.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How should you respond to Intrum?

You should respond in writing to Intrum when they contact you. Even when the debt is too old to enforce or it’s not yours.

Send a letter by registered mail telling Intrum they’ve contacted the wrong person.

Or you can tell them the debt is statute-barred and therefore, they should stop harassing you!

Harassing behaviour on the part of a debt collection company is unlawful and you can report them if it happens to you.

Make sure you don’t sign the letter. Instead, print your name at the end of it.

Should you seek independent debt advice?

Yes. It’s always a good idea to seek independent advice when a debt collector contacts you.

Intrum must allow you enough time to discuss things with either a charity or an independent debt adviser. But let the debt collector know which prevents them from taking the matter further.

You have the right to find the best debt management plan available and an adviser can help you do this. But, as mentioned if the debt is statute-barred, it can’t be enforced through the courts!

Is the Intrum debt too old to enforce?

You may find the debt you’re being chased for is statute-barred. You may not have to pay if it’s six years old!

Intrum can’t pursue you through the courts when a debt is six years old and you can’t receive a County Court Judgement either.

What can Intrum Ltd do?

As a member of the Credit Services Association (CSA), Intrum must abide by its Code of Conduct when they collect debts.

They must also follow the law which includes abiding by privacy laws and their rights.

Also, The Office for Fair Trading and the Financial Conduct Authority set out rules that all debt collectors must follow.

Intrum can legally do the following when they contact you about an alleged outstanding debt:

- Call you on the phone, text you, send you emails and letters. A debt collection agent can visit you at home if all other methods fail but must warn you beforehand

- Talk to you politely and discreetly about an alleged debt

- Ask you to pay the outstanding debt to them directly rather than to the original lender/creditor

Can you offer a part payment to Intrum?

Yes. If the debt is proven to be yours, you could offer a partial payment to settle the debt.

However, you should discuss things with an independent adviser beforehand. But let Intrum know so they don’t escalate the matter and it stops them from sending more threatening letters!

Could Intrum reject a debt settlement offer?

Yes. Debt collection companies aren’t obliged to accept debt settlement offers.

They could reject your offer for several reasons which I’ve listed below:

- The offer is too low and the original creditor rejected it

- Intrum purchased the debt and is looking for a higher settlement

» TAKE ACTION NOW: Fill out the short debt form

Can you file a complaint against Intrum Limited?

You have the right to file a complaint against Intrum if you feel the debt collector harassed you, or acted unlawfully or inappropriately.

First, file your complaint with Intrum. If you’re not happy with the way the debt collector deals with your complaint, you can then contact the Financial Ombudsman Service.

How do you contact Intrum?

I’ve listed ways to contact Intrum in the table below:

| Company Name: | Intrum |

| Other Names: | Intrum Holdings Ltd |

| Address: | Intrum UK Limited, The Omnibus Building, Lesbourne Road Reigate, Surrey, RH2 7JP |

| Phone: | 01737 237 370 Monday to Friday – 08:00am to 20:00pm Saturday – 09:00am to 13:30pm |

| Email: | [email protected] |

| Website: | https://www.intrum.co.uk/ |