Should I Pay Lowell Portfolio 1 Ltd Debt Collectors?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Having to deal with Lowell Portfolio 1 Ltd Debt Collectors can be a bit scary. You might be feeling lost and unsure of what to do.

But you’re not alone. Each month, over 12,000 people visit this site looking for guidance on debt matters.

In this article, we’re going to talk about:

- Who Lowell Portfolio and Lowell Financial Ltd are

- How to handle debt collectors and lower repayments

- Your rights when dealing with a debt collection agency

- What happens if you don’t pay your debt

- Steps to take if you think a debt is too old or not yours

It’s tough when you owe money, and it’s even harder when you’re dealing with debt collectors. I understand because I’ve been there, too. This is why I’m here to help you navigate through this.

Ready to learn more about how to handle Lowell Portfolio 1 Ltd Debt Collectors? Let’s get started!

Why would Lowell contact you?

You may have forgotten about owing money to a credit card provider or other creditors. Maybe, you thought the matter was resolved? It could be a debt on an unsecured loan you took out and forgot about.

That said, Lowell will contact you if they believe you owe money on an outstanding debt that’s gone unpaid. Moreover, having purchased the debt, they have the right to contact you as it’s become a Lowell debt and not something you owe to another company!

Should you ask Lowell Financial to prove the debt?

Yes. Absolutely. Even when you know you may owe the money! Ask Lowell Financial to prove the debt is yours. Not only does it gain you a little time, but it also means the debt recovery company may not be able to prove you owe the money!

So, after checking if the debt is too old to enforce, next write a letter to Lowell Financial asking them to prove it’s yours!

You have every right to make the request and Lowell Financial must respect your wishes. It may take a while for them to get back to you or a letter proving the debt could arrive by return post!

All copies of a Credit Agreement or other contract you signed must be authenticated by the original creditor or someone authorised to do so on their behalf!

It’s not up to you to prove you don’t owe the money, although it could help if you can. It’s up to Lowell to provide solid evidence in the form of a Credit Agreement or other type of contract!

You shouldn’t just accept Lowell’s word for it!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What if Lowell Financial proves the debt?

If Lowell Financial proves you owe money to them, you’d have to pay. Whether it’s the full amount or instalments over time. However, you should seek advice from a debt expert first!

As mentioned, Lowell Financial must allow you enough time to seek advice and to establish what options are available. However, don’t wait too long and always let a debt collection agency know what you’re doing!

What if Lowell can’t prove the debt?

When a debt collection agency can’t prove you owe money, they can’t make you pay. A court won’t issue a County Court Judgement against you either!

If the case did go to court and Lowell Financial fails to provide hard evidence you owe the money, a judge could find it hard to rule in their favour.

» TAKE ACTION NOW: Fill out the short debt form

In short, you could be let off paying when Lowell Financial can’t prove you owe the money. So, you should write back to the debt collection agency telling them to stop contacting you! If they continue to harass you with correspondence, you have the right to report them to the Financial Ombudsman Service (FOS).

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Should you ignore a debt collector?

No. You shouldn’t bin a debt letter from Lowell even when you know you paid off the debt, or the debt is too old to enforce. Moreover, the debt may not be yours in the first place.

So, ignoring Lowell when they contact you would mean you never find these things out! In short, you would miss out on establishing the following important information:

- The debt is at least six years old and therefore it could be too old to enforce

- The debt was resolved with the original creditor – mistakes happen!

- The debt is not even yours

What if you don’t pay Lowell Financial?

When you don’t pay Lowell Financial it could result in the following:

- Lowell Financial taking legal action against you and winning the court case

- A court order is issued for you to pay which means your credit rating is harmed by a County Court Judgement (CCJ)

- Court enforcement officers (bailiffs) knocking on your door and seizing possessions

- An attachment placed on your bank account or earnings

The only way to avoid this from happening is to remain in touch with Lowell even when you know you don’t owe the money!

In short, make Lowell Financial do the work of proving the debt. Also, debt collection agencies must allow you enough time to seek independent advice. You must be allowed to find out what sort of debt solution could be available to you!

Will Lowell Group use enforcement officers (bailiffs)?

If Lowell Portfolio wins a case against you, bailiffs could be instructed to recover the money owed. That said, there must be a court order for you to pay for bailiffs to get involved.

Enforcement officers have the power to seize possessions to the value of the money you owe. So, in short, it’s wiser to stay in touch with Lowell and work with them to prevent things from escalating to this stage.

Can you prevent debt collectors from contacting you?

No. It’s not possible to prevent a debt collector from contacting you. However, you have the right to tell them when and how to contact you.

So, you can write to Lowell Financial Ltd asking them to contact you in writing and to stop phoning or emailing you. Debt collectors must respect this request!

Moreover, send the letter by registered mail so you have a record of your request.

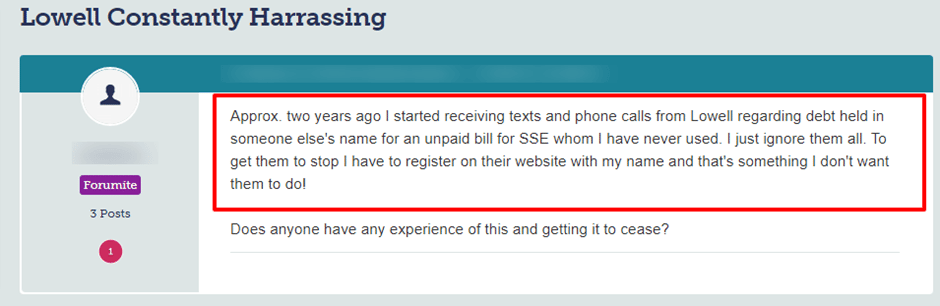

Take a look at what one unfortunate person had to put up with when contacted by Lowell Financial Ltd:

Source: Moneysavingexpert

How do you contact Lowell Financial Ltd?

I’ve listed ways to contact Lowell Financial in the table below:

| Website | www.lowell.co.uk |

| Phone number | 0333 556 5552 |

| Post | Lowell Financial, PO Box 13079, Harlow, CM20 9TE |

| Office Address | Ellington House 9 Savannah Way, Leeds Valley Park West, Leeds LS10 1AB |

| Opening hours | 8am-8pm Monday to Friday, and 8am-2pm on Saturday |

Make sure you keep records of who you speak to at Lowell and note down the time and date of each call you make. It’s always a good idea to have these records in case you’re taken to court.