Who is Newlands House, Caxton Way, Eastfield Scarborough?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with debt can feel scary. Maybe you’ve received a letter from Newlands House, Caxton Way, Eastfield Scarborough, and you’re not sure what to do next.

Don’t worry; this happens more often than you might think. In fact, every month, 12,000 people visit this site to learn about how to handle debt issues.

In this easy-to-understand guide, we’ll explore:

- Who Newlands House, Caxton Way, Eastfield Scarborough is.

- The reason behind getting a letter from Henriksen Limited.

- Ways to manage your repayments and make them smaller.

- How to know if a debt is too old to be enforced.

- Available free advice about dealing with debt.

We truly understand the worry of dealing with the money you owe; some of us have been in the same boat.

So, we’re here to help you understand how to manage the situation if you’ve received a letter from Newlands House, Caxton Way, Eastfield Scarborough. Let’s dive in!

Who sends Newlands House letters out?

Henriksen Limited sends out mail using this address. They are a debt recovery company based in the UK that works internationally too.

The debt collection agency is a bit sneaky because they just use their address on their mails, not the company name. Hence, the confusion and question, ‘who’s it from’?

Who uses Henriksen Ltd debt collectors?

Henriksen has a plethora of clients which include:

- Local authorities

- Utility providers

- Telecom companies

- Credit card providers

- Loan providers

- Smaller businesses such as dentists and vets

It’s likely your details were forwarded to Henriksen over an unpaid debt when you get mail from Newlands House.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should you ignore a Henricksen Limited Debt Letter?

No. It’s always a mistake to ignore a debt recovery agency whether they write, phone, text, or email you..

First, you may not find out important info about the debt. This includes:

- Discovering Henriksen is chasing the wrong person because the debt isn’t yours

- Finding out the debt is no longer enforceable because it’s statute barred and therefore, passed its limitation period

- Being offered a repayment plan you can afford

- Having some of the debt wiped off makes it easier to settle

Other things that could happen when you ignore a Henriksen debt include:

- Facing legal proceedings if the original credit wants to take you to court

- Getting a County Court Judgement on your credit file without knowing it

- Having enforcement officers (bailiffs) visit you at home and seizing possessions to cover what’s owed

- Getting an attachment on your bank account or weekly income

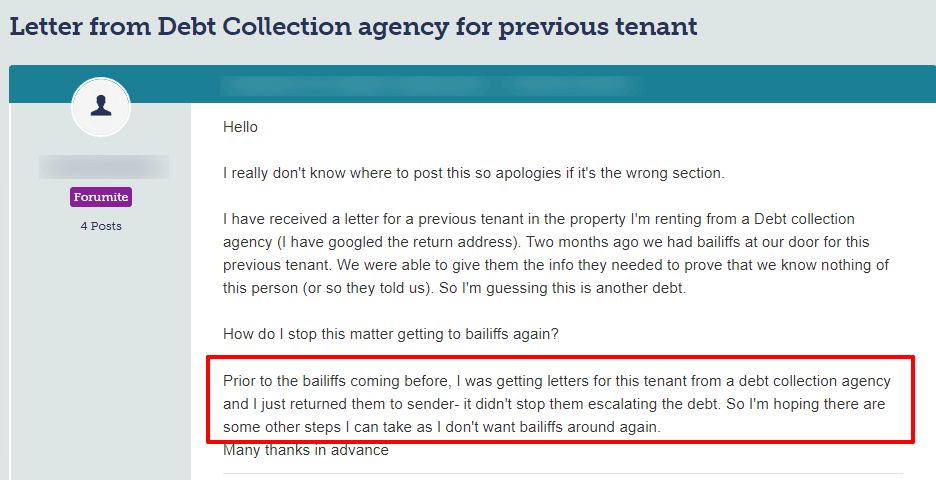

Check out what happened to one unfortunate person:

Source: Moneysavingexpert

Is the debt too old to enforce?

The first thing to check when you get a letter from Henriksen is whether the details are correct. Then check if the debt is statute-barred.

A court won’t take on a case over a statute-barred debt. So you won’t get a County Court Judgement either!

When is a debt too old to enforce?

Debts are too old to enforce when they’re at least six years old. However, the debt must meet specific criteria for it to be statute barred as explained below:

- There isn’t a CCJ against the debt

- You or a representative never admitted owing the money in the last six years

- You or a representative didn’t pay anything towards settling the debt in the last six years

You should write to Henriksen telling them the debt is too old to enforce. Make sure you send it via registered mail.

The debt recovery company should stop contacting you. But if they continue to chase you, file a complaint with their head office. After this complaint to:

- The Office for Fair Trading

- The Financial Ombudsman Service

Is the debt yours?

Once you determine the debt isn’t statute barred, the next step is to ask Henriksen to prove the debt is yours!

Send the debt collector a ‘prove the debt’ letter which they must respond to. It’s not your obligation to prove you don’t owe the money!

It’s up to Henriksen to prove it!

Don’t just accept a verbal confirmation over the phone. Debt collectors must provide you with solid proof. For example, an authenticated copy of a Credit Agreement you signed!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What happens when a debt can’t be proven?

You can’t be held liable if Henriksen can’t prove the debt is yours to pay. As such, the debt collector should stop chasing you. If they don’t, report them to the Office for Fair Trading and the Financial Ombudsman.

However, make sure you file a complaint with Henriksen Limited first!

What if the debt is proven?

You may have to pay if Henriksen Limited proves the debt is yours. But not before seeking debt advice from a leading UK charity!

Getting advice is essential because you don’t want to make a mistake when negotiating a debt settlement figure! The advice a debt adviser provides could be invaluable if you’re confused or worried about the debt.

What’s a fair debt settlement amount?

Most debt recovery companies will accept a settlement figure in the region of 75% of the original debt.

However, with Henriksen Limited, this could be problematic because they try to add their fees to the debt! That’s why you should seek advice from a debt expert before settling on an amount.

How do you contact Henriksen?

You should stay in touch with Henriksen Limited if you owe money on a debt. Their contact details can be found below:

| In writing | Newlands House Caxton Way, Eastfield, Scarborough, England YO11 3YT, United Kingdom |

| By phone | 0344 411 3201 |

| By email | [email protected] |

| Website | https://hcollect.com/ |