Can Debt Collectors Find My New Address in the UK?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you dealing with debt collectors and have recently moved house? You might be worried about them finding your new address. You’re not alone in this. Every month, over 12,000 people come here to seek advice on such debt matters.

In this article, we’ll discuss:

- If you must pay debt collectors.

- Moving house as a way to deal with debt.

- If debt collectors can find your new address.

- How to lower your repayments.

- What happens if your debt is very old.

We know how hard it can be to owe money as our team has dealt with similar issues before, so we understand your worries. We’re here to help you and provide clear guidance. We’ll go through everything you need to know about debt collectors and moving house in the UK. Let’s get started.

Will debt collectors find your new address?

The world is a lot smaller with the advent of the internet and so is the country. Digital footprints are easier to follow which debt collectors can use to find your new address.

You could move several times over a period of time, but you’ll likely leave a digital trail with each move!

It might be more challenging for creditors and debt collectors to find your new address. But in reality, you could just be delaying things. Moreover, as soon as creditors have the information, you’ll start receiving a ton of mail. All demanding payment!

You may find the original debt is a lot more thanks to interest and other fees being added to the amount!

How do debt collectors find you?

Debt collectors have several tools at their disposal when it comes to finding debtors. This includes:

- Contacting the DVLA if you’ve taken out a car loan

- Accessing your details from a mobile phone contract

- Finding out if you’re receiving benefits which provide information about your new address

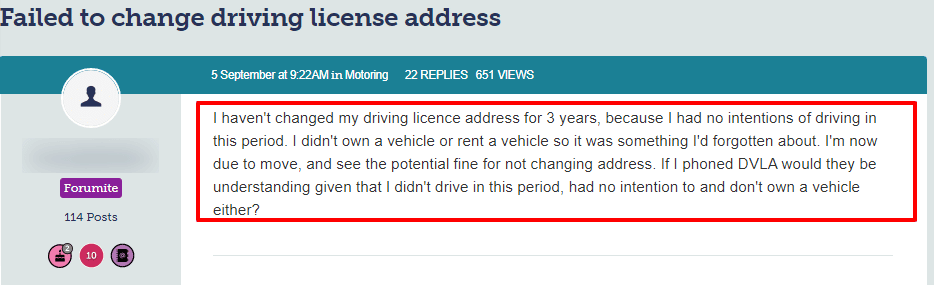

However, if you don’t update your details with the DVLA, a debt collector can’t get hold of your new address through this channel. But you could get a DVLA fine!

Check out what happened to one person below:

Source: Moneysavingexpert

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Could enforcement officers visit your new address?

Yes. If there’s a court order for enforcement officers to visit your new address, they can come to your home. They can seize your possessions. Or an attachment could be placed on your earnings!

If you don’t have any possessions or earnings, a court could make you insolvent!

» TAKE ACTION NOW: Fill out the short debt form

Can creditors find me if I move abroad?

Creditors and debt collectors find it more challenging if you move abroad when you owe money. It makes it harder for them to trace you because countries don’t often share credit and debt information.

In short, new credit files taken out abroad may not be linked to your credit history in the UK.

But, and there’s always a “but”. If you owe a ton of money to a creditor, there are ‘tracing’ specialists who could track you down even if you move abroad.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Should you change your name?

You may think you could get out of paying your debts by changing your name. But if you do it officially, there’ll be a record of the change.

Plus, it’s not that simple and involves lots of official documents!

Plus, the debts remain even when you change your name and databases still exist that could link an old name to a new name.

Should you contact a debt adviser?

You could contact a debt adviser when you’re struggling financially and need advice. But you’d be charged a fee for the advice a debt adviser provides.

So, if you’re already struggling, it may not be the best solution to solving a debt problem.

How should you respond to creditors and debt collectors?

You should stay in touch with your creditors or a debt collection agency instead of running away. Moving home could be a short-term solution, but the debt doesn’t go away!

Plus, contacting a creditor or debt collector could mean:

- Having some of the debt wiped off

- Being offered an affordable payment schedule, or debt settlement offer

Not responding to a debt collector or creditor could also mean you miss out on discovering the debt isn’t yours. Or that it’s statute barred and there’s no CCJ against you.

Thanks for reading my post. I hope the information provided about moving when you have debts helps answer the question, ‘can debt collectors find my new address in the UK’.