Do I Pay LCS Debt Recovery? HMRC and Other Debts

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you faced with debt and don’t know what to do? This can be a worrying time. You may have heard from LCS Debt Recovery and are unsure of your next steps.

You’re not alone. Every month, over 12,000 people visit this site looking for guidance on debt problems.

In this easy-to-understand article, we’ll cover:

- Who LCS Debt Recovery are, and why they might contact you

- How you can respond to LCS Debt Recovery

- The steps you can take to lower your repayments

- What happens if you ignore LCS Debt Recovery

- How to reach out to LCS Debt Recovery

We understand that debt issues can be tough; some of us have been in the same boat. Don’t worry; we’re here to help you find out more about dealing with LCS Debt Recovery and other debts.

Why would LCS Debt Recovery contact you?

LCS Debt Recovery typically contacts you over an unpaid debt. So, when you owe money to a utility provider, the debt collector will chase you for payment on their behalf.

Moreover, like all debt collectors, LCS can be pretty persistent and don’t just go away!

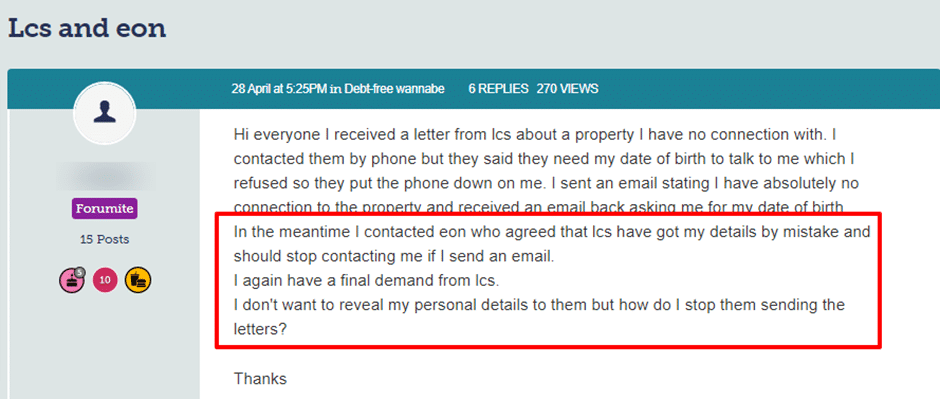

That said, mistakes happen! Take a look at what LCS did to one unfortunate person:

Source: Moneysavingexpert

How should you respond to LCS Debt Recovery?

You may panic when you get a letter from LCS Debt Recovery. So, after the initial shock, you should contact them sooner rather than later.

Sit down and write a letter to LCS asking them to provide evidence that the debt is actually yours. Send the letter by registered post. Some debt collectors are unscrupulous and could say they never receive it.

LCS can’t just tell you that you owe the money. Debt collection agencies must provide you with ‘hard’ proof the debt is yours. Plus, a copy of an agreement must be authenticated by the original creditor or an authorised person!

Is the debt LCS is chasing you for statute-barred?

You should check the age of the debt because if it’s at least six years old, it is statute-barred. Therefore, LCS can’t force you to pay and a court won’t issue a CCJ against you!

That said, there are specific criteria that must be met for a debt to be statute barred. I’ve listed them here:

- You never admitted liability

- You haven’t paid anything towards the debt in the last six years

- There are no current, ongoing proceedings to recover the debt

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Should you pay LCS Debt Recovery?

You should only pay LCS Debt Recovery when the debt collector has proved the debt is yours. Next, find out if you’ve already paid the debt off, or if it is statute-barred.

You should do this before admitting, signing, or paying anything to LCS Debt Recovery.

Debt collection agencies must give you enough time to assess your situation, and to seek debt advice if needed!

What happens when you ignore LCS Debt Recovery?

LCS Debt Recovery claims to take people to court if they ignore their correspondence. Moreover, by ignoring their letters you may not find out the following in time:

- That the debt isn’t yours

- The debt is statute-barred

- Paying a reduced amount because some of the debt is wiped off

- Paying a reasonable payment plan you can afford

Plus, ignoring an LCS letter could lead to:

- Being sued in a court by HMRC if the debt is tax-related

- Having to deal with enforcement officers who turn up at your home to seize possessions

- Having a lien placed on your earnings (attachment of earnings)

- Having a Charge Order placed on your home

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What can LCS Debt Recovery do?

There are things that LCS Debt Recovery can legally do which I’ve listed here:

- Contact you

- Visit your home

- Talk to you about a debt politely and with empathy

- Request that you pay them directly

However, there are things that debt collectors cannot legally do, which I’ve outlined here:

- A debt collector can’t force their way into your home

- They can discuss a debt with other people, this includes your family, friends, neighbours and employer. If a debt collector does, they would be in breach of privacy laws

- Pretend they have more powers than they really have. This includes leading you to believe they are bailiffs which is deemed unlawful

- Pretend the documents they show you are court-issued

- Use legal jargon to confuse you

- Clamp a car or seize your possessions

- Pressure you to take out a new loan to pay a debt

» TAKE ACTION NOW: Fill out the short debt form

Can you prevent LCS Debt Recovery from contacting you?

No. You can’t stop debt collection agencies from contacting you. But you can dictate when and how LCS Debt Recovery contacts you.

In short, you should write to LCS informing them of the following:

- When to contact you. For example in the afternoon after 2pm

- How to contact you. For example, in writing

LCS Debt Recovery must respect your wishes and if they don’t, their actions would be seen as unlawful harassment!

How can you contact LCS Debt Recovery?

I’ve listed how you could contact LCS here:

| Phone: | 0344 543 9001 |

| [email protected] | |

| Website | https://www.lcsdr.com/ |

| Online chat | live chat service |

| Address | First Floor West WingTown Centre House, The Merrion CentreWoodhouse Lane, Leeds LS2 8LY |

| Opening hours | Monday to Friday 8am-8pm and Saturday 9am-1pm |