Should I pay Creditlink Account Recovery Solutions Debt?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you dealing with Creditlink Account Recovery Solutions about a debt and not sure what to do next? This can be a scary time. You may feel worried about what will happen if you can’t pay or if debt collectors will interrupt your daily life. But you’re not alone. Each month, over 12,000 people visit this site looking for guidance on similar issues.

In this article, we’ll answer your questions:

- Who is Creditlink Account Recovery Solutions?

- Do you have to pay them?

- Can they visit you at home?

- Can they take you to court?

- How to stop them contacting you?

We deeply understand how hard it can be to owe money as some of us have been in your shoes and dealt with owing money. We know what you’re going through and we know how to help. Let’s dive in and find out more about dealing with Creditlink Account Recovery Solutions and what you can do next.

Why would you get a Creditlink letter?

You’d be contacted by Creditlink because you allegedly owe money to a company! Chances are the company sold the debt to Creditlink. Or maybe, the company asked the debt collection agency to recover the debt on their behalf!

Rather than ignore Creditlink Account Recovery Solutions, contact the company and try to sort things out to your advantage!

Should you pay Creditlink Account Recovery Solutions?

You should only pay Creditlink when you know the debt is yours. Moreover, if you can afford it!

But first, ask the debt collector to ‘prove the debt’. It’s a good move that can gain you a little time. Plus, if the debt can’t be proven, you won’t have to pay!

Also, don’t panic when you get threatening letters from the debt collector. If you’re worried, seek advice from one of the debt charities. Their advice is free and could be invaluable in times of debt trouble.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can you ignore Creditlink Account Recovery Solutions?

No. It wouldn’t be wise to ignore any correspondence you get from Creditlink Account Recovery Solutions. They can take you to court which could be stressful.

Binning a letter from a debt collector won’t make the problem disappear. On the contrary, it could make matters even worse. Debt collectors are persistent and won’t give up chasing you for the money!

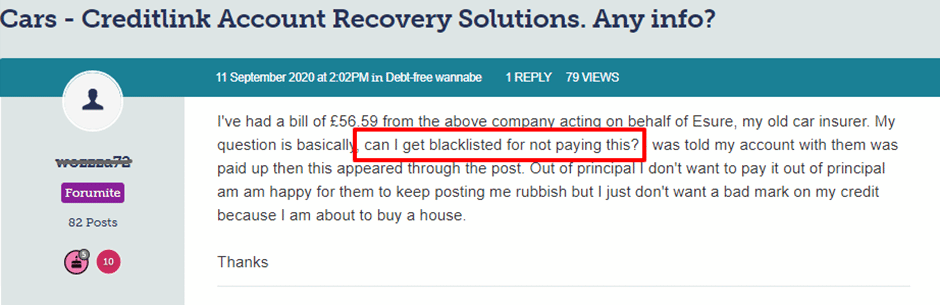

Take a look at this question from a concerned motorist.

Source: moneysavingexpert

Can Creditlink visit you at home?

Yes, but you should be given a 7-day warning in writing before Creditlink turns up at your door. Moreover, their powers are limited which means a debt collector can’t force entry into your property.

A debt collector can only request a payment from you. And it has to be the amount you owe.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What can’t Creditlink legally do?

There are things that debt collectors can and cannot do. I’ve listed them here:

- A debt collector cannot harass you

- They cannot harass or threaten you

- Call you at unreasonable times of the day or evening

- Force you to apply for another loan to pay the debt you owe them

- Use tactics that trick you into paying such as claiming they have powers they don’t have

- Use documents that look like a court have issued them

- Breach your privacy by contacting others about your debt

If a debt collector does any of the above, you’ve got the right to lodge a complaint with Creditlink first. Then, you should contact the Financial Ombudsman!

Can Creditlink take you to court?

Yes. Creditlink could take you to court when you ignore any correspondence from them. The debt collector could apply for a County Court Judgement (CCJ) to be issued against you.

The CCJ is registered on your credit history and it’ll negatively impact your ability to borrow, get a loan or a mortgage!

If things really get out of hand, a bankruptcy petition could be issued against you although this rarely happens. It is, however, worth taking on board.

How do you contact Creditlink Account Recovery Solutions?

I’ve listed how to contact Creditlink here.

| By phone | General Enquiries – 0333 136 3349Debit and credit card hotline – 0333 136 8282 |

| By email | [email protected] |

| By post | C.A.R.S. PO Box 6520, Basingstoke, Hampshire, RG21 4UY |

Can you stop Creditlink from contacting you?

You can contact Creditlink and tell them how and when they can contact you. The law states that debt collectors cannot ‘harass’ you or use dishonest tactics!

» TAKE ACTION NOW: Fill out the short debt form

The company must respect your request which should be in writing and sent by registered post! If they don’t, you can report them to the Financial Conduct Authority (FCA).

Moreover, the debt collector would be breaking the law if they continue to harass you with unwanted calls!