Should I Pay or Appeal Clean Air Zone Charges?

Have you been given a Clean Air Zone (CAZ) charge? Don’t worry, you’re not alone. Every month, over 32,000 people visit this site looking for advice on tickets and fines. It can be a bit scary and confusing, but we’re here to help.

In this guide, we’ll share with you:

- What Clean Air Zone charges are and why you might get one.

- How to appeal and perhaps beat your fine.

- The types of cars that get charged in a Clean Air Zone.

- When you need to pay a Clean Air Zone charge and what happens if you don’t.

- Where to find more help if you need it.

Our team knows how it feels to get a charge, and we’re here to help you. Let’s dive in to learn how you can deal with your Clean Air Zone charge.

Most Ticket Appeals Succeed

In some circumstances, you might have a legitimate reason not to pay your fine.

It’s a bit sneaky, but the last time I needed legal advice, I paid £5 for a trial to chat with an online solicitor called JustAnswer.

Not only did I save £50 on solicitor feeds, I also won my case and didn’t have to pay my £271 fine.

Chat below to get started with JustAnswer

*According to Martin Lewis, 56% of people who try to appeal their ticket are successful and get the charge overturned, so it’s well worth a try.

Where are the UK’s Clean Air Zones?

The UK’s Clean Air Zones are put in place to tackle low-quality air. They’re currently in place in the most urbanised areas, including:

- Bath

- London

- Birmingham

- Bradford

- Bristol

- Portsmouth

- Sheffield

- Newcastle and Gateshead

This list could be set to increase as more local authorities look at the possibility of including a CAZ in their region, including Manchester.

What cars get charged in a Clean Air Zone?

Daily Clean Air Charges are imposed on vehicles that don’t meet minimum emissions standards.

There can be some variation in the minimum requirements, but in general, petrol vehicles must have been registered after January 2006 and diesel vehicles must have been registered after September 2015 to avoid the CAZ fee.

This is also known as at least Euro 4 compliant for petrol vehicles and at least Euro 6 compliant for diesel vehicles. There is an online service on the government’s website to help you check if your UK-registered vehicle meets a CAZ emission standard.

If you’re checking your vehicle against the London CAC, you need to use the Transport for London online checker instead.

Successful Appeal Case Study

Situation

| Initial Fine | £100 |

| Additional Fees | £171 |

| Total Fine | £271 |

The Appeal Process

Scott used JustAnswer, online legal service to enhance his appeal. The trial of this cost him just £5.

| Total Fine | £271 |

| Cost of legal advice | £5 |

JustAnswer helped Scott craft the best appeal possible and he was able to win his case.

Scott’s fine was cancelled and he only paid £5 for the legal help.

In partnership with Just Answer.

What is the Clean Air Zone cost?

The CAZ cost differs between the different CAZs, but cars and light-goods vehicles should expect to pay a daily fee of £8 or £9. Coaches and heavy-goods vehicles can expect to pay a daily fee of £50 to £100.

How do I know if I need to pay a Clean Air Zone charge?

The only way to know that you need to pay a Clean Air Zone charge is by staying alert to road signs. Clean Air Zones are usually well signposted, alerting drivers to the fact they’re approaching a CAZ and then when they enter and leave a CAZ boundary.

Local authorities also have online maps of the CAZ so drivers can plan their journey in advance to use or avoid the CAZ.

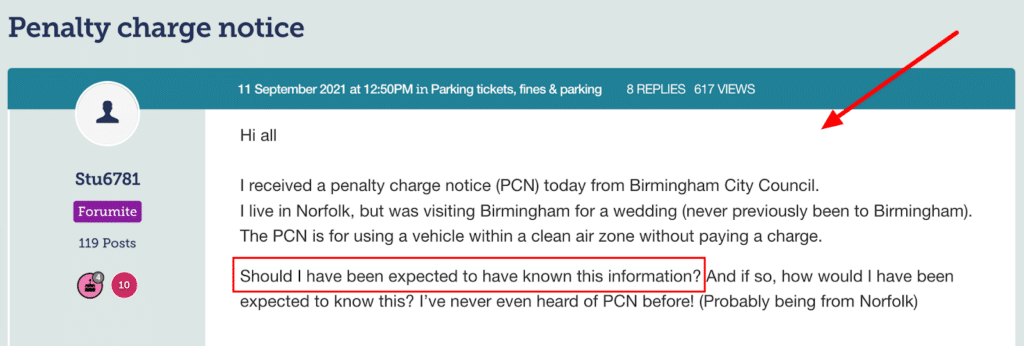

However, for motorists who aren’t from the area, this can be frustrating. They might end up using a Clean Air Zone without even realising it.

This forum user shares their frustration on this subject:

Source: https://forums.moneysavingexpert.com/discussion/comment/78600259#Comment_78600259

For people out of town, it can happen that you miss the sign and end up using a CAZ without realising. Unfortunately, this isn’t a good enough excuse, so always look up your journey in advance and plan ahead.

Join thousands of others who got legal help for a £5 trial

Getting the support of a Solicitor can take a huge weight off your mind.

Reviews shown are for JustAnswer.

How do you pay a clean air charge?

You can pay your Clean Air Zone charge using a debit or credit card using an online portal from the government’s website. You can also pay over the phone using a payment hotline.

Payments can be made in advance or up to midnight on the sixth day after using the CAZ.

Do you have to pay Clean Air Zone charges?

You must pay a Clean Air Zone fee within the deadline, otherwise, you’ll receive a Penalty Charge Notice (PCN). A PCN is a monetary fine for failing to pay the CAZ charge on time, and you’ll still have to pay the daily fee as well.

A PCN for not paying the CAZ fee can be up to £120 depending on the location. This fine is halved if you pay within 14 days, but if you miss this deadline to pay (28 days), the fine is increased by 50%.

If the fine still isn’t paid, court action can be taken, which could escalate to the use of bailiffs. This comes with many other charges and fees.

Should you pay or appeal the CAZ charge?

It’s only worth appealing a CAZ Penalty Charge Notice if you have a good excuse and evidence to back up your claims. Otherwise, paying within 14 days will save you money overall.

It’s an entirely personal decision, but you may want to do independent research before deciding.

» TAKE ACTION NOW: Get legal support from JustAnswer

How to appeal a Clean Air Zone PCN

You have the right to challenge a PCN for not paying the CAZ fee if you don’t believe it should have been served.

However, the authority will have footage of your vehicle within the Clean Air Zone, so the appeal must be based on an excuse regarding the vehicle meeting emission standards. You might win an appeal if relevant road signs have been damaged, removed or hidden.

Is there VAT on clean air zone charges?

Many sources online state that VAT isn’t included in Clean Air Zone charges, including by Transport for London. However, it’s best to engage your accountant for an accurate determination.

Can I claim vat on clean air zone charges?

You can only claim VAT if you’re VAT registered and VAT is charged on CAZ payments. Multiple sources suggest that VAT isn’t charged on these fees, but it’s best to seek clarification from a qualified accountant.

If the journey was made wholly and exclusively for business purposes, the daily fee is tax deductible for your business, including for sole traders.

Need help making your appeal?

If you decide that you want to challenge a Clean Air Zone PCN, you might benefit from my How to Appeal a Ticket page. On here you’ll find helpful information on appealing different types of motoring and parking fines, including Penalty Charge Notices.

Hire a Parking Solicitor for less than a coffee.

If you’re thinking about appealing your parking ticket then getting some professional advice is a good idea.

Getting the support of a Solicitor can make your appeal much more likely to win.

For a £5 trial, Solicitors from JustAnswer can look at your case and help you create an airtight appeal.

In partnership with Just Answer.