Should You Pay or Ignore ZZPS Parking Fine Debt?

Have you been handed a parking ticket by ZZPS and not sure what to do next? You’re not alone. Every month, over 32,000 people visit our site seeking advice on tickets and fines.

A ZZPS parking fine can seem scary, but you don’t need to panic. In this article, we’ll guide you through:

- Who ZZPS is and why they might contact you

- How to respond to a ZZPS parking fine

- The legal powers of ZZPS and what happens if you don’t pay

- How to know if the debt ZZPS is chasing is valid

- Where to get free debt help in the UK

We understand your worries about the impact of not paying parking fines on your financial health and the fear of potential legal action. We’re here to help you make the best decision.

Ready to learn how to handle your ZZPS parking fine? Let’s dive in!

Most Ticket Appeals Succeed

In some circumstances, you might have a legitimate reason not to pay your fine.

It’s a bit sneaky, but the last time I needed legal advice, I paid £5 for a trial to chat with an online solicitor called JustAnswer.

Not only did I save £50 on solicitor feeds, I also won my case and didn’t have to pay my £271 fine.

Chat below to get started with JustAnswer

*According to Martin Lewis, 56% of people who try to appeal their ticket are successful and get the charge overturned, so it’s well worth a try.

How to avoid paying ZZPS parking tickets

If you want to avoid paying a ZZPS parking ticket then you’ll need an airtight appeal.

The best way to perfect your appeal is getting a little advice from a Solicitor. I’d 100% recommend spending a fiver to get a trial of JustAnswer.

You can explain your situation in their chat and they’ll connect you with a Solicitor who can advise you and give you the best chance to win your appeal.

Click here to get the trial offer with JustAnswer.

Why would ZZPS contact you?

ZZPS will contact you over an unpaid parking fine. That said, the debt collector will have been instructed to recover the amount by a car park management company!

The letter you get from ZZPS should tell you who issued the parking fine and how much is owed!

Don’t feel intimidated by ZZPS although their initial correspondence can be threatening. Especially when they say they’re going to take you to court!

Instead, write to ZZPS and ask them to prove the debt is yours! It’s a request debt collectors must respect!

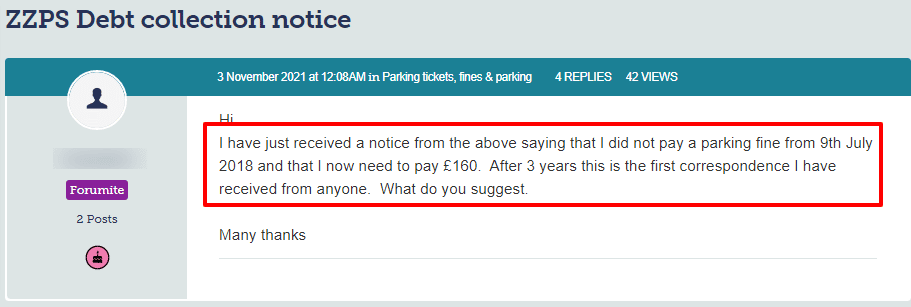

Take a look at what happened to one unfortunate and confused motorist:

Source: Moneysavingexpert

Should you pay a ZZPS parking fine debt?

You should only pay a ZZPS parking fine debt when the debt collection agency proves the debt is really yours! If they can’t provide authenticated proof, you may not have to pay them!

Also, find out whether the debt is statute-barred, and if it is, tell ZZPS to stop contacting you.

If however, ZZPS proves you owe the money, try to negotiate an affordable repayment plan with them.

Successful Appeal Case Study

Situation

| Initial Fine | £100 |

| Additional Fees | £171 |

| Total Fine | £271 |

The Appeal Process

Scott used JustAnswer, online legal service to enhance his appeal. The trial of this cost him just £5.

| Total Fine | £271 |

| Cost of legal advice | £5 |

JustAnswer helped Scott craft the best appeal possible and he was able to win his case.

Scott’s fine was cancelled and he only paid £5 for the legal help.

In partnership with Just Answer.

How should you respond to ZZPS?

It can be really difficult to think clearly when ZZPS gets in touch. You may not even know if their letter is a scam or legitimate. After all, not many people have ever heard of ZZPS unless they’ve had previous dealings with them.

Once you’ve read the letter and taken everything it says onboard, you should sit down and write a letter to ZZPS. You should formally ask the debt collection agency for proof the debt is yours!

ZZPS must respond in writing and provide authenticated proof the debt is really yours. Also, send your letter to the debt collection agency by registered post!

Don’t accept verbal confirmation! Debt collectors must provide you with a copy of an original agreement which is authenticated by the creditor. Of a person who is authorised to authenticate it!

What happens when you don’t pay ZZPS?

ZZPS could do several things all of which are not good news when you don’t pay them. In short, the debt collection agency could:

- Report you to credit bureaus

- Apply for a CCJ against you

- Apply for an attachment on your wages

- Apply for a Charging Order on your house although this rarely happens

Join thousands of others who got legal help for a £5 trial

Getting the support of a Solicitor can take a huge weight off your mind.

Reviews shown are for JustAnswer.

What can ZZPS legally do?

The Code of Practice lays out what debt collectors like ZZPS can and cannot do which I’ve listed here:

ZZPS can:

- Contact you and even visit you at home

- Ask that you pay them directly

- Talk about the debt with you but only politely and discreetly

ZZPS cannot:

- Force their way into your home

- Seize your possessions or clamp your vehicle

- Talk about a debt with your neighbours, family, friends or employer which breaches your privacy

- Infer they have the same powers as a bailiff which is a criminal offence

- Pretend the documents they show you are court-issued

- Use lots of legal jargon to confuse you

- Put pressure on you to take out a loan to repay the debt

When debt collectors act in an intimidating or threatening way, it could be deemed harassment. You have the right to file a complaint with their head office!

Then you should contact the Financial Ombudsman Service (FOS) and report ZZPS!

» TAKE ACTION NOW: Get legal support from JustAnswer

Does ZZPS have the same powers as bailiffs?

No. ZZPS are debt collectors and have exactly the same powers as an original creditor. In short, they can chase you for payment but they cannot pretend they have the power to seize possessions!

Is the debt ZZPS chasing you for statute-barred?

You may be wondering what statute barred means. The answer is when a debt is at least 6 years or more old, it’s deemed statute barred. Courts won’t hear cases involving statute-barred debts.

Therefore, you can’t be given a CCJ. Moreover, a debt collector can make you pay. They can ask you to pay, but you can refuse and that’s the end of it!

However, there are criteria which must be met for a debt to be statute barred. These are:

- You never paid anything towards clearing the debt in the last six years

- You never admitted liability or contacted the original creditor in the last six years

- There’s no existing court order for you to pay the debt

That said, although a debt is statute-barred, it doesn’t actually go away. It just means a debt collector can make you pay.

But it can still impact your credit rating!

How do you contact ZZPS over a parking fine debt?

I’ve listed ZZPS’s contact details below:

| Address: | ZZPS Limited Bacchus House 1 Station RoadAddlestone Surrey, KT15 2AG |

| Via email | [email protected] |

| By phone | 01932918916 |

Hire a Parking Solicitor for less than a coffee.

If you’re thinking about appealing your parking ticket then getting some professional advice is a good idea.

Getting the support of a Solicitor can make your appeal much more likely to win.

For a £5 trial, Solicitors from JustAnswer can look at your case and help you create an airtight appeal.

In partnership with Just Answer.